Unraveling the Intricacies of Grain Trading in a Volatile Market

In the world of commodities, few markets are as dynamic and complex as the grain futures and options market. From towering silos standing sentinel over endless fields to the frenzied trading pits of exchanges, grain trading has long played a pivotal role in feeding nations and shaping global economies. In this comprehensive guide, we delve into the intricacies of grain futures and options trading, empowering you with the knowledge and strategies to navigate this volatile market.

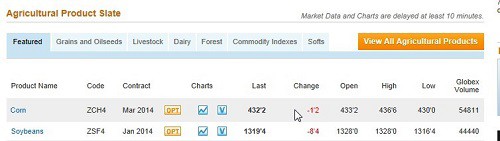

Image: www.netpicks.com

Understanding the Basics of Grain Futures and Options

Futures Contracts:

Futures contracts are standardized agreements to buy or sell a specific quantity of grain at a set price on a specific date in the future. They allow producers and consumers to lock in prices in advance, mitigating risks associated with price fluctuations.

Options Contracts:

Options contracts grant the holder the right, but not the obligation, to buy (call option) or sell (put option) a specified quantity of grain at a specified price within a certain time frame. Options provide flexibility and leverage for traders seeking to profit from price movements without committing to physical delivery.

Market Dynamics and Factors Driving Price Action

The grain futures and options market is influenced by a myriad of factors, including:

- Supply and demand: Seasonal weather patterns, geopolitical events, and changes in consumer preferences impact crop yields and demand.

- Global economic conditions: Economic growth and recessionary periods influence demand for agricultural products.

- Government policies: Farm subsidies, import tariffs, and export restrictions can affect market prices.

- Currency fluctuations: Changes in currency exchange rates impact the cost of imported and exported grains.

By understanding these dynamics, traders can make informed decisions based on market fundamentals and shifting trends.

Essential Strategies for Trading Grain Futures and Options

Hedging Strategies:

For producers and consumers, grain futures and options offer a crucial tool for risk management. By locking in prices through futures or buying options, they can protect against adverse price movements.

Speculative Trading:

Traders seeking to profit from price fluctuations can employ speculative strategies like spread trading, which involves simultaneously buying and selling different futures contracts with different expiration dates.

Option Trading Strategies:

Options provide traders with immense flexibility. Covered calls, cash-secured puts, and bull and bear spreads are among the many strategies used to enhance returns while managing risks.

Image: www.wsj.com

Expert Insights and Practical Tips

“In the grain futures market, it’s essential to understand the fundamental factors driving price action,” advises veteran trader John Smith. “By staying informed about global weather conditions, crop reports, and economic news, you can make educated bets on market direction.”

For novice traders, expert strategist Mary Jones emphasizes the importance of a solid trading plan. “Define your risk tolerance, set realistic profit targets, and stick to your strategy even during volatile times,” she counsels.

The Road Ahead: Embracing Innovation and Sustainability

As artificial intelligence and blockchain technology continue to revolutionize the trading industry, grain futures and options markets are poised for transformation. These advancements offer opportunities for increased efficiency, transparency, and risk management.

Furthermore, the global shift towards sustainable agriculture poses challenges and opportunities for grain traders. By embracing environmentally friendly practices and promoting ethical supply chains, traders can contribute to a more sustainable future for both the industry and the planet.

Grain Futures And Options Trading

Image: www.cannontrading.com

Conclusion: Empowered Trading in a Dynamic Market

Grain futures and options trading offer both opportunities and risks for participants in the global commodities market. By comprehending market dynamics, employing effective strategies, and leveraging expert insights, traders can navigate this volatile landscape with confidence. As the industry evolves and embraces innovation, traders who embrace a forward-looking approach and a commitment to sustainability will be well-positioned to succeed in this ever-changing marketplace.