Options trading, a versatile investment strategy, grants traders the right, not the obligation, to buy (call option) or sell (put option) an underlying asset at a predefined price (strike price) on or before a specific date (expiration date). This flexibility offers traders the potential to generate substantial profits by speculating on the future price movements of the underlying asset.

Image: www.pinterest.com.au

Among the myriad of options trading strategies, certain approaches consistently stand out due to their high profitability potential. Let’s delve into the intricacies of the most lucrative strategies employed by seasoned options traders:

1. Covered Call Strategy: Harnessing Upside Potential

The covered call strategy involves selling (writing) a call option while simultaneously owning the underlying asset. This strategy is ideal in scenarios where the trader anticipates a modest appreciation or sideways movement in the underlying asset’s price.

- Benefits: Limited risk exposure capped at the difference between the strike price and the purchase price of the underlying asset. Premium income generated from selling the call option enhances the return potential.

- Example: Trader owns 100 shares of Apple stock purchased at $150 per share. The trader sells a call option with a strike price of $155 for a premium of $5. If Apple’s stock price rises above $160, the trader retains the profit on the underlying shares, while the sold call option expires worthless.

2. Cash-Secured Put Strategy: Generating Income from Downside Bets

Similar to the covered call strategy, the cash-secured put strategy involves selling (writing) a put option while holding sufficient cash to purchase the underlying asset if the option is exercised. This strategy exploits the potential for the underlying asset’s price to either stay stable or decline.

- Benefits: Premium income received upfront reduces the cost basis of the underlying asset. If the stock price falls below the strike price, the trader is obligated to buy the asset, but at a lower effective price due to the premium received.

- Example: Trader has $10,000 in cash and believes Tesla stock is overvalued. The trader sells a put option with a strike price of $900 for a premium of $20. If Tesla’s stock price remains above $900, the put option expires worthless, and the trader keeps the premium.

3. Iron Condor Strategy: Capitalizing on Market Volatility

The iron condor strategy involves selling (writing) both a call and a put option at different strike prices, while simultaneously buying (purchasing) a call and a put option at even higher and lower strike prices, respectively. This strategy thrives in markets with low volatility.

- Benefits: Generates premium income from selling the options while mitigating potential losses through the purchased options. Most profitable when the underlying asset’s price remains within a narrow range.

- Example: Trader expects moderate volatility in Amazon stock and sells a call option with a strike price of $1,200 and a put option with a strike price of $1,100, while buying a call option with a strike price of $1,250 and a put option with a strike price of $1,050.

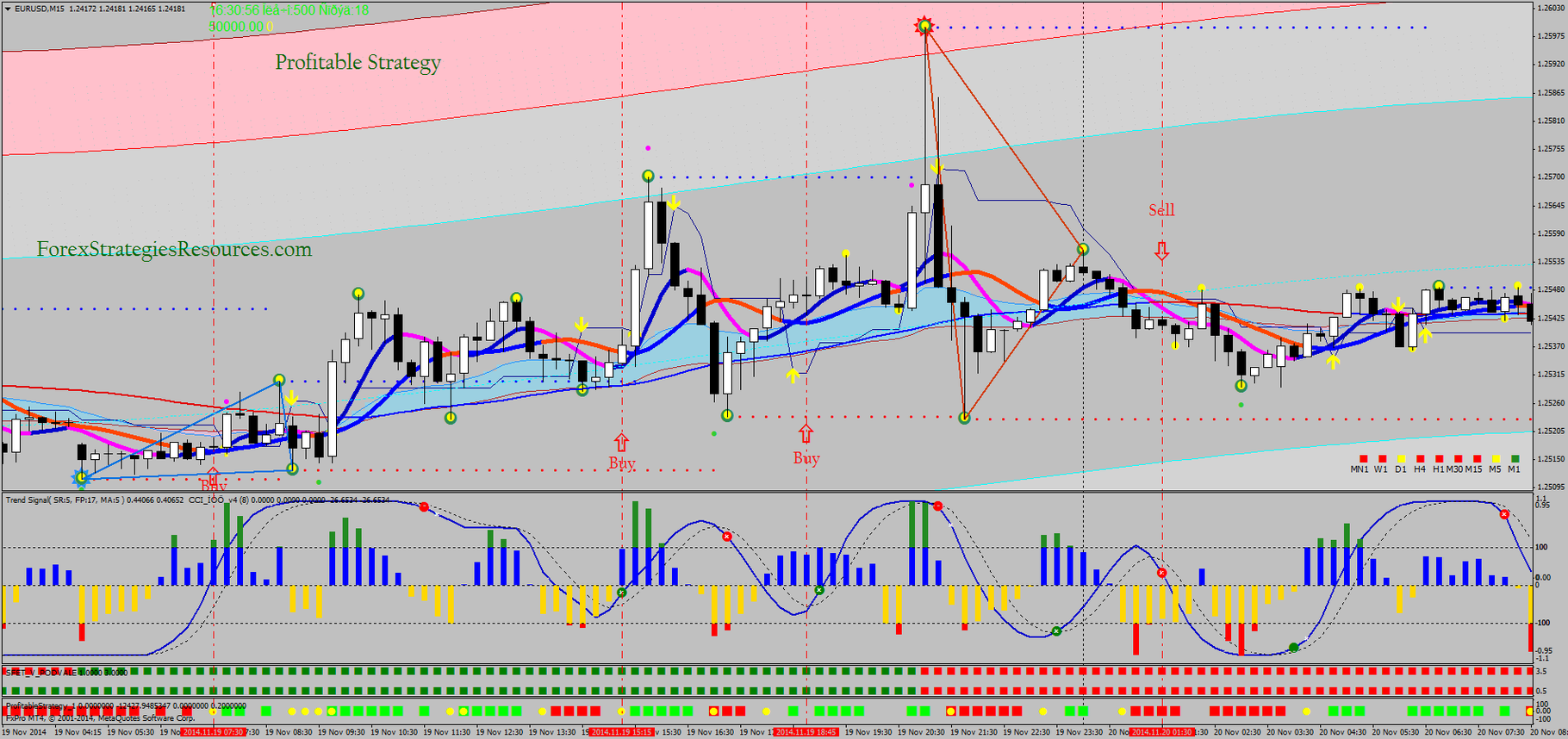

Image: www.investingshortcuts.com

4. Butterfly Spread Strategy: Targeting Specific Price Moves

A butterfly spread strategy involves buying (purchasing) one option at the middle strike price and simultaneously selling (writing) two options at strike prices above and below the middle strike price. This strategy benefits from a specific, moderate price movement in the underlying asset.

- Benefits: Limited profit potential but also limited risk, making it suitable for traders with a moderate risk appetite. Generates income if the underlying asset’s price moves in the anticipated direction.

- Example: Trader believes that Facebook stock will experience a modest increase and buys a call option with a strike price of $200, while selling two call options with strike prices of $205 and $207.

Most Profitable Options Trading Strategy

Image: www.forexstrategiesresources.com

Conclusion

The world of options trading offers a plethora of strategies, each catering to different market conditions and risk tolerance levels. By understanding the nuances of these strategies, traders can harness the potential for substantial profits while mitigating risks. Remember to conduct thorough research, consider market volatility, and seek professional advice if needed to maximize your success in exploiting the lucrative opportunities in options trading.