Introduction

Venturing into the world of options trading can be both daunting and exhilarating. As a novice trader, I remember the apprehension I initially felt, grappling with unfamiliar concepts and the inherent risks involved. However, with perseverance and a thirst for knowledge, I gradually unraveled the intricacies of options trading, uncovering its potential as a lucrative financial instrument. In this comprehensive guide, I aim to demystify the world of options definition trading, equipping you with the fundamental knowledge to navigate this dynamic market.

Image: howtotradecurrencys.blogspot.com

Demystifying Options Definition Trading

Options definition trading involves buying or selling contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. This flexibility allows traders to tailor their trading strategies based on their market outlook and risk tolerance. Unlike stocks, which represent ownership in a company, options provide leverage and enable traders to profit from price fluctuations without requiring substantial capital investment upfront.

Comprehending the Lexicon of Options Definition Trading

Navigating the world of options definition trading requires familiarity with a unique set of terms and concepts. Let’s delve into some key terminology:

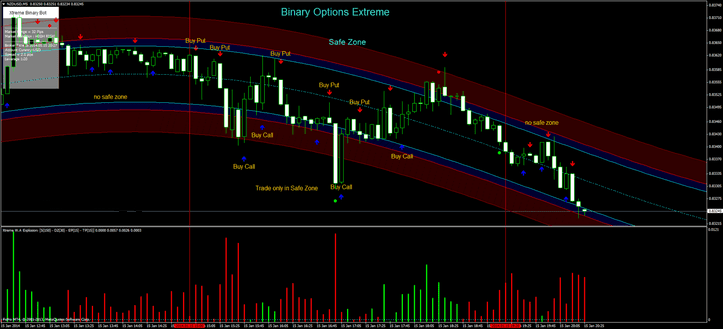

- Call Option: A contract that gives the holder the right to buy an underlying asset at a specified price (strike price) on or before the expiration date. Traders typically purchase call options when they anticipate an increase in the underlying asset’s price.

- Put Option: A contract that grants the holder the right to sell an underlying asset at a set price (strike price) on or before the expiration date. Traders often buy put options when they expect a decline in the underlying asset’s price.

- Strike Price: The predetermined price at which the underlying asset can be bought (in the case of call options) or sold (in the case of put options).

- Expiration Date: Specifies the date on or before which the options contract can be exercised.

- Premium: The price paid to purchase an options contract, representing the right to exercise the option.

Mastering the Mechanics of Options Definition Trading

To execute an options definition trade, you need to possess a brokerage account that permits options trading. Once your account is established, you can place an order to buy or sell an options contract. Orders can be placed online, through a mobile trading platform, or via phone call with your broker. When executing a trade, you will need to specify the following details:

- Type of option (call or put)

- Underlying asset

- Strike price

- Expiration date

- Number of contracts

:max_bytes(150000):strip_icc()/Option-fe0c0ee9204c4a50a281e728fb4c7cab.jpg)

Image: www.investopedia.com

Deciphering Option Quotes and Market Dynamics

Understanding how options are priced and the factors that influence their value is crucial for successful options definition trading. Market makers determine option premiums based on several key factors, including:

- Underlying Asset Price: Changes in the price of the underlying asset directly impact the value of the options contract.

- Volatility: Options with higher implied volatility tend to have higher premiums, as they offer more potential for profit but also carry a greater risk of loss.

- Time to Expiration: The closer an option gets to expiration, the lower its premium will become, as time decay reduces the potential for profit.

- Interest Rates: Interest rates can impact the cost of borrowing money to exercise options contracts.

Exploring Advanced Options Definition Trading Strategies

Once you have grasped the fundamentals of options definition trading, you can explore more sophisticated strategies to enhance your trading performance. Some common strategies include:

- Covered Call Writing: Selling call options against an underlying asset you own to generate additional income.

- Protective Put Buying: Buying put options to hedge against potential losses in an underlying asset.

- Vertical Spreads: Combining multiple call or put options with different strike prices and expiration dates to create tailored risk-reward profiles.

FAQs on Options Definition Trading

Q: What are the potential advantages of options definition trading?

A: Options trading offers leverage, allowing traders to control a larger position with a smaller capital investment. It provides flexibility to tailor trading strategies based on market outlook, and it can be used for both hedging and speculative purposes.

Q: What are the risks associated with options definition trading?

A: Options trading involves significant risk, as the value of options contracts can fluctuate rapidly. Traders can potentially lose their entire investment, and it is crucial to manage risk effectively through proper position sizing and understanding market dynamics.

Options Definition Trading

Image: www.bank2home.com

Call to Action

Embark on your options definition trading journey with confidence, armed with the knowledge imparted in this comprehensive guide. Remember, the financial markets are ever-evolving, and continuous learning is essential for success. Immerse yourself in the intricacies of options trading, seek out additional resources, and connect with experienced traders to expand your knowledge and sharpen your skills. Embrace the challenges that the market presents, as they are opportunities for growth and refinement. Are you eager to delve deeper into the world of options definition trading?