In the ever-evolving landscape of financial trading, options have emerged as powerful tools for managing risk and unlocking profit potential. However, navigating the complexities of options markets can be a daunting task. Fortunately, the advent of machine learning (ML) has opened a new chapter, empowering traders with unprecedented insights and predictive capabilities. Join us on an exploration of options trading with machine learning, where we unravel the secrets of this transformative alliance.

Image: iknowfirst.com

Unlocking the Potential of Options Trading

Options are financial contracts that grant buyers the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a specified price (strike price) within a predetermined period (expiration date). This flexibility makes options versatile tools for portfolio management, risk hedging, and income generation.

The Role of Machine Learning

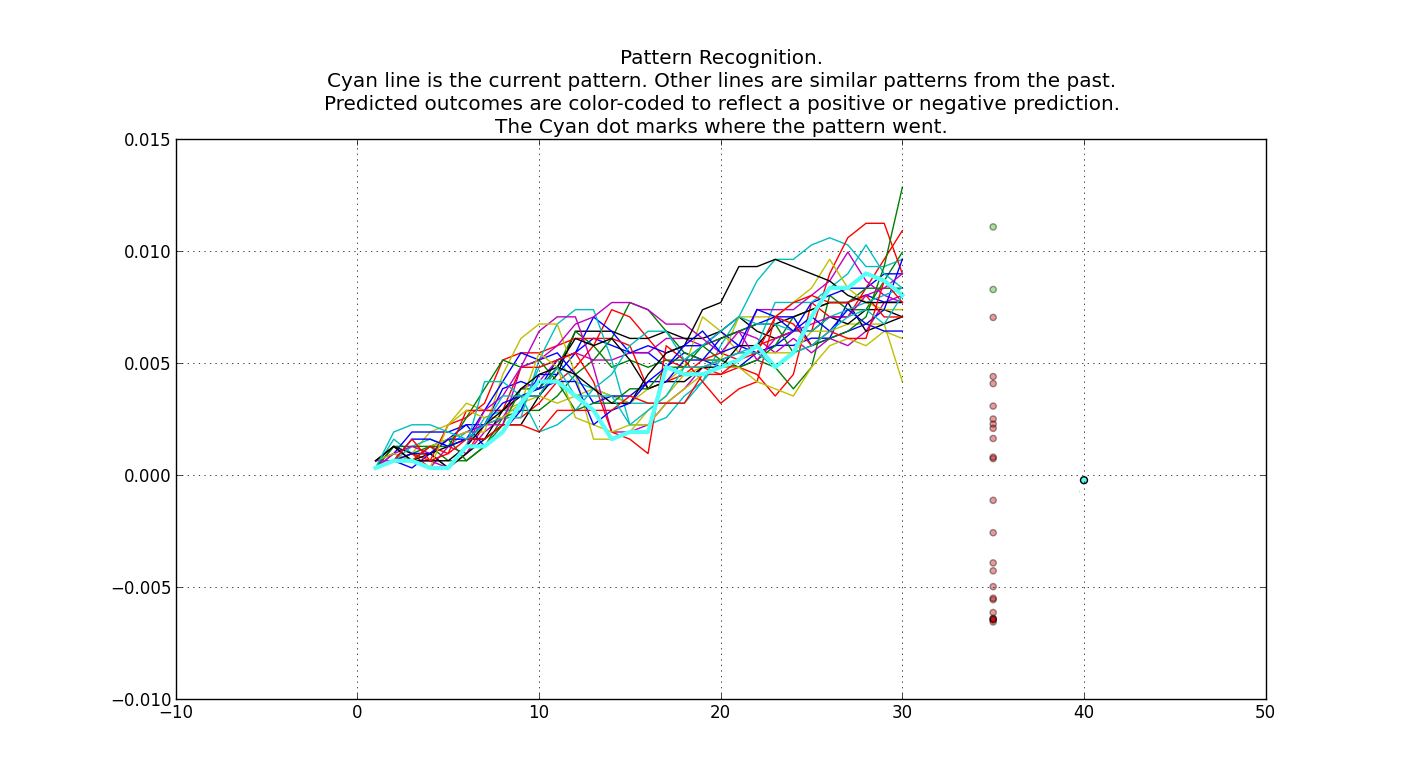

Machine learning, a subset of artificial intelligence, empowers computers to learn patterns and extract insights from large datasets. By analyzing historical market data, order flow, and a myriad of other factors, ML algorithms can identify trading strategies with high probabilities of success.

ML-Powered Options Trading Strategies

ML algorithms excel in developing a wide range of options trading strategies tailored to specific market conditions and risk profiles. Some notable strategies include:

- Trend Following: ML algorithms can identify emerging uptrends and downtrends, allowing traders to capitalize on momentum.

- Statistical Arbitrage: ML algorithms leverage price discrepancies across different markets to generate low-risk returns.

- Volatility Trading: ML algorithms predict future volatility levels, enabling traders to optimize their trading strategies based on market volatility.

Expert Insights: Unleashing the Power of ML

Experts in the field emphasize the game-changing potential of ML in options trading. “Machine learning has revolutionized the way we approach options trading by providing real-time insights into market sentiment and risk,” says Dr. Mark Harrison, a leading quantitative finance researcher.

Actionable Tips for Traders

- Leverage High-Quality Data: The success of ML algorithms hinges on the quality of data used in training. Ensure your data sources are reliable and comprehensive.

- Understand Your Trading Strategy: Before implementing ML-powered strategies, have a clear understanding of the underlying logic and risk parameters.

- Monitor Performance Regularly: Track the performance of your ML-powered trading strategies over time and make necessary adjustments based on evolving market conditions.

Conclusion: Navigating with Confidence

Options trading with machine learning is a transformative force in the financial markets, empowering traders of all levels with data-driven insights and predictive power. By harnessing the capabilities of ML, traders can navigate the complexities of options markets with greater confidence, optimize their risk-reward profiles, and unlock new avenues for profit generation. As technology continues to advance, ML’s role in options trading is poised to expand even further, opening up exciting possibilities for traders in the years to come.

Image: www.datatobiz.com

Options Trading With Machine Learning

Image: belucydyret.web.fc2.com