Have you ever dreamed of venturing into the world of options trading, but the associated risks have held you back? Robinhood, a renowned stock trading platform, offers a solution: paper trading options. As the name suggests, paper trading allows you to simulate the experience of trading options without putting any real money at stake. It’s the perfect way to practice your trading skills, test out different strategies, and gain confidence before taking the plunge into live trading.

Image: www.youtube.com

Before delving into the specifics of paper trading options on Robinhood, let’s briefly explore the fundamentals of options trading. Options are financial instruments that provide their holders with the option (not obligation) to buy or sell an underlying asset at a predetermined price within a specified time frame. Understanding this concept is crucial for navigating the world of options trading.

How to Paper Trade Options on Robinhood

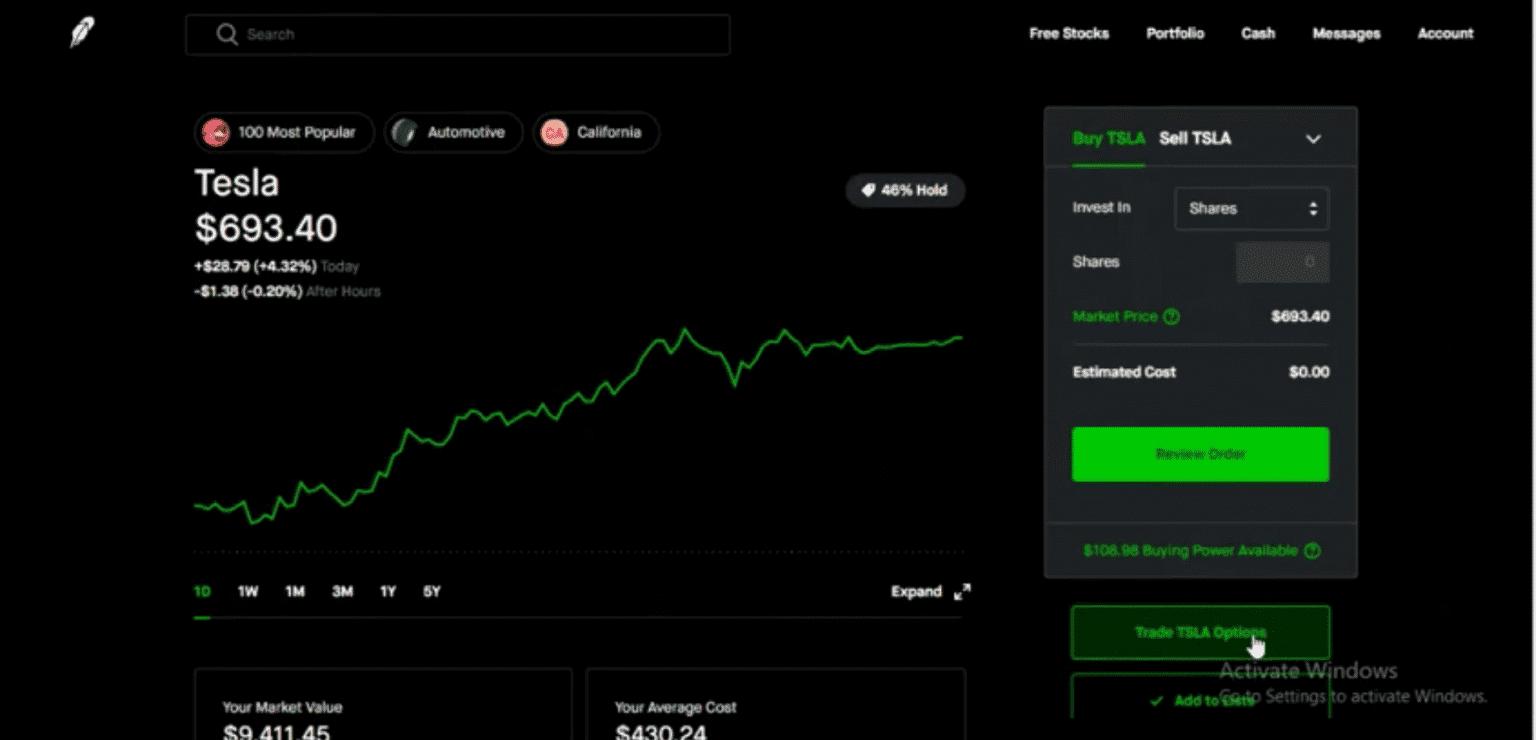

Getting started with paper trading options on Robinhood is straightforward and user-friendly. Simply follow these steps:

- Create a Robinhood account: If you don’t already have one, create a new account on the Robinhood website or through their mobile app.

- Activate paper trading: Within your Robinhood account, enable the paper trading feature. This will create a virtual portfolio where you can practice trading without using real money.

- Choose an underlying asset: Once paper trading is enabled, you can select the underlying asset you’d like to trade options on, such as stocks, ETFs, or cryptocurrencies.

- Select an option contract: Robinhood offers various option contracts based on the underlying asset you choose. Select the one that suits your trading strategy.

- Place your order: Submit your order, specifying the number of contracts, purchase/sale price, and expiration date. Remember, paper trading does not involve real money transactions.

Benefits and Uses of Paper Trading

Paper trading provides numerous advantages for aspiring options traders:

- Risk-free learning: Practice your trading skills without exposing yourself to financial losses.

- Test strategies: Experiment with different trading strategies without compromising your capital.

- Build confidence: Gain confidence in your trading decisions by simulating real-market scenarios.

- Identify opportunities: Explore potential trading opportunities without the pressure of actual trades.

Tips and Expert Advice

To make the most of paper trading, consider these tips and insights from experienced traders:

- Start small: Begin with small simulated trades to get a feel for the process.

- Track your trades: Keep a record of your trades, including the underlying asset, option contract, and trading strategy, to identify patterns and areas for improvement.

- Stay informed: Keep up with the latest market news and trends to make informed trading decisions.

- Seek professional help: Consider consulting with a financial advisor or experienced trader for guidance and support.

Image: marketxls.com

FAQ on Paper Trading Options

Q: What is the difference between paper trading and live trading?

A: Paper trading involves simulating trades using virtual funds, while live trading involves actual financial transactions.

Q: Is it possible to profit from paper trading options?

A: While paper trading offers a risk-free environment to practice, it does not generate real profits.

Q: Can I transition from paper trading to live trading seamlessly?

A: Transitioning to live trading requires real capital and involves risk. It’s recommended to start with small, real-money trades and gradually increase your exposure as you gain confidence and experience.

Paper Trading Options Robinhood

Conclusion

Paper trading options with Robinhood provides a valuable opportunity to learn the nuances of options trading without incurring financial losses. Embrace this educational tool to master trading strategies, build confidence, and prepare yourself for the real-world challenges of options trading.

Remember, paper trading is a simulation, and although it offers a valuable learning experience, it cannot fully replicate the psychological and emotional pressures associated with live trading. Transitioning to live trading requires a different mindset, careful planning, and prudent risk management.

Are you interested in elevating your options trading skills through paper trading?