Introduction:

Image: www.cmcmarkets.com

In the ever-evolving realm of financial markets, astute investors seek innovative strategies to augment their returns. One such strategy is forex options trading, a sophisticated instrument that offers the potential to mitigate risk and amplify profits. In this comprehensive guide, we delve into the intricacies of forex options trading, exploring its history, key concepts, and real-world applications. We provide a step-by-step approach to implementing an effective forex options trading strategy, empowering traders with the knowledge and confidence to navigate this dynamic marketplace.

History and Evolution of Forex Options:

Forex options have their roots in the mid-20th century, initially utilized by corporations and financial institutions to hedge against currency fluctuations. Over time, as the forex market grew, options became increasingly popular among individual traders seeking to supplement their income and manage risk. Today, forex options are widely traded globally, providing a versatile tool for investors of all experience levels.

Understanding Forex Options:

A forex option is a derivative contract that provides the holder the right, but not the obligation, to buy (call option) or sell (put option) a specific currency pair at a predetermined price (strike price) on or before a specified date (expiration date). Unlike futures contracts, which obligate the buyer to purchase or sell the underlying asset, options offer flexibility and control, allowing traders to tailor their positions according to their risk tolerance and market outlook.

Call Options vs. Put Options:

Call options grant the holder the right to buy the underlying currency pair at the strike price, while put options provide the right to sell. The choice between a call or put option depends on the trader’s market expectations. If a trader anticipates a rise in the value of a currency pair, a call option would be appropriate. Conversely, if a decline is expected, a put option would be a more suitable choice.

Key Considerations in Forex Options Trading:

-

Strike Price: The strike price is a crucial factor that determines the potential profitability of an option. It is essential to select a strike price that aligns with the trader’s market outlook and risk tolerance.

-

Expiration Date: The expiration date defines the time frame within which the option can be exercised. Traders must consider the market outlook and their investment timeline when choosing an expiration date.

-

Premium: The premium is the price paid by the option buyer to acquire the right to buy or sell the underlying asset. Premiums are influenced by various factors, including market volatility, time to expiration, and interest rates.

-

Risk Management: Forex options trading carries inherent risk, and it is vital to implement robust risk management strategies. Stop-loss orders and position sizing are essential tools for managing capital and mitigating potential losses.

Steps to Develop an Effective Forex Options Trading Strategy:

-

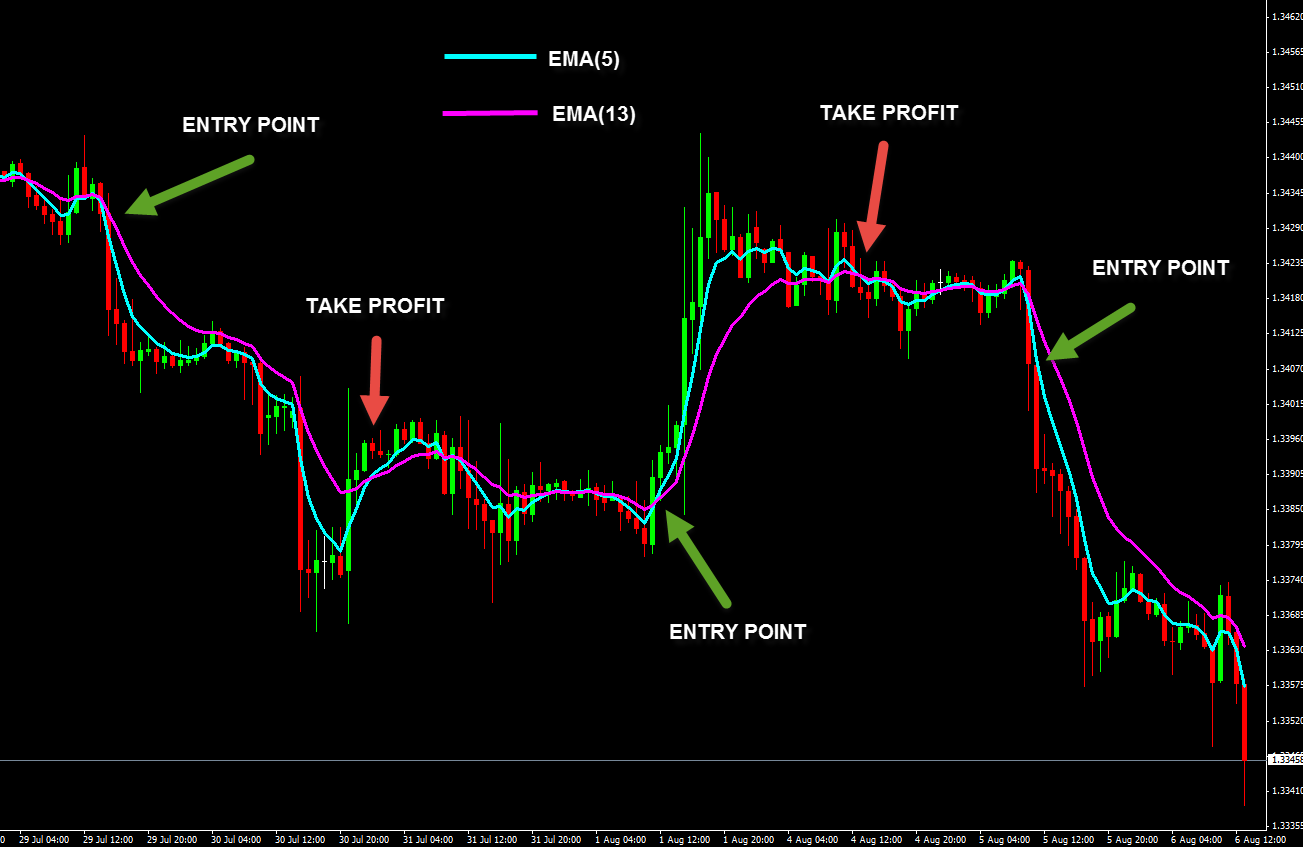

Identify Market Opportunity: The first step is to identify a compelling trading opportunity by analyzing market trends, economic data, and technical indicators. Forex options can be used for both long and short positions, depending on the market outlook.

-

Select Option Type: Based on the market analysis, determine whether to purchase a call or put option. Consider the expected market movement and potential profit and loss scenarios.

-

Choose Strike Price and Expiration Date: Select a strike price that aligns with the trading target and an expiration date that provides sufficient time for the option to move in the desired direction.

-

Manage Risk: Implement appropriate risk management strategies, such as stop-loss orders and position sizing. Determine the maximum risk tolerable and adhere to a disciplined trading plan.

-

Monitor Position: Once the trade is placed, actively monitor market conditions and the performance of the option position. Make adjustments or exit the trade as needed based on market developments and the defined risk parameters.

Conclusion:

Forex options trading empowers investors with a versatile instrument to enhance returns and manage risk in the currency markets. By understanding the key concepts, considering the underlying factors, and adopting a well-structured trading strategy, traders can leverage the advantages of forex options trading. This comprehensive guide provides a solid foundation for traders to navigate the complexities of this market and achieve their financial goals.

Image: www.reed.co.uk

Forex Options Trading Strategy

Image: forexsignalsmarket.blogspot.com