Introduction

In the realm of sophisticated financial instruments, options trading stands tall as a powerful tool for both seasoned investors and aspiring traders seeking to amplify their returns or mitigate risks. Among the leading financial institutions offering options trading services, Scotiabank shines as a beacon of innovation and expertise. This comprehensive guide delves into the captivating world of Scotiabank options trading, unveiling its intricacies, advantages, and potential pitfalls.

Image: headquartersoffice.com

Understanding Options Trading

Options are contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified period. This unique characteristic provides traders with unparalleled flexibility and the potential for substantial gains, as options can be used to speculate on market movements or hedge against existing positions.

Scotiabank’s Options Trading Platform

Scotiabank, a multinational banking and financial services giant, offers a robust and user-friendly options trading platform that empowers traders with a seamless and efficient experience. Its intuitive interface and advanced analytical tools make it a preferred choice for both novice and experienced options traders.

Types of Options Traded at Scotiabank

Scotiabank offers a wide range of options, catering to the diverse needs of its clients. These include:

- Call Options: Provide the buyer with the right to buy the underlying asset at a specified price.

- Put Options: Grant the buyer the right to sell the underlying asset at a specified price.

- European Options: Exercisable only on their specified expiration date.

- American Options: Exercisable anytime up until their expiration date.

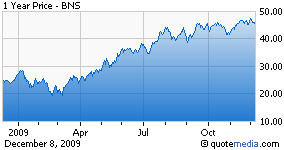

Image: seekingalpha.com

Benefits of Options Trading with Scotiabank

Opting for Scotiabank as your options broker entails a suite of benefits, including:

- Competitive pricing and reduced commissions.

- Access to a vast range of underlying assets, including stocks, indices, and commodities.

- Expert support and educational resources tailored to your skill level.

- Dedicated account executives providing personalized guidance and assistance.

Understanding Options Terminology

Understanding the jargon of options trading is crucial for success. Here are some key terms to familiarize yourself with:

- Strike Price: The predetermined price at which an option can be exercised.

- Expiration Date: The date on which the option expires.

- Premium: The price paid by the buyer of an option.

- Intrinsic Value: The difference between the current market price of the underlying asset and the strike price.

- Time Value: The portion of the premium that reflects the remaining time until the option’s expiration.

Trading Strategies for Different Market Conditions

The beauty of options trading lies in its adaptability to changing market conditions. Here are some popular trading strategies:

- Bullish Strategies: Used when traders anticipate a rise in the underlying asset’s price.

- Bearish Strategies: Implemented when traders anticipate a decline in the underlying asset’s price.

- Neutral Strategies: Seek to capitalize on price fluctuations within a defined range.

Risk Management in Options Trading

While options offer immense potential, it’s crucial to remember that they carry inherent risks. Sound risk management practices are essential for protecting capital and minimizing losses.

Scotiabank Options Trading

Conclusion

Scotiabank options trading empowers investors and traders to tap into the lucrative world of options and amplify their returns. By harnessing Scotiabank’s expertise, advanced platform, and wealth of educational resources, individuals can navigate the subtleties of options trading confidently and proficiently.

Embrace the opportunities and exercise caution with Scotiabank options trading, and open the door to a world of financial exploration and potential gains.