Introduction

Welcome to the intriguing world of elite option trading, where skill and strategy converge to yield amplified returns. Option trading stands apart as a dynamic financial instrument that empowers traders to potentially profit from market movements in both directions, but it’s not a path for the faint of heart. This comprehensive guide will equip you with the knowledge and insights necessary to navigate this complex realm and unlock the potential of elite option trading.

Image: twitter.com

Understanding Elite Option Trading

Elite option trading encapsulates a refined approach to this specialized financial instrument. Seasoned traders employ advanced techniques, harness market subtleties, and orchestrate sophisticated strategies to maximize gains. While options trading may seem daunting at first, we’ll decode the concepts and empower you with the tools to make informed decisions.

The Basics: Understanding Options

An option is a contract that grants you the right, but not the obligation, to buy or sell an underlying asset (stock, currency, or commodity) at a predetermined price (strike price) on a specified date (expiration date). Calls confer the right to buy, while puts convey the right to sell.

Mastering Advanced Strategies

Elite option traders delve into a repertoire of sophisticated strategies to elevate their returns. These strategies often involve combining multiple options contracts, creatively utilizing differing expiries, and employing refined risk management techniques. The marriage of calls and puts in intricate strategies allows traders to tailor outcomes to specific market scenarios.

Image: tradingstrategyguides.com

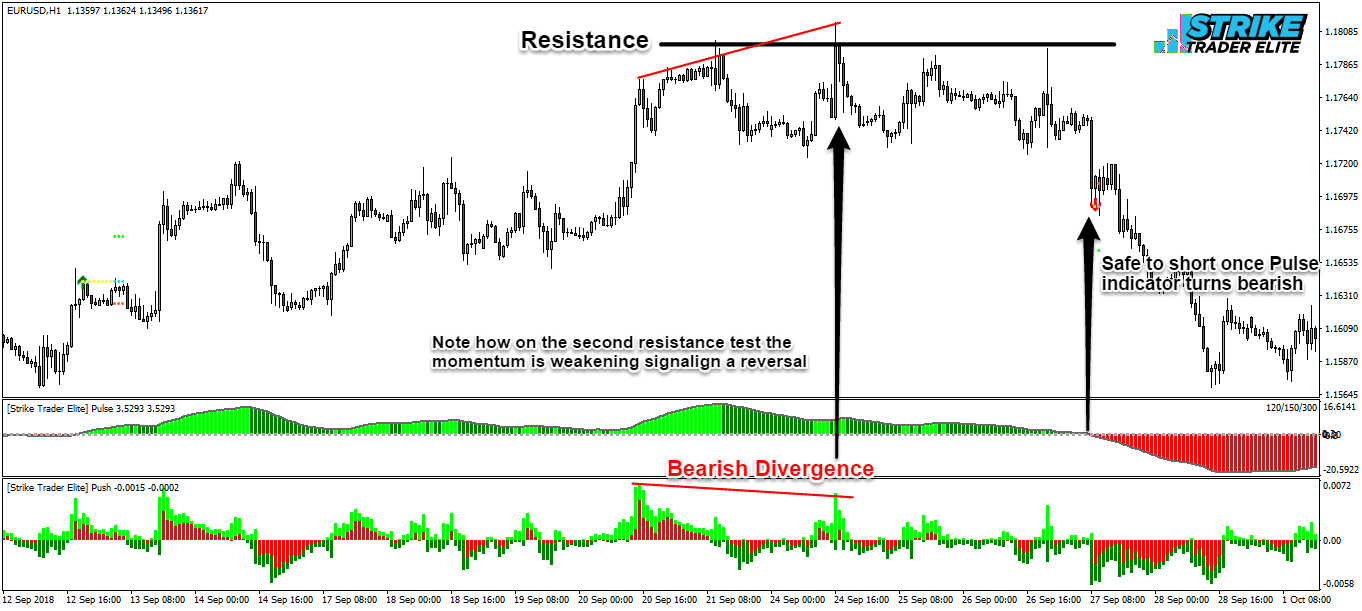

Decoding Market Trends and Technical Indicators

A keen understanding of market dynamics is paramount for elite option traders. Technical indicators, which analyze historical price data to discern patterns and trends, become indispensable tools. By integrating indicators such as moving averages, oscillators, and support and resistance levels into their analyses, traders seek to anticipate market movements with greater accuracy.

Risk Management

Risk management lies at the heart of elite option trading. Discipline, sound judgment, and meticulously calculated risk-reward ratios are essential to preserving capital and maximizing returns. Elite traders embrace the concept of position sizing, prudently allocating capital to mitigate potential losses and enable consistent profitability.

Elite Option Trading

Image: elitefxacademy.com

Conclusion

Elite option trading is an art form that requires a confluence of skill, knowledge, and unwavering dedication. By mastering advanced strategies, decoding market trends and technical indicators, and adhering to stringent risk management principles, you can unlock the potential for substantial returns. Embrace the challenge, engage in continuous learning, and seek mentorship from seasoned veterans to evolve into an elite option trader who consistently outperforms the market.