Introduction

The world of finance can feel intimidating, with its jargon and complex strategies. But beneath the surface, lies a fascinating realm of investment opportunities. One such opportunity is options trading, a powerful tool that can be used to amplify returns, manage risk, and generate income. I first stumbled upon options trading while researching alternative investment strategies. What intrigued me was the ability to control a large position in a stock without actually owning it – a concept known as “leverage.” This piqued my curiosity, and I dove deeper, realizing the enormous potential of options but also the complexities involved.

Image: www.trade-stock-option.com

This article aims to demystify options trading for beginners and provide a solid foundation to navigate this exciting (and potentially lucrative) financial market. We will explore the basics, discuss different strategies, and share valuable tips to help you embark on your own options trading journey.

What are Options?

Options are financial contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a certain price (known as the strike price) on or before a specific date (known as the expiration date).

There are two main types of options:

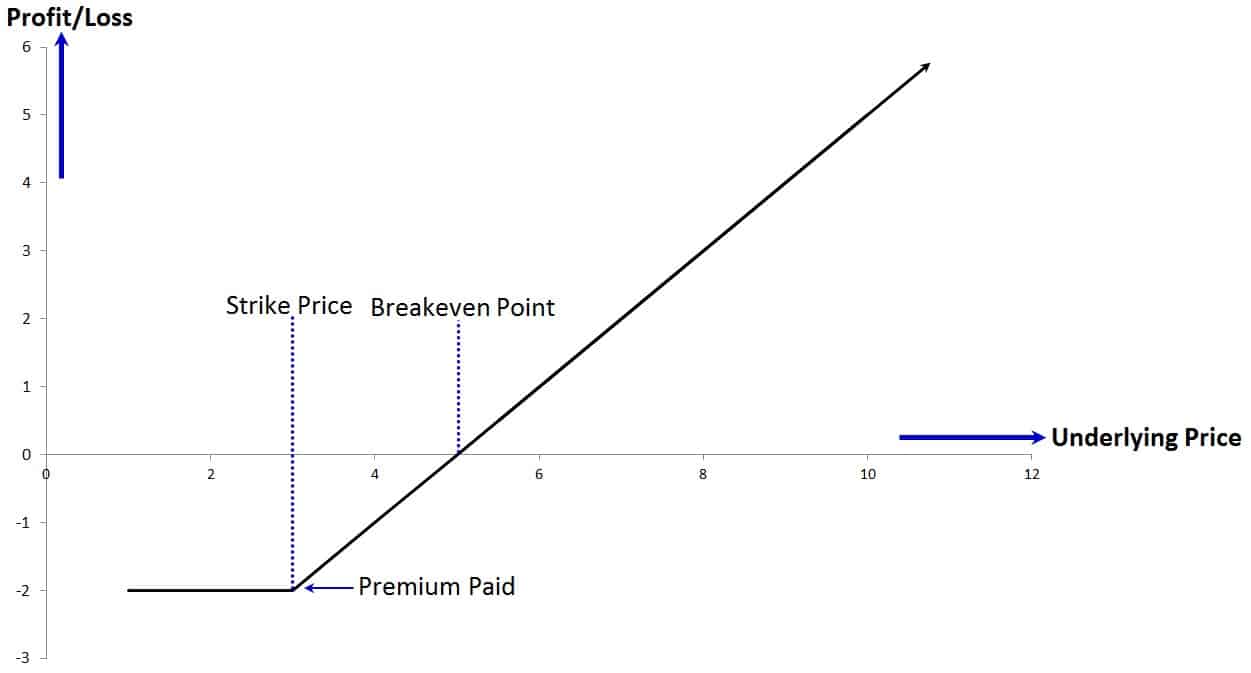

- Call Options: Give the holder the right to buy an underlying asset.

- Put Options: Give the holder the right to sell an underlying asset.

Imagine you believe the price of Apple stock (AAPL) will rise. You could buy a call option on AAPL, giving you the right to buy AAPL shares at a specific price, even if the market price goes up. If AAPL does indeed rise, you can exercise your option, buy the shares at the strike price, and sell them in the market at a higher price, making a profit. On the other hand, if the price falls, you could let the option expire worthless, limiting your potential losses to the premium you paid for the option.

Key Concepts in Options Trading

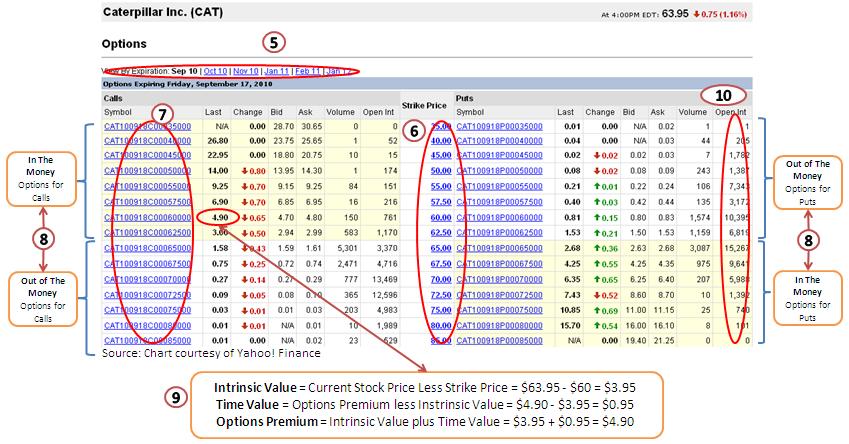

1. Premium

The premium is the price you pay to buy an option. It represents the intrinsic value (the difference between the strike price and the current market price, if any) and the time value (the remaining time until expiration, influencing how much the price could potentially rise).

Image: www.netpicks.com

2. Strike Price

The strike price is the predetermined price at which you can buy or sell the underlying asset if you exercise your option. It’s crucial for determining the potential profit or loss.

3. Expiration Date

The expiration date is the final date on which the option can be exercised. Options expire worthless if they are not exercised by this date.

4. Leverage

Options trading offers leverage, meaning you can control a large position in an asset with a relatively small investment. This can amplify profits, but it can also magnify losses. Understanding leverage is paramount to managing risk effectively.

Popular Options Trading Strategies

1. Covered Call Writing

Covered call writing involves selling a call option on an asset you already own. This strategy generates income from the option premium, but it limits potential upside if the asset price goes up. You’re essentially taking a bet that the asset price won’t rise quickly.

2. Protective Put

A protective put strategy involves buying a put option on an asset you own. This protects your investment from potential losses if the asset price falls. The cost of the put option is the price you pay for this protection.

3. Bullish Spread

A bullish spread involves buying a call option and selling a different call option on the same underlying asset with a higher strike price. This strategy seeks to profit from a rising asset price with a limited downside risk.

4. Bearish Spread

A bearish spread involves buying a put option and selling a different put option on the same underlying asset with a lower strike price. This strategy seeks to profit from a falling asset price with a limited downside risk.

Latest Trends in Options Trading

The options market has witnessed significant growth in recent years. One key trend is the increased adoption of options trading by retail investors, fueled by the rise of online trading platforms and the growing popularity of financial education resources.

Furthermore, the emergence of meme stocks and volatility in the broader market has led to increased demand for options contracts, particularly those with short-term expiration dates. The options market is constantly evolving, with new strategies and tools appearing regularly.

Tips for Successful Options Trading

Here are some valuable tips to enhance your options trading approach:

- Start with a Solid Understanding of Options Basics: Before you even think about placing a trade, ensure you grasp the fundamentals of options trading. Read books, articles, watch videos, and take courses to acquire a strong foundation.

- Develop a Trading Plan: A well-structured trading plan is crucial for success. Define your trading goals, risk tolerance, and investment strategy. This plan will help you navigate the market and make informed trading decisions.

- Manage Risk Effectively: Options trading involves inherent risks. Manage your risk by using stop-loss orders and diversifying your portfolio. Consider limiting your total investment to a percentage of your overall portfolio.

- Stay Informed: The options market is dynamic, with market trends and news constantly affecting prices. Stay informed by reading market insights, following financial news, and utilizing trading platforms with real-time data.

- Consider a Demo Account: Before investing real money, practice trading on a demo account. This allows you to experiment with different strategies and get familiar with the trading platform without risking your capital.

FAQ

Q: What is the difference between buying and selling an option?

Buying an option gives you the right to buy or sell the underlying asset, while selling an option creates an obligation to sell or buy the asset if the buyer chooses to exercise the option.

Q: How risky is options trading?

Options trading is inherently riskier than traditional stock trading due to the leverage involved. It can amplify potential profits, but it can also lead to significant losses.

Q: What are some common mistakes beginners make in options trading?

Common mistakes include:

- Trading without a plan

- Ignoring risk management

- Chasing quick profits

- Overtrading

Q: What resources are available for learning more about options trading?

There are numerous resources available, including:

- Books

- Online courses

- Trading platform tutorials

- Financial websites and blogs

Trading Options Basics

Conclusion

Options trading can be a powerful tool for investors seeking to amplify returns, manage risk, and generate income. However, it’s essential to approach this market with an informed and disciplined mindset. Learn the basics, develop a trading plan, manage risk effectively, and stay informed about market trends. Remember, practice makes perfect, so consider a demo account to develop your skills before risking real capital.

Are you interested in learning more about options trading? Share your thoughts and questions in the comments below.