Unveiling the Dynamics of Options Trading with Chase Bank

In the vast and ever-evolving landscape of financial markets, options trading stands out as a powerful instrument for hedging risks and unlocking profit-generating opportunities. Among the leading financial institutions offering options trading, Chase Bank stands tall, catering to the diverse needs of investors seeking to navigate the complexities of this multifaceted market. This comprehensive guide delves into the intricacies of chase bank options trading, empowering you with the knowledge to make informed decisions and maximize your financial potential.

Image: campbellyorkblogs.blogspot.com

Understanding Chase Bank Options Trading Basics:

Options trading involves the buying or selling of contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price within a defined timeframe. Chase Bank offers a wide range of options contracts, tailored to cater to varying investor strategies and risk profiles. These include equity options, index options, and exchange-traded funds (ETFs), each with its unique characteristics and application in the financial landscape.

Deciphering Option Types: Calls, Puts, and More:

The world of options trading encompasses two primary types: calls and puts. Call options provide the holder with the right to buy an underlying asset at a set price (strike price), while put options grant the holder the right to sell an underlying asset at a specified strike price. These options can be traded in different styles, including long calls, short calls, long puts, and short puts, each carrying distinct implications for the trader’s position in the market.

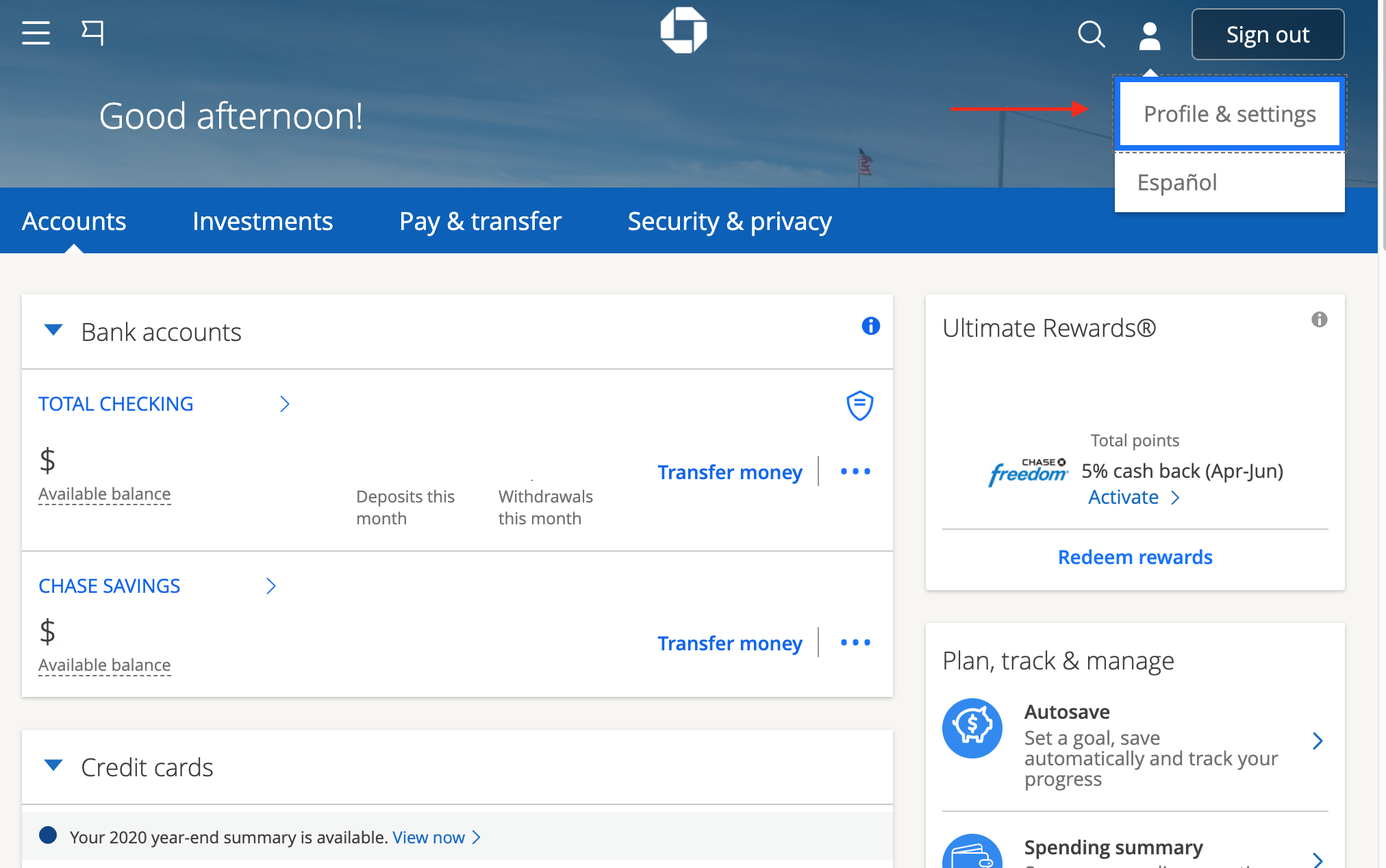

Navigating the Chase Bank Options Trading Platform:

Chase Bank offers a user-friendly and feature-rich options trading platform designed to empower traders of all levels of expertise. The platform provides real-time market data, analytical tools, and sophisticated charting capabilities, enabling you to make informed decisions and execute trades seamlessly. Whether you’re a seasoned professional or just starting your journey in options trading, Chase Bank’s platform caters to your specific needs.

Image: www.creditdonkey.com

Smart Strategies for Chase Bank Options Trading:

Effective options trading requires a well-defined strategy that aligns with your risk tolerance and profit objectives. Seasoned traders employ a range of strategies, including covered calls, cash-secured puts, and multi-leg strategies, each designed to exploit specific market conditions and maximize returns. Understanding these strategies and tailoring them to your trading style is crucial for long-term success in options trading.

Chase Bank Options Trading

Image: www.pinterest.com

Unlocking the Power of Chase Bank Options Trading:

Options trading with Chase Bank provides a gateway to a world of opportunities, but it also carries inherent risks. Careful consideration of your investment goals, risk appetite, and market knowledge is paramount before venturing into this dynamic and rewarding arena. With proper research, a sound trading strategy, and the support of Chase Bank’s expertise, you can harness the power of options trading to enhance your financial portfolio and achieve your investment aspirations.