Market momentum holds immense power in the trading world. Traders who can harness this momentum to their advantage have the potential to achieve significant gains. Enter momentum option trading, an advanced technique that allows traders to profit from the continuance of price trends.

Image: pocketoption.trading

Momentum option trading involves utilizing options contracts to bet on the continuation of an asset’s price movement. Traders analyze technical indicators and market trends to identify assets that are predicted to continue their upward or downward trajectory. By purchasing call options on rising assets or put options on falling assets, traders can capitalize on the continued price swings.

Foundations of Momentum Option Trading

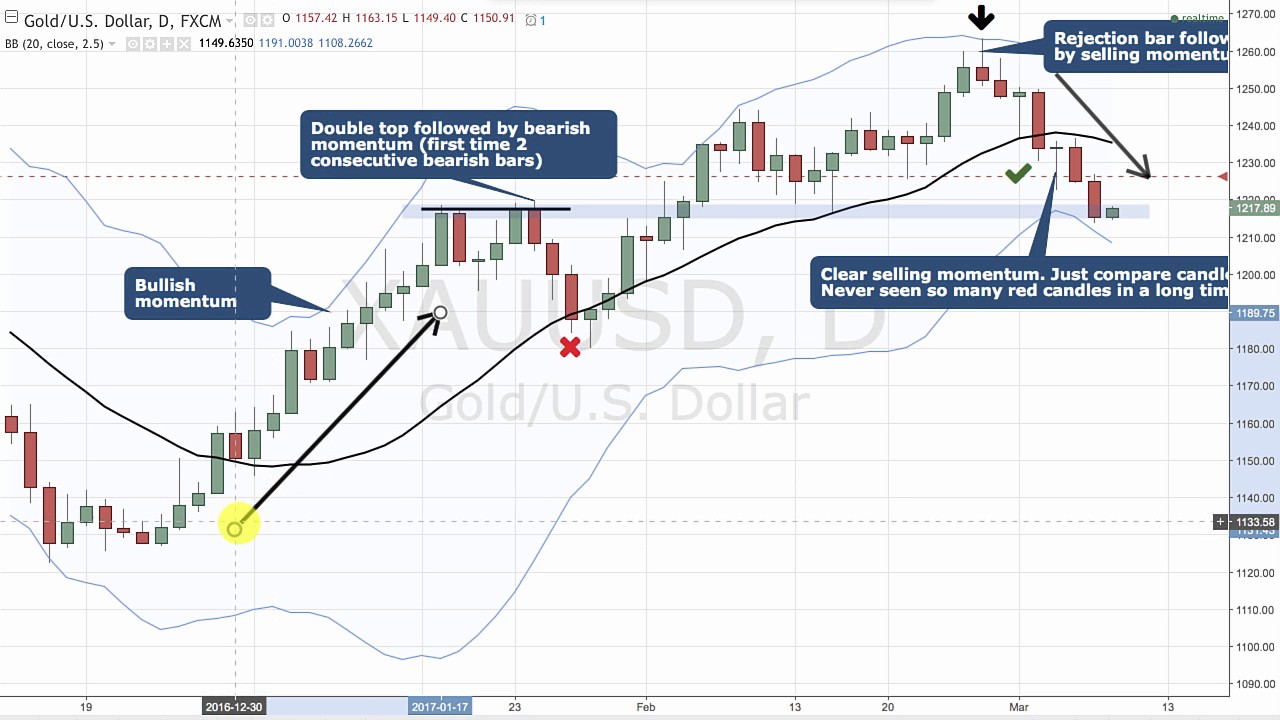

At the heart of momentum option trading lies the concept of technical analysis. Traders utilize various technical indicators, such as moving averages, parabolic SAR, and relative strength index (RSI), to gauge market momentum and predict future price movements. These indicators help identify trends and patterns in the asset’s price action, providing valuable insights into the underlying market sentiment.

Equally crucial is understanding the concept of options contracts. Options are financial instruments that grant the right (but not the obligation) to buy (call option) or sell (put option) an asset at a predetermined price (strike price) on or before a specific date (expiration date). Traders use options to speculate on future price movements without having to commit to directly buying or selling the underlying asset.

Harnessing Momentum: A Strategic Approach

To effectively harness market momentum in option trading, traders follow a strategic and disciplined approach.

Firstly, they identify an asset that exhibits sustained momentum. This requires analyzing multiple technical indicators and market news to determine the prevailing trend. Once a suitable asset is identified, traders purchase call options if the trend is upward or put options if the trend is downward.

Secondly, traders carefully select the strike price and expiration date of the option contract. The strike price should align with the anticipated price movement while the expiration date should provide ample time for the trend to continue.

Lastly, traders manage their risk diligently. Momentum option trading involves inherent risks, and proper risk management is crucial. This includes utilizing stop-loss orders, monitoring market fluctuations, and adjusting positions as needed to protect against potential losses.

Real-World Applications and Expert Insights

Momentum option trading has proven to be a lucrative strategy for experienced traders. Consider the example of a stock that breaks above a key resistance level, signaling a potential continuation of its upward trend. A trader might purchase a call option with a strike price slightly above the breakout level and an appropriate expiration date, enabling them to profit from the continued upward movement of the stock.

Renowned trader Mark Douglas, in his book “Trading in the Zone,” emphasizes the importance of psychology in successful option trading. He advocates for a disciplined approach, where traders avoid emotional decision-making and stick to their predetermined trading plan.

Image: www.youtube.com

Momentum Option Trading

Image: learnpriceaction.com

Embracing Momentum Option Trading: A Path to Enhanced Profits

Understanding momentum option trading and leveraging the power of market momentum can elevate your trading strategies to new heights. By carefully analyzing technical indicators, employing appropriate risk management techniques, and incorporating sound trading practices, you can harness the incredible potential of momentum option trading to enhance your profitability.