Unveiling the Enigma of Volatility: An Introduction

In the ever-evolving landscape of financial markets, volatility reigns supreme as the enigmatic force that shapes the ebb and flow of asset prices. Like a tempestuous sea, volatility can thrust investors to unprecedented heights or cast them into treacherous depths. Yet, within this formidable force lies an untapped potential—a path to harness the inherent volatility of markets and reap substantial rewards. Enter volatility options trading, an advanced financial strategy that allows savvy investors to navigate the uncertain tides of the market with precision and profit. In this comprehensive guide, we will embark on a journey to unravel the complexities of volatility options trading, empowering you with the knowledge and strategies to conquer the financial tempest.

Image: wirafiy.web.fc2.com

Venturing into the Realm of Volatility

Volatility, in its essence, measures the rate at which the price of an asset fluctuates over time. It is a double-edged sword, simultaneously presenting both opportunities and perils. On one hand, high volatility can amplify profits exponentially; on the other, it can magnify losses with equal ferocity. Volatility options trading capitalizes on this inherent market volatility, allowing investors to speculate on the future direction of price movements without owning the underlying asset.

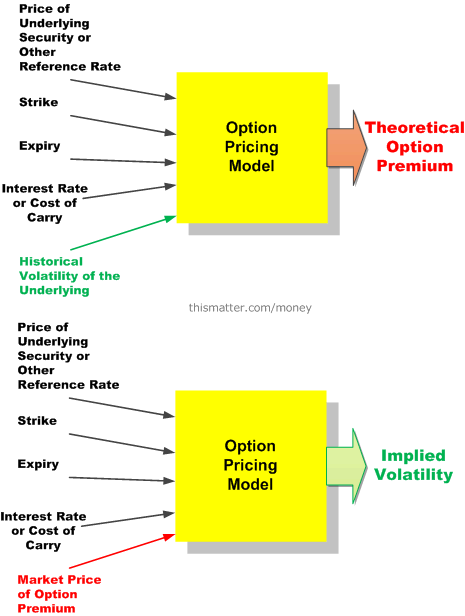

An option contract, in its core form, is an agreement that grants the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) a specified asset at a predefined price, known as the strike price, on or before a predetermined date, known as the expiration date. Volatility options, in particular, are options whose value is directly tied to the volatility of the underlying asset. This means that as volatility rises or falls, the value of the volatility option contract changes accordingly.

Deciphering the Volatility Landscape

Understanding the underlying principles of volatility is paramount for successful options trading. The Volatility Index, or VIX, serves as a widely recognized benchmark for measuring the implied volatility of the S&P 500 index, often referred to as the “fear gauge” of the market. High VIX levels indicate elevated market uncertainty and a heightened potential for significant price swings, while low VIX levels suggest a more stable market environment.

Traders can leverage various analytical tools and indicators to assess volatility patterns and make informed trading decisions. Technical analysis, which involves studying historical price data, charts, and trends, can provide valuable insights into market behavior. Fundamental analysis, which examines economic indicators and company-specific news, can further enhance one’s understanding of factors influencing volatility.

Empowering Strategies: Navigating the Market

Armed with a firm understanding of volatility and options trading, investors can venture into the market armed with a diverse array of strategies. One common approach involves buying volatility options—specifically, long call options—when volatility is low and the market is perceived to be undervalued. As volatility rises, so too does the value of the options contract, potentially yielding substantial profits.

Conversely, selling volatility options—writing put or call options—can generate income if volatility remains within a certain range or even declines. This strategy is often employed by investors seeking to generate a steady stream of income from their portfolio.

More complex strategies, such as straddles and strangles, involve simultaneously buying options at different strike prices to capitalize on both high and low volatility environments. Butterfly spreads, on the other hand, offer a more refined approach, targeting specific volatility ranges.

Image: www.forex.com

Expert Insights: Wisdom from the Masters

Navigating the treacherous waters of volatility options trading demands guidance from experienced traders and esteemed market experts. To this end, let’s glean invaluable insights from seasoned professionals:

- “Volatility is the heartbeat of the market. By understanding and harnessing it, you can gain a competitive edge in trading.” – Mark Douglas

- “When volatility is low, it’s best to be an option seller. When volatility is high, it’s time to become an option buyer.” – Nassim Taleb

- “Volatility options are powerful tools, but they can also be dangerous. Always manage your risk carefully and seek professional advice when necessary.” – Warren Buffett

Actionable Tips: Strategies for Profitable Trading

To empower traders of all levels, let’s delve into a trove of actionable tips for profitable volatility options trading:

- Research thoroughly and stay abreast of market news and economic data.

- Implement robust risk management strategies, including setting stop-loss orders and limiting leverage.

- Start with smaller trades and gradually increase your position size as you gain confidence.

- Choose options with an expiration date that aligns with your trading outlook.

- Monitor your trades closely and adjust your strategy as market conditions evolve.

Volatility Options Trading

Conclusion: Empowering Investors, Transforming Markets

Volatility options trading, while complex, presents a formidable opportunity for investors to capitalize on market fluctuations. By mastering the concepts outlined in this comprehensive guide, you can unlock the potential to mitigate risk, generate income, and achieve consistent profits in the financial markets. Remember, the path to success in volatility options trading lies in knowledge, experience, and a disciplined approach. Embrace the market’s inherent volatility as an ally, not an adversary, and witness your financial endeavors soar to new heights.