The realm of investing offers an array of avenues through which individuals seek to multiply their wealth. Two such popular options are margin accounts and options trading, each bearing its own distinct characteristics, risks, and potential rewards. In this article, we delve into the nuances of these strategies, providing clarity for investors seeking to make informed decisions about their financial futures.

Image: www.crudeoildaily.com

Margin Accounts: Amplifying Gains and Magnifying Losses

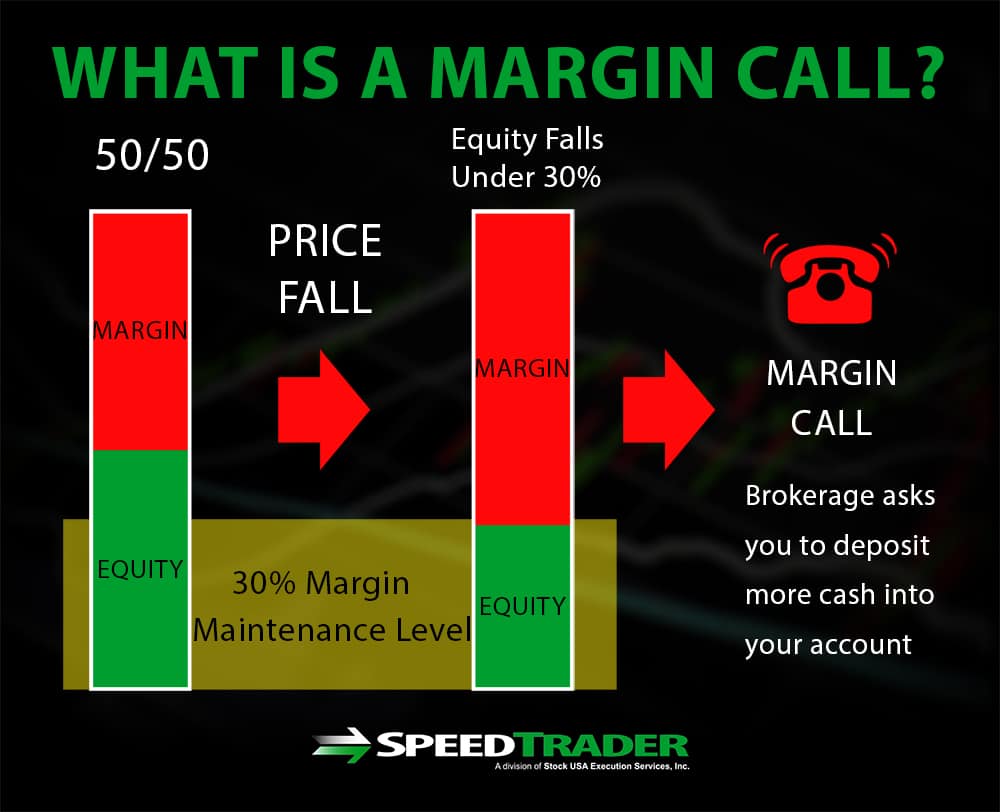

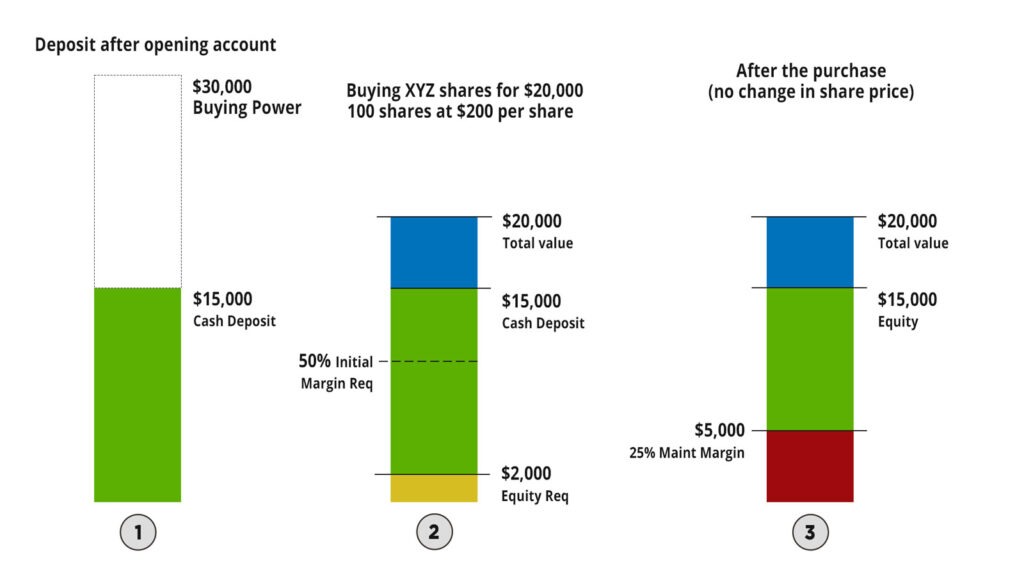

A margin account, also known as a leveraged account, allows investors to borrow funds from their broker to purchase securities. This leverage can potentially amplify gains, as it enables investors to invest more capital than they initially possess. Borrowing capacity is typically determined by a combination of factors, including account equity, income, and creditworthiness.

While margin accounts provide the allure of enhanced returns, they also come with heightened risks. One significant concern is the potential for losses that exceed the initial capital invested. In a scenario where market conditions deteriorate and the value of purchased securities decline, investors may be obligated to cover the shortfall, leading to substantial financial penalties.

Options Trading: A Sophisticated Strategy for Speculation

Options are derivative instruments that provide investors with the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a predetermined price on or before a specified expiration date. Unlike margin accounts, options trading does not necessarily involve the purchase of the underlying asset, offering greater flexibility and reduced capital requirements.

The allure of options trading stems from its potential for substantial gains, particularly in volatile markets. However, it is crucial to acknowledge the inherent complexity and risks associated with this strategy. Options can be multifaceted and difficult to comprehend, making them more appropriate for experienced investors with a comprehensive understanding of financial markets.

Key Differences and Similarities

Both margin accounts and options trading entail inherent risks and require astute financial judgment. Margin accounts offer the potential for amplified gains, but the amplified losses should be carefully considered. Options trading, on the other hand, grants flexibility and reduced capital requirements, but its intricacies demand a high level of expertise.

Despite their differences, margin accounts and options trading share a common ground in their suitability for specific investor profiles. Both strategies are generally more suited for experienced investors who possess a tolerance for risk and a deep understanding of financial markets.

Image: www.tradingoptionscashflow.com

Margin Account Vs Options Trading

Image: shortthestrike.com

Conclusion

The choice between a margin account and options trading hinges on individual investor profiles, risk appetite, and investment objectives. Margin accounts offer the allure of enhanced returns with amplified risks, while options trading provides flexibility and potentially substantial gains with inherent complexity.

For novice investors, it is imperative to meticulously assess their comprehension of financial markets and risk tolerance prior to engaging in either margin accounts or options trading. Seeking professional guidance from experienced financial advisors can prove invaluable in navigating these sophisticated investment strategies and maximizing the chances of fulfilling financial aspirations.