Introduction

The allure of options trading beckons many, promising the potential for substantial profits. However, embarking on this intricate domain necessitates a clear understanding of the experience required to navigate its complexities. Here’s a comprehensive guide to help you ascertain the level of preparedness needed before venturing into the world of options.

Image: diohysba.blogspot.com

Exploring the Options Landscape

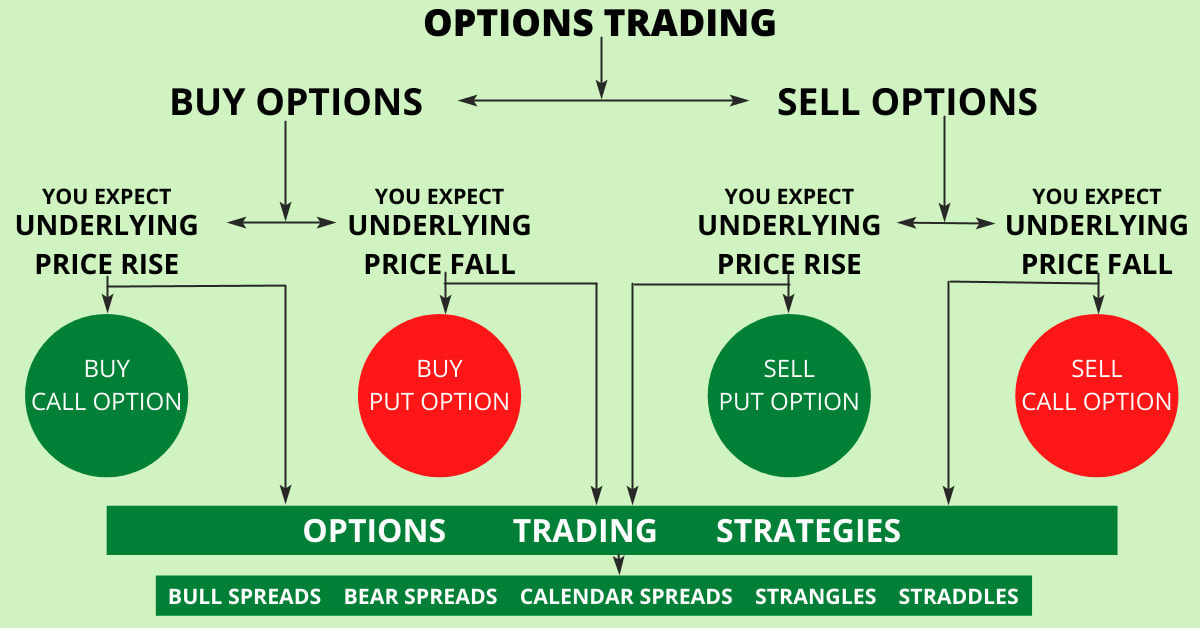

Options are financial instruments that grant traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. They offer a wide array of strategies, allowing traders to hedge against risk, speculate on price movements, and generate additional income. However, the complexities inherent in options trading mandate a solid foundation in financial markets and risk management principles.

Unveiling the Experience Threshold

Assessing the requisite experience for options trading is subjective, primarily influenced by an individual’s risk tolerance, financial goals, and learning agility. That said, most experts concur that a minimum of one to two years of experience actively trading stocks or other financial instruments is prudent.

During this preparatory period, it’s imperative to immerse oneself in the nuances of options trading, comprehending key concepts such as time value, volatility, and greeks (measures of risk and sensitivity to price changes). This foundation will equip traders with the knowledge to make informed decisions and effectively manage risk.

Essential Prerequisites: Skill Sets and Knowledge Base

Beyond a time frame, specific skill sets and knowledge gained through experience are paramount for successful options trading. These include:

- Technical analysis: Interpreting price charts and indicators to identify trends and patterns.

- Fundamental analysis: Understanding the intrinsic value of an asset based on its financial performance and industry outlook.

- Risk management: Implementing strategies to mitigate potential losses, including stop-loss orders and hedging techniques.

- Options pricing models: Proficiency in pricing models like Black-Scholes to determine fair value and assess premiums.

- Market dynamics: Comprehending the factors influencing market fluctuations, such as economic indicators, news events, and geopolitical developments.

Image: fintrakk.com

Recent Trends and Developments in Options Trading

The options trading landscape is constantly evolving, influenced by regulatory changes and technological advancements. In recent years, we’ve witnessed a surge in:

- Algo trading: The use of algorithms to execute trades based on predefined criteria.

- Exotic options: More complex options strategies with unique payoff structures.

- Volatility trading: Strategies that capitalize on price fluctuations and market uncertainty.

- Blockchain-based options: The exploration of distributed ledger technology for secure and transparent options trading.

Tips and Expert Advice: Enhancing Your Skills

As you embark on your options trading journey, consider these expert tips to enhance your skills:

- Start with paper trading: Practice trading options in a simulated environment before risking real capital.

- Choose contracts carefully: Select options with a strike price and expiration date aligned with your risk tolerance and investment goals.

- Manage your risk: Establish clear stop-loss levels and position sizing strategies to limit potential losses.

- Educate yourself continuously: Stay abreast of market trends, trading strategies, and regulatory updates.

- Consult a financial advisor: Seek guidance from a qualified professional to tailor an options trading plan that aligns with your unique circumstances.

Frequently Asked Questions: Navigating the Essentials

Q: What are the risks associated with options trading?

A: Options trading carries inherent risks, including the potential for significant financial losses. Traders should thoroughly understand the risks involved before engaging in this activity.

Q: How much capital do I need to start options trading?

A: The required capital varies depending on the size and number of contracts traded. It’s advisable to start with a manageable amount of capital and increase it gradually as you gain experience and confidence.

Q: Are there any certifications or qualifications required for options trading?

A: While certifications are not mandatory, obtaining the Series 7 Options Principal examination or the Certified Financial Planner (CFP) designation can demonstrate your expertise and credibility.

How Much Trading Experience Is Required For Options

Image: stewdiostix.blogspot.com

Conclusion

Delving into the realm of options trading demands a conscious assessment of your experience and skill set. By gaining a solid understanding of options concepts, risk management strategies, and market dynamics, you can navigate the intricacies of this dynamic financial instrument with greater confidence. Remember, the journey of an options trader is one of continuous learning and adaptation. Embrace the educational opportunities available and seek guidance from experienced professionals to maximize your potential for success.

Are you ready to explore the fascinating world of options trading and unlock its potential? Embark on this adventure with knowledge, preparation, and a commitment to continuous learning.