The whirlwind of the stock market can be both thrilling and intimidating for investors, but navigating its complexities can be made easier with the strategic use of options trading. Among the various options, dd options have emerged as a dynamic tool that empowers seasoned traders to hedge risks and enhance their returns. Join us as we delve into the intricate world of dd options trading, equipping you with the knowledge to unleash their potential.

Image: supermaskinen.blogspot.com

Unveiling the Enigma of dd Options

At their core, dd options are a type of cash-settled option that grants the holder the right, but not the obligation, to sell an underlying security at a predetermined price (strike price) within a specified time frame (expiration date). This unique characteristic distinguishes them from traditional options, which typically involve the physical delivery of the underlying asset.

The flexibility offered by dd options makes them an attractive choice for investors seeking to protect their portfolios from market downturns. Unlike conventional options, dd options allow for speculation on the price movements of the underlying security without the necessity of actually owning the underlying asset. This feature reduces the risk associated with ownership and enables investors to capitalize on price fluctuations.

Executing a Smart DD Options Strategy

To maximize the effectiveness of your dd options trading, a well-crafted strategy is paramount. The first step involves selecting the right underlying security. Consider assets that exhibit high volatility and strong price trends, as these factors enhance the potential for profitable trading.

Next, you’ll need to determine an appropriate strike price. This should be based on your market analysis and the desired risk-reward profile. Setting the strike price at or near the current market price allows for speculative plays without excessive risk.

Finally, it’s crucial to select an expiration date that aligns with your trading timeframe. Short-term options (weekly or monthly) cater to active traders seeking quick returns, while long-term options (quarterly or yearly) suit longer-term investment strategies.

Exploring the Benefits of dd Options

The inclusion of dd options in your trading toolbox offers a multitude of advantages. Their cash-settled nature eliminates the need for physical settlement, reducing trading costs and streamlining the process. Additionally, dd options provide a level of flexibility that traditional options lack, empowering traders to adjust their positions based on changing market conditions.

Beyond hedging risks, dd options can also enhance your portfolio’s income-generating potential. By employing sophisticated strategies such as covered calls or spreads, skilled traders can generate income while maintaining a core position in the underlying asset.

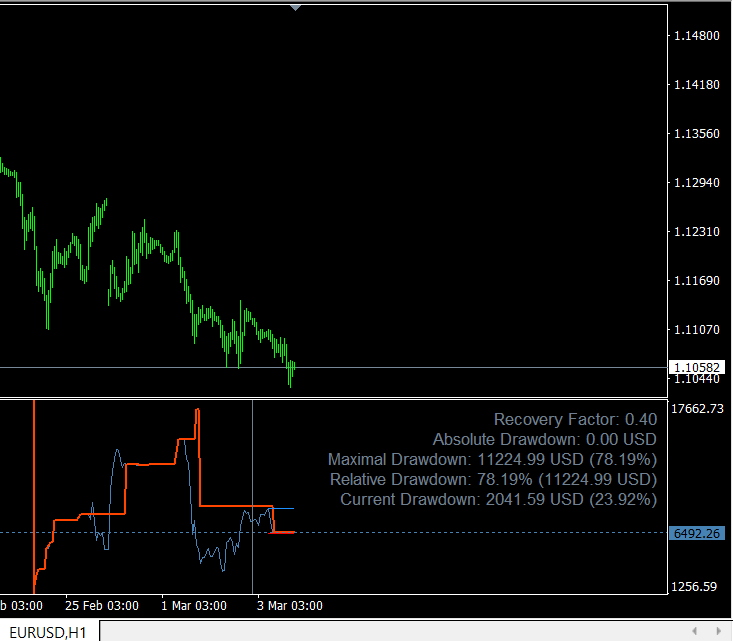

Image: www.mql5.com

Dd Options Trading

Image: www.theforexgeek.com

Conclusion: Unleashing the Power of dd Options Trading

dd options trading is a powerful financial instrument that, when wielded with knowledge and strategy, can significantly enhance your portfolio’s performance. By understanding the dynamics of dd options, selecting the right underlying securities and strike prices, and implementing a well-defined trading plan, you can harness this tool to mitigate risks and maximize returns. Embrace the possibilities of dd options trading and embark on a journey towards financial empowerment!