The intricate world of financial markets presents ample opportunities for investors to delve into diverse instruments. However, understanding market nuances is essential to avoid potential pitfalls. Trading in illiquid options, a topic that garners scant attention, invites a thorough exploration. This article embarks on a journey to unravel the intricacies of this market segment, shedding light on its implications and equipping readers with strategies to navigate its challenges.

Image: www.youtube.com

Grasping the Concept of Illiquidity

When venturing into the realm of options trading, it is imperative to comprehend the concept of liquidity. Liquidity gauges the ease with which an asset can be bought or sold without affecting its market price significantly. Illiquid options, unlike their highly liquid counterparts, lack active market participants to facilitate efficient trading. This disparity in liquidity stems from factors such as low demand, limited market knowledge, and infrequent trading activity.

Consequently, illiquid options pose unique challenges for market participants. The absence of ample buyers and sellers can lead to extended periods of holding, diminished price transparency, and higher trading costs. Navigating this market landscape necessitates a prudent approach, underpinned by a thorough understanding of the potential risks and rewards involved.

Understanding the Risks Associated with Illiquid Options

Before embarking on trades involving illiquid options, it is essential to be cognizant of the inherent risks. The lack of liquidity can result in:

- Wide Bid-Ask Spreads: Limited market participation can lead to significant disparities between bid and ask prices, resulting in higher transaction costs and potentially unfavorable execution prices.

- Delays in Execution: The scarcity of active counterparties may prolong the time required to execute trades, potentially impeding timely market exits or entries.

- Price Volatility: Illiquid options are more susceptible to price fluctuations compared to their liquid counterparts, raising the risk of losses due to abrupt market movements.

Approaching Illiquid Options with Prudence

Despite the challenges posed by illiquid options, strategic approaches can mitigate risks and maximize potential returns. Prudent investors should consider the following strategies:

- Thorough Research: Meticulous research is paramount to evaluate the underlying asset, market conditions, and potential liquidity constraints before initiating trades.

- Price Discovery: Exploring multiple market venues can enhance price transparency, enabling investors to gauge fair market value and make informed decisions.

- Appropriate Sizing: Avoiding concentrated positions in illiquid options is advisable. Managing risk through appropriate position sizing ensures that potential losses are contained within manageable limits.

Furthermore, staying abreast of market updates, monitoring trading activity, and seeking professional guidance when necessary can further enhance trading strategies. By adopting a well-rounded approach, investors can capitalize on the potential rewards of illiquid options while minimizing associated risks.

Image: myforex.com

Frequently Asked Questions on Illiquid Options

Q: What factors contribute to the illiquidity of certain options?

A: Low demand, lack of market knowledge, and infrequent trading activity can all contribute to option illiquidity.

Q: Is it possible to profit from trading illiquid options?

A: Yes, with appropriate risk management strategies and thorough research, skilled traders can capitalize on the potential rewards of illiquid options.

Q: What are the main challenges associated with trading illiquid options?

A: Illiquid options present challenges such as wide bid-ask spreads, delays in execution, and price volatility due to the limited number of market participants.

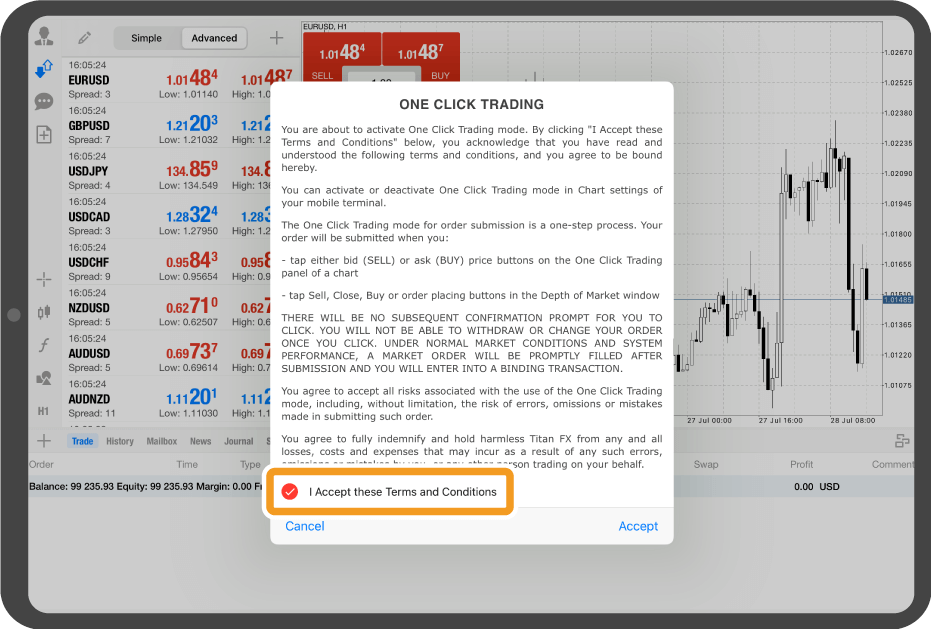

Trading In Illiquid Options Not Allowed

Image: www.youtube.com

Conclusion

Venturing into the realm of illiquid options can be a daunting prospect, yet it holds potential rewards for those who tread cautiously. A thorough understanding of market dynamics, prudent risk management strategies, and the ability to adapt are paramount for success. By embracing these principles, market participants can navigate this segment with increased confidence, unlocking the potential while mitigating risks.

Do you find the topic of illiquid options intriguing? Share your thoughts and engage in the discussion below. Stay tuned for further insights, tips, and strategies related to this fascinating and ever-evolving aspect of financial markets.