In the dynamic world of options trading, the chart layout you choose can serve as your compass, guiding your decision-making and maximizing your returns. With a vast array of options and indicators available, navigating the complexities of chart layouts can be overwhelming. Fear not, my fellow traders, for in this comprehensive guide, we will delve into the intricacies of the best chart layouts for options trading, empowering you to unlock the secrets of the financial markets.

Image: in.pinterest.com

The Anatomy of a Winning Chart Layout

Before we dive into specific layouts, it’s essential to understand the key elements that constitute a well-designed options chart. These include:

- Timeframe: Determine the timeframe that aligns with your trading style and risk tolerance, whether it’s daily, weekly, or monthly.

- Type: Familiarize yourself with different chart types such as line, candlestick, or bar charts, each offering unique insights.

- Indicators: Leverage technical indicators to enhance your analysis, such as moving averages, Bollinger Bands, or RSI.

- Customization: Customize your chart with colors, line styles, and scales that suit your preferences and trading strategy.

Unveiling the Top 5 Chart Layouts for Options Trading

Now that we’ve laid the foundation, let’s explore the five chart layouts that have proven their mettle in the options trading arena:

- The Baseline: This classic layout presents a clean and straightforward representation of price action, allowing you to focus on key support and resistance levels.

- The Candlestick Extravaganza: With its vibrant candlesticks, this layout provides a visual depiction of price fluctuations, making it ideal for quick trend identification.

- The Moving Average Meander: Moving averages add a layer of smoothing to the price action, enabling you to discern longer-term trends and potential trading opportunities.

- The Bollinger Bandwagon: Bollinger Bands create an enveloping effect around the price, highlighting potential overbought or oversold conditions.

- The RSI Revelation: RSI (Relative Strength Index) measures momentum and can assist in identifying overbought or oversold conditions, providing valuable insights into market sentiment.

Tailoring Your Chart to Perfection

Remember, the best chart layout is the one that resonates with your trading approach. Experiment with different layouts and find the one that suits your trading style and risk tolerance. Consider the following tips for customization:

- Experiment with various combinations of indicators until you find a harmonious blend that complements your trading strategy.

- Fine-tune indicator parameters, such as moving average period length or Bollinger Band width, to enhance their responsiveness to market conditions.

- Customize colors and line styles to create a visually pleasing and intuitive chart that aids in decision-making.

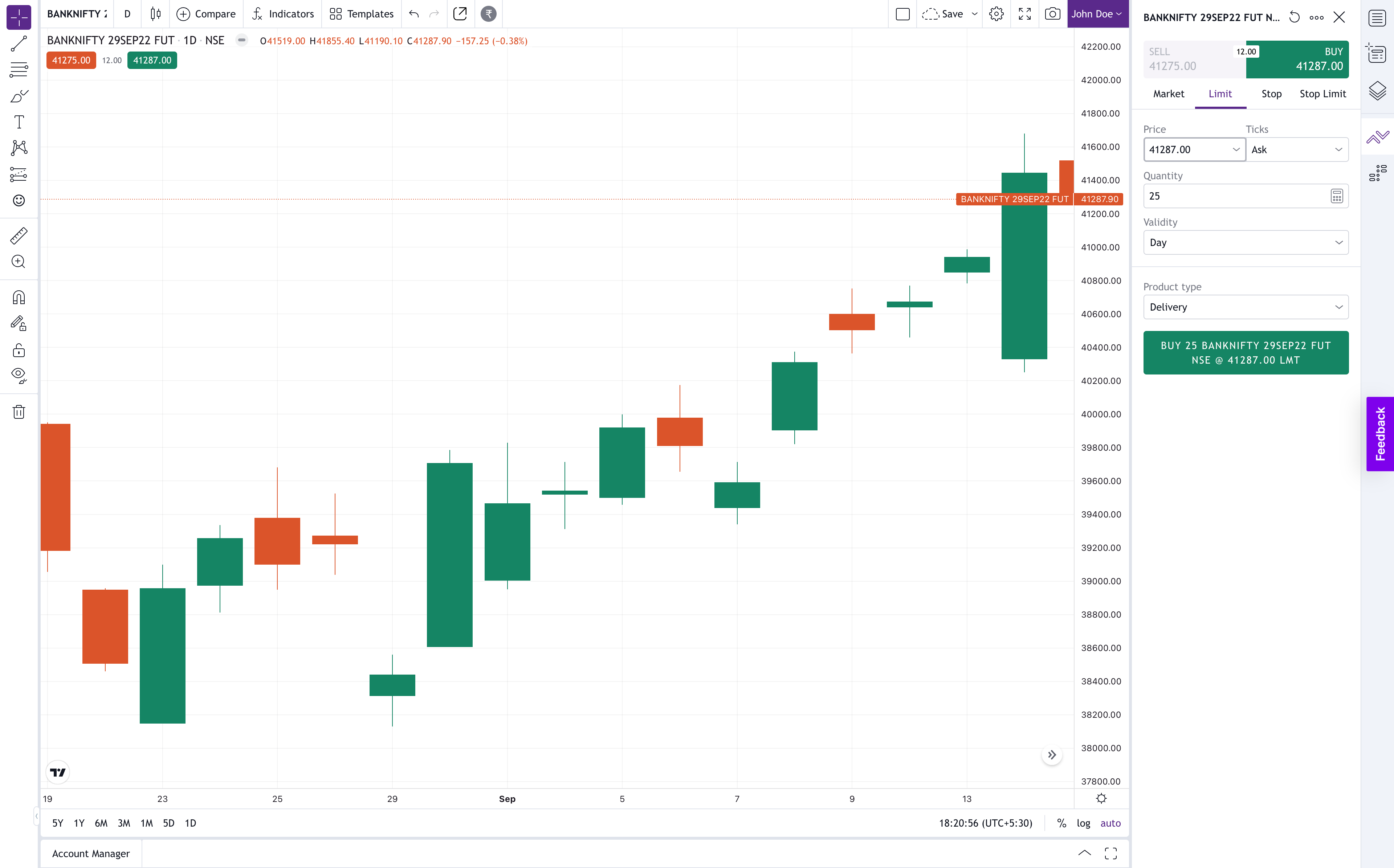

Image: upstox.com

Best Chart Layout For Trading Options

Conclusion: The Power of Visual Clarity

In the realm of options trading, the chart layout you choose can make all the difference. By understanding the fundamentals of chart design, experimenting with various layouts, and customizing them to suit your needs, you can unlock the potential of these visual tools. Embrace the knowledge contained within this guide and embark on a transformative journey towards profitable options trading.