Harnessing Technology for Informed Investing

In today’s fast-paced financial landscape, investors and traders seek innovative solutions that empower them to navigate market complexities with precision. Automated options trading software has emerged as a transformative tool, enabling investors to leverage technology for more efficient, informed, and potentially profitable decision-making.

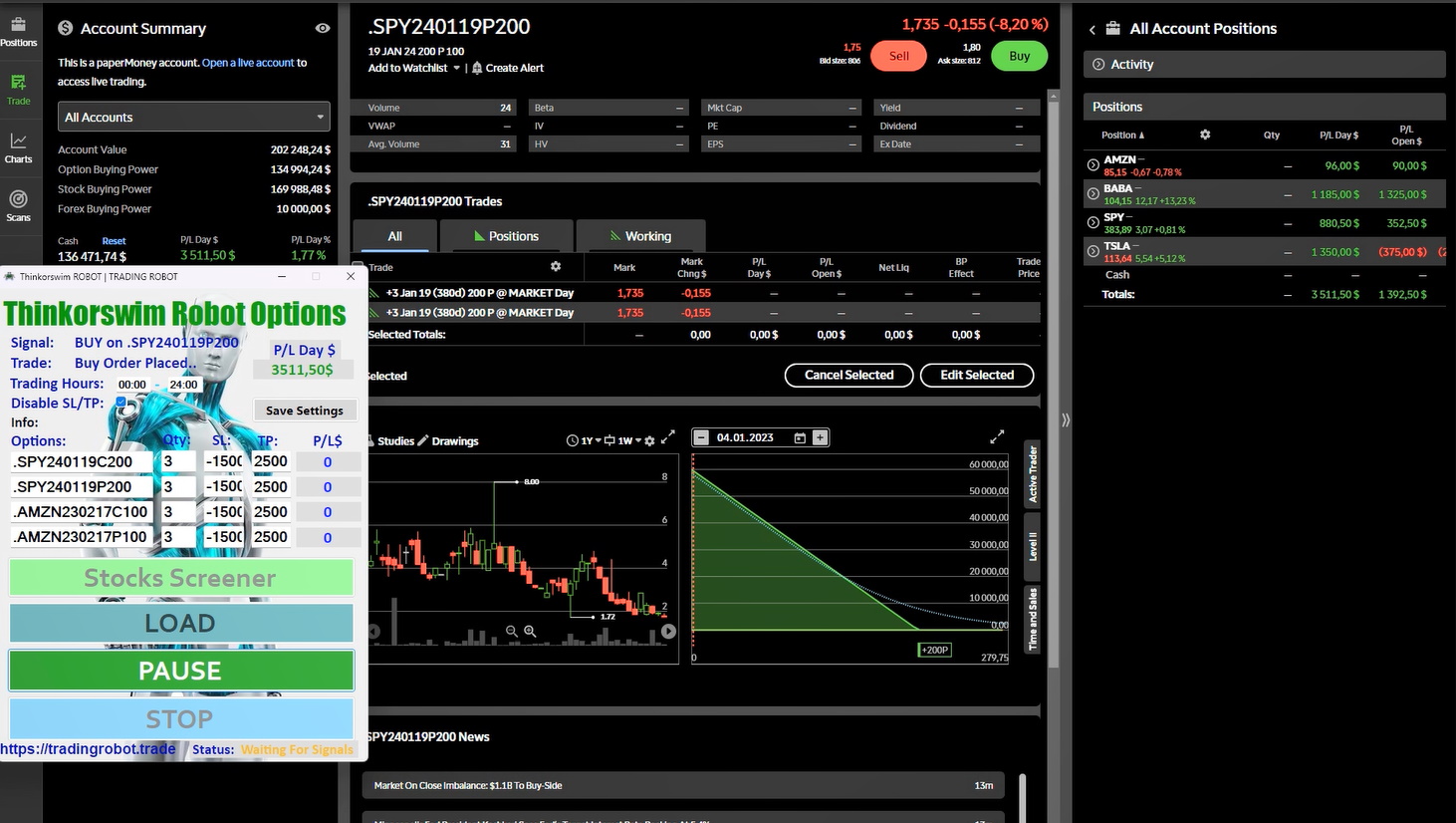

Image: tradingrobot.trade

Demystifying Automated Options Trading Software

Options trading involves contracts that grant buyers the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified timeframe. Automated options trading software utilizes complex algorithms and advanced analytics to streamline the process, empowering traders to identify opportunities, execute trades, and manage positions with greater efficiency.

Key Features of Automated Options Trading Software

The capabilities of automated options trading software are vast, including:

-

Real-Time Data Analysis: The software monitors market conditions and analyzes historical data in real-time, providing traders with up-to-date insights for informed decision-making.

-

Trade Execution Automation: Advanced algorithms execute trades based on pre-defined parameters, ensuring timely and precise order fulfillment.

-

Risk Management Tools: In-built risk management features help traders set limits, receive alerts, and optimize their portfolio performance to mitigate losses.

-

Backtesting and Optimization: Traders can simulate trades using historical data to test strategies and optimize parameters before implementing them in live trading.

Benefits of Using Automated Options Trading Software

Harnessing the power of automated options trading software offers numerous advantages for traders:

-

Efficiency and Time Savings: The software automates repetitive tasks, freeing traders to focus on strategic analysis and portfolio management.

-

Enhanced Accuracy and Consistency: Algorithms can execute trades with precision, reducing human error and maintaining a consistent approach.

-

Emotional Discipline: Automated trading eliminates emotional biases that can cloud judgment and lead to suboptimal decision-making.

-

Global Market Access: Software allows traders to access global markets 24/7, capitalizing on opportunities across time zones.

-

Tailor-Made Strategies: Traders can customize algorithms to suit their unique trading goals and risk tolerance, creating personalized trading plans.

Image: www.youtube.com

Expert Insights: Utilizing Automated Options Trading Software

Industry experts emphasize the importance of understanding the risks and limitations of automated options trading software:

-

“While automation can improve efficiency, it’s crucial to remember that algorithms are not infallible,” explains financial analyst Dr. Emily Carter. “Traders must exercise caution and continually monitor their strategies.”

-

“Proper education is key,” adds trading coach Mark Anderson. “Traders should gain a thorough understanding of options trading and risk management before relying solely on software.”

-

“Seek out reputable providers,” suggests technology expert David Wilson. “Look for software with a proven track record, technical support, and transparent fee structures.”

Automated+Options+Trading+Software

Conclusion: Empowering Traders with Automation

Automated options trading software empowers traders with unparalleled speed, accuracy, and analytical capabilities. By harnessing technology to streamline operations, investors can gain a competitive edge in today’s dynamic financial markets. However, traders must approach automated trading with caution, ensuring a sound understanding of the risks and benefits involved. With proper education and diligence, individuals can leverage automated options trading software to enhance their investing strategies and pursue financial success with greater confidence.