Introduction

In the labyrinthine world of finance, stock options stand as enigmatic instruments, their complexities often veiled beneath an opaque jargon. Yet, beyond the technicalities, these financial derivatives hold profound philosophical implications. This Philosophical Friday, we embark on a journey to explore the philosophical depths of stock options, shedding light on their intrinsic nature and the ethical quandaries they present.

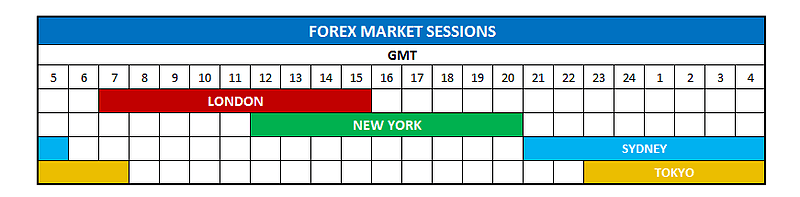

Image: dailypriceaction.com

Stock options, in essence, grant individuals the right to buy or sell an underlying stock at a predetermined price within a specified period. This seemingly innocuous concept, however, has ignited fierce philosophical debates, delving into questions of fairness, speculation, and the very nature of value. It is this intellectual terrain that we shall traverse, seeking to illuminate the philosophical undercurrents that shape the world of stock options.

Philosophical Implications

The fundamental philosophical question surrounding stock options centers around their potential for value creation and speculation. Options, unlike stocks, do not represent ownership in a company but rather a conditional right to acquire or dispose of shares. This distinction raises the question of whether options, in and of themselves, create economic value or merely provide a platform for speculation and risk-taking.

The speculative nature of options has been a subject of both praise and criticism. Proponents argue that options foster market liquidity, enabling investors to manage risk and potentially enhance their returns. Detractors, on the other hand, contend that excessive speculation can lead to market volatility and exacerbate financial instability.

Equity and Fairness

Another philosophical dimension of stock options concerns their implications for equity and fairness. Unlike bonuses or salaries, stock options are typically granted to executives and key employees of a company. This practice has sparked debates about whether option compensation creates excessive wealth disparities and whether it truly aligns with employee performance.

The question of fairness extends beyond executive compensation. The complexity of options can make it challenging for ordinary investors to fully understand the risks and rewards involved. This asymmetry of knowledge raises concerns about whether retail investors are being treated equitably and have access to the necessary information to make informed decisions.

The Essence of Value

The philosophical exploration of stock options also delves into the intricate nature of value. Options, being derivative instruments, derive their value from the underlying asset. However, the valuation of options is not a straightforward exercise. It requires sophisticated mathematical models and an understanding of factors such as volatility, time decay, and interest rates.

This complexity has led to philosophical questions about the nature of value itself. Are options merely abstract constructs with no intrinsic worth, or do they possess a fundamental value that is independent of their underlying assets? These questions challenge our conventional notions of value and force us to re-examine the foundations of economic theory.

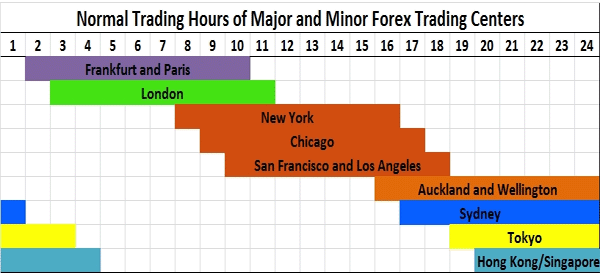

Image: www.daytradetheworld.com

Ethical Quandaries

The realm of stock options also presents ethical quandaries that test our moral principles. Insider trading, for instance, poses a serious ethical challenge. Insiders, who possess non-public information about a company, may be tempted to use that knowledge to profit from stock options. Such behavior undermines trust in the markets and raises questions about the boundaries of ethical conduct.

Another ethical issue arises from the practice of backdating options. Backdating, which involves granting options to employees at a favorable price in retrospect, has been used by some companies to boost executive compensation. This practice has been widely condemned as unethical and has led to investigations and legal action.

Https Www.Learn-Stock-Options-Trading.Com Philosophicalfriday.Html

Image: tradingeconomics.com

Conclusion

The philosophical implications of stock options extend far beyond the technicalities of finance. These instruments touch upon profound questions of fairness, speculation, value, and ethics. By exploring these philosophical depths, we gain a deeper understanding of the nature of stock options and their impact on our economic and social systems.

As we delve into the future of finance, it is essential to remain cognizant of the philosophical dimensions of stock options. By embracing critical thinking and ethical reflection, we can navigate the complexities of this financial landscape with both sophistication and integrity, ensuring that stock options continue to serve as a catalyst for innovation and economic growth, while safeguarding the principles of fairness and transparency.