In the dynamic world of options trading, understanding the Greek letters reigns supreme. These elusive characters hold the secrets to maximizing profits and minimizing risks, enabling astute investors to navigate market intricacies with finesse. Among the renowned authorities on this subject stands Dan Passarelli, whose comprehensive guide has become a trusted companion for aspiring options traders. Get ready to unlock the power of Greeks and level up your options game!

Image: pdfcoffee.com

Delving into the Options Lexicon: A Greek Odyssey

Greek letters, seemingly borrowed from ancient mythology, represent a specialized vocabulary that encapsulates the intricate characteristics of options contracts. These metrics, calculated using precise mathematical formulas, provide a snapshot of an option’s behavior under various market conditions. Understanding these Greeks empowers traders to make informed decisions, adjust strategies on the fly, and ultimately tame the options market.

Demystifying the Key Greeks

The Greek pantheon consists of a constellation of essential parameters, each shedding light on different aspects of an option’s DNA:

- Delta: The heartbeat of an option, revealing its sensitivity to underlying asset price movements.

- Gamma: The accelerator, indicating how Delta changes in response to price fluctuations.

- Theta: The timekeeper, highlighting the inexorable decay of option value as expiry approaches.

- Vega: The volatility gauge, reflecting the impact of implied volatility changes on option pricing.

- Rho: The interest rate whisperer, showcasing the influence of interest rate movements on option premiums.

The Greeks in Action: Practical Applications

These Greek letters are much more than mere abstract concepts. In the hands of savvy traders, they become invaluable tools for:

- Pricing options accurately: Greeks provide the foundation for reliable option pricing models.

- Hedging strategies: By understanding how Greeks interact, traders can craft effective hedging strategies to mitigate risks.

- Profit optimization: Greeks allow traders to fine-tune their positions to maximize profit potential.

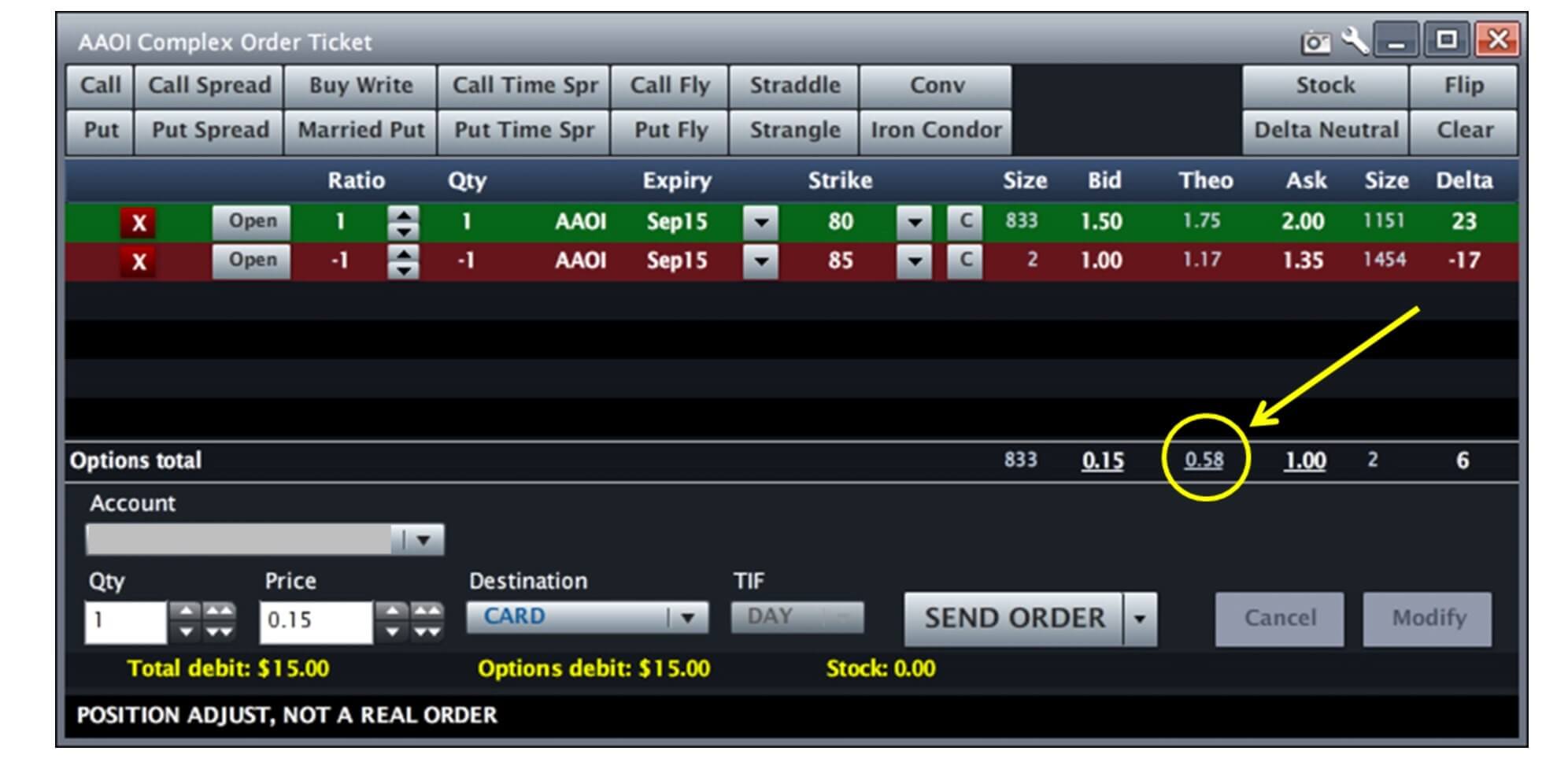

Image: options.cafe

Dan Passarelli: Your Mentor in the Greek Labyrinth

Dan Passarelli, a revered figure in options trading, has generously shared his wisdom in his groundbreaking guide, “Trading Options Greeks.” This comprehensive tome delves into the intricacies of each Greek, providing a roadmap for unlocking their full potential. With clarity, real-world examples, and time-tested strategies, Passarelli empowers traders to conquer the options market, one Greek at a time.

Trading Options Greeks Dan Passarelli Pdf

Image: www.youtube.com

Embrace the Power of Greeks: A Conclusion

Options Gree