Trading futures and options can be a daunting prospect, but with the right knowledge, it can become a powerful tool for enhancing your investment portfolio. Join us as we delve into the intricate world of these financial derivatives, exploring their history, concepts, and practical applications.

The Dawn of Futures and Options: A Historical Perspective

Image: www.ig.com

The origins of futures and options can be traced back to ancient civilizations, where merchants and traders used rudimentary forms of these instruments to mitigate risk and speculate on future price movements. The Chicago Board of Trade (CBOT), established in 1848, played a pivotal role in formalizing futures contracts, offering a standardized platform for agricultural commodities. Options, on the other hand, gained prominence in the 1970s with the advent of the Chicago Board Options Exchange (CBOE).

Understanding the Fundamentals: Key Concepts Demystified

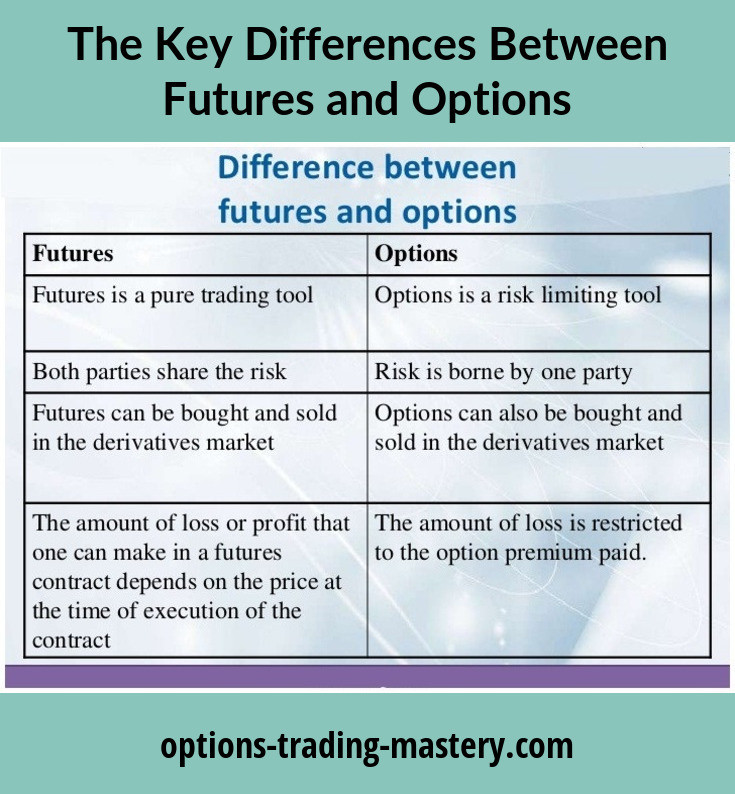

Futures contracts resemble forward contracts, obligating the buyer (long position) to purchase and the seller (short position) to deliver a specific asset at a predetermined price and date. Futures are standardized, traded on exchanges, and often used for hedging or speculation. Options, however, offer the right but not the obligation to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) within a given period (expiration date).

Navigating the Markets: Applications in Practice

Futures and options are versatile tools that cater to a wide range of financial objectives:

-

Risk Management: By taking opposite positions in futures or options, investors can effectively hedge against adverse price fluctuations in their underlying assets.

-

Speculation: Sophisticated traders often leverage futures and options to speculate on future price movements, aiming to profit from fluctuations.

-

Income Generation: Selling covered calls or put options can yield additional income while limiting potential downside risks.

-

Diversification: Introducing futures and options into an investment portfolio can help diversify risk and enhance returns.

Expert Insights: Unlocking the Wisdom of Seasoned Professionals

“Futures and options are not for the faint of heart,” cautions financial expert Mark Douglas. “It’s imperative to master risk management strategies to navigate these markets effectively.”

“Embrace a learning mindset,” advises renowned trader Alexander Elder. “The constant evolution of markets demands continuous exploration and adaptation.”

Taking the Next Step: Actionable Tips for Success

-

Start Small: Begin with modest investments until you gain familiarity and confidence.

-

Research Thoroughly: Conduct extensive research on the underlying assets and market dynamics.

-

Use Limit Orders: Limit orders help mitigate the impact of adverse price fluctuations, protecting your capital.

-

Set Stop-Loss Levels: Pre-determine the tolerable loss amount and implement stop-loss orders to limit potential losses.

-

Seek Professional Guidance: Consider consulting with financial advisors or mentors for personalized guidance.

Conclusion: Unlocking Your Financial Potential

The world of futures and options offers a vast canvas for financial exploration. By embracing a comprehensive understanding of these instruments, implementing sound risk management strategies, and tapping into the wisdom of experts, you can harness their power to enhance your investment portfolio and achieve financial success. Remember, the journey to financial empowerment is paved with knowledge and calculated decisions. Embrace the possibilities, delve into the intricacies of futures and options, and unlock a world of opportunities that await your discovery.

Image: www.options-trading-mastery.com

Trading Future And Options

Image: www.ifmcinstitute.com