In the realm of finance, options trading stands as a sophisticated and potentially lucrative investment strategy, enabling investors to leverage market movements for both downside protection and profit-making opportunities. This comprehensive guide aims to demystify the world of options trading, guiding you through its foundational concepts and empowering you to navigate its dynamic landscape with confidence.

Image: tradebrains.in

What are Options?

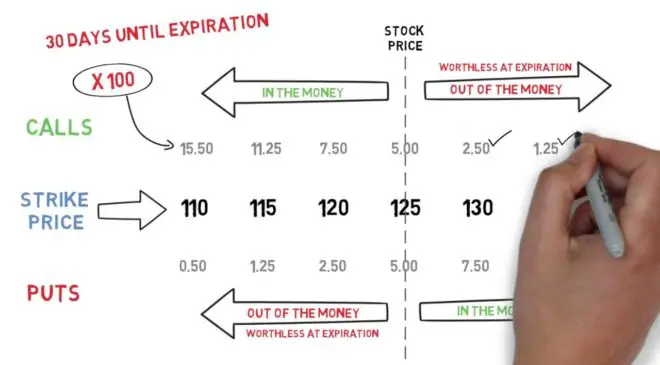

Options, in simplest terms, represent financial instruments that grant investors the right, but not the obligation, to purchase (in the case of call options) or sell (for put options) an underlying asset at a predetermined price (known as the strike price) on or before a specific date (the expiration date). This versatility empowers traders with the flexibility to capitalize on market fluctuations while limiting potential losses.

Call Options: A Primer

Consider a scenario where Microsoft’s stock (MSFT) is trading at $250 per share. An investor who anticipates a future price surge might purchase a call option with a strike price of $260 expiring in three months. This move gives them the right to buy MSFT shares at $260, even if the market price has risen significantly higher.

Put Options: The Downswing Shield

Now, imagine that a trader has concerns about Alphabet Inc.’s (GOOGL) stock performance and believes it will decline in value. The trader could acquire a put option that grants them the right to sell GOOGL shares at a strike price of $1200, protecting themselves against potential losses if the stock price falls below that threshold.

Image: stockmarketpartner.com

Risks and Rewards: Navigating the Spectrum

Options trading offers immense potential for gains, but it also entails inherent risks that must be carefully considered. For instance, if the underlying asset price does not move in the anticipated direction, an option can expire worthless, resulting in the loss of the premium paid to acquire it.

The Role of the Option Premium

The premium paid for an option reflects the market’s perceived probability of the underlying asset reaching the strike price. Options with shorter expiration dates and deeper in-the-money attitudes command higher premiums due to their increased likelihood of profitability.

Real-World Applications: Unveiling the Strategies

Options trading empowers investors with a wide range of strategies, each tailored to specific market conditions and investment objectives. Some popular strategies include:

-

Covered Calls: A prudent choice for those holding a bullish view on stocks owned, combining downside protection with the potential for income generation.

-

Naked Puts: A strategy employed by investors who expect a neutral-to-upward market trend, offering premium income in exchange for the obligation to sell the underlying asset.

-

Bull Spreads: A multi-leg strategy designed to profit from a significant move in the underlying asset’s price, typically executed during periods of expected volatility.

The Future of Options Trading: Embracing Technology

The evolution of technology is reshaping options trading, creating new possibilities and enhancing accessibility. Algorithmic trading platforms, machine learning tools, and sophisticated volatility modeling techniques are increasingly being utilized to analyze market data and optimize trading decisions.

Options Trading 101: From Theory To Application

Image: knowhowtoearn.com

Conclusion: The Path to Options Trading Proficiency

Mastering options trading requires a comprehensive understanding of its fundamentals, risk assessment, and strategic implementation. By leveraging the knowledge imparted in this guide, investors can unlock the potential of this multifaceted financial instrument, embracing both the challenges and rewards that it presents. The journey towards options trading proficiency is an enriching endeavor, equipping investors with the tools to navigate the market’s complexities and pursue their financial aspirations.