Welcome to the World of Stock Option Trading:

As an avid investor, I often immerse myself in the thrilling realm of stock option trading. It’s a savvy way to unlock substantial returns from potential market swings while navigating risks. Join me as we explore the fascinating facets of this vibrant trading strategy, understanding its mechanics and unraveling the secrets to success.

Image: www.warsoption.com

Decoding Stock Option Trading:

In its simplest form, a stock option is a contract granting the holder the right, but not the obligation, to buy or sell a specified number of shares of an underlying stock at a predetermined price on or before a set date. This empowers traders with the flexibility to seize opportunities while mitigating risks in the fluctuating stock market.

Types of Stock Options:

The two primary types of stock options are calls and puts. Call options grant the holder the right to buy, while put options offer the right to sell. Each type can be executed at specific points in time, such as American-style options which can be exercised anytime up to expiration, or European-style options which can only be exercised on the expiration date.

Call Options:

Call options are ideal for bullish investors anticipating an incline in the underlying share price. If the price rises above the strike price (the predetermined price in the contract), the option yields profit, providing a levered return on the initial investment.

Image: stockoc.blogspot.com

Put Options:

Put options cater to bearish investors expecting a decline in the underlying share price. When the price falls below the strike price, the option becomes profitable, offering a safety net in a downward-trending market.

Strategies for Enhanced Returns:

The strategic deployment of stock options can significantly enhance portfolio performance. Consider these expert tips:

-

Sell Covered Calls:

Leverage your existing stock holdings to generate income while mitigating downside risk. Sell call options against shares you own, granting others the right to buy your shares at a higher price.

-

Buy Protective Puts:

Shield your portfolio from potential losses in volatile markets. Purchase put options with a strike price below the initial stock purchase. This strategy creates a floor, protecting your investments from extreme market declines.

Frequently Asked Questions:

Q: What are the key factors to consider when trading stock options?

A: Market volatility, interest rates, liquidity, and the underlying stock’s price movements all play vital roles.

Q: Is stock option trading suitable for all investors?

A: While it can be a powerful tool, beginners should approach it with caution, understanding its complexities and potential risks.

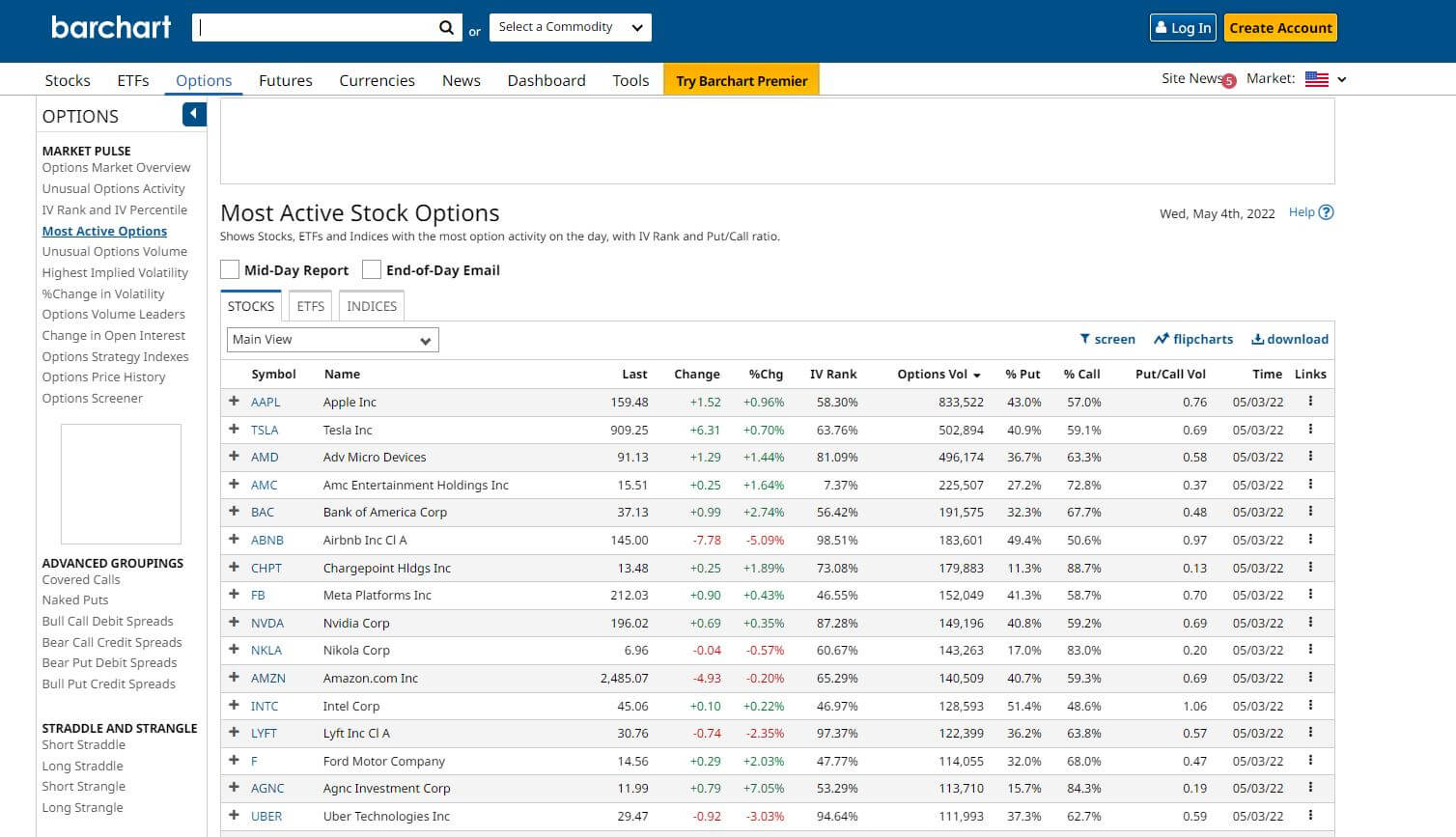

Best Stocks Option Trading

Image: cryptobuz.blogspot.com

Conclusion:

Stock option trading offers a sophisticated approach to unlocking potential profits and managing risks in the stock market. By comprehending its nuances and employing proven strategies, you can navigate the trading landscape with confidence and maximize your returns.

Are you fascinated by the potential returns and strategic advantages of stock option trading? Take the next step towards financial empowerment and explore this captivating realm further.