When navigating the turbulent waters of volatility trading, understanding UVXY option trading hours is paramount. ProShares Ultra VIX Short-Term Futures ETF (UVXY) options provide a unique opportunity to capitalize on market swings, but traders must adhere to specific timeframes to maximize their potential. This comprehensive guide delves into the intricacies of UVXY option trading hours, empowering you with the knowledge to conquer the volatility market’s temporal challenges.

Image: seekingalpha.com

Decoding UVXY Option Trading Hours

UVXY options, mirroring the performance of the S&P 500 VIX Short-Term Futures Index, are traded exclusively on Cboe Global Markets. The trading hours for UVXY options align with those of other Cboe-listed options:

- Opening Bell: 9:30 AM Eastern Time (ET)

- Closing Bell: 4:00 PM ET

This timeframe provides ample liquidity and trading opportunities throughout the day. However, it’s crucial to note that UVXY options contracts have specific expiration dates, typically monthly intervals. Traders must consider these expiration dates when strategizing their trades.

Trading Considerations During UVXY Option Trading Hours

The optimal time to trade UVXY options largely depends on market conditions and the trader’s risk tolerance. Early morning hours, between 9:30 AM and 11:00 AM ET, often witness higher volatility as traders react to overnight news and economic data releases. This period presents potential trading opportunities for those seeking short-term gains.

As the trading day progresses, volatility tends to subside, leading to tighter trading ranges during the afternoon hours. This time window may be suitable for traders seeking more conservative strategies or holding overnight positions. However, traders should remain vigilant, as market conditions can shift swiftly during any trading session.

Maximizing Trading Potential Within UVXY Option Timeframes

To maximize trading potential within UVXY option trading hours, consider the following strategies:

- Scalping: This short-term trading approach involves entering and exiting trades within minutes or hours, capitalizing on minor market fluctuations.

- Day Trading: Day traders hold positions for the entirety of a trading day, leveraging intraday price movements to generate profits.

- Swing Trading: Swing traders maintain positions for multiple days or weeks, riding market trends for elongated periods.

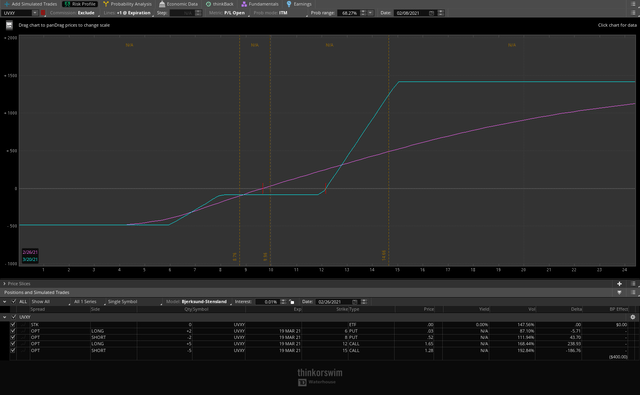

- Options Strategies: UVXY options provide versatile opportunities for constructing bullish or bearish strategies based on market expectations.

The choice of trading strategy depends on individual risk tolerance, time constraints, and market conditions.

Image: www.stoxline.com

Navigating Market Closures and Holidays

UVXY option trading hours do not operate on weekends or certain market holidays. During these times, no trading activity occurs, and open positions remain in effect until the market reopens. Traders should be aware of upcoming market closures and holidays to avoid potential holding risks.

Uvxy Option Trading Hours

Image: www.tradingview.com

Conclusion

Mastering UVXY option trading hours is fundamental for successful volatility trading. By understanding the trading schedule, considering market conditions, and employing appropriate strategies, traders can maximize their potential within the specific timeframes allocated for UVXY option trading. Remember to prioritize knowledge, patience, and risk management to navigate the dynamic and ever-evolving volatility market.