Once upon a time, on Wall Street’s glittering stage, a trading giant stumbled upon a $6.5 billion nightmare. Goldman Sachs, renowned for its financial prowess, faced an embarrassing and costly options trading error that sent shockwaves through the markets. This incident, a mesmerizing tale of risk gone awry, offers valuable lessons in the treacherous realm of investing.

Image: www.msn.com

In the realm of options trading, a certain degree of risk is inherent, a delicate dance between reward and uncertainty. But in April 2021, Goldman Sachs found itself caught in a whirlwind of its own making, a self-inflicted wound that left the financial world reeling.

Options Trading: A Risky Game of Probabilities

Options, financial instruments that grant the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date, introduce an intricate layer of speculation into the investment landscape. Traders, donning the guise of risk-takers, navigate the labyrinthine terrain of probability, calculating potential payoffs against the ever-looming threat of losses.

In Goldman Sachs’ ill-fated adventure, the bank wagered heavily on the relative stability of the VIX, a volatility index that acts as a barometer of market uncertainty. However, as fate would have it, the VIX underwent an unpredictable surge, casting Goldman’s carefully laid plans into disarray. The bank’s colossal options position, once a bastion of confidence, became a liability, exposing it to a staggering loss that would reverberate throughout the financial industry.

A Cascade of Consequences: The Aftermath of the Error

News of Goldman Sachs’ trading misadventure spread like wildfire, igniting a media firestorm and tarnishing the bank’s reputation as a paragon of financial acumen. Regulators descended upon the scene, launching a meticulous investigation into the incident. The financial blow to Goldman’s bottom line was severe, but the damage to its credibility proved even more costly.

In the wake of the calamity, Goldman Sachs faced a barrage of lawsuits from investors seeking compensation for their losses. The bank’s esteemed reputation, once the envy of Wall Street, was irreparably damaged. The trading error became a cautionary tale, a somber reminder of the unforgiving consequences of complacency and miscalculation.

Lessons Learned: Risk Management in the Spotlight

The Goldman Sachs options trading debacle serves as a stark reminder of the paramount importance of prudent risk management in the high-stakes world of investing. The incident laid bare the potential perils of excessive risk-taking, highlighting the need for robust internal controls and rigorous oversight.

In the aftermath of the error, Goldman Sachs overhauled its risk management framework, instituting stricter protocols and enhancing its monitoring capabilities. The bank’s leadership acknowledged the shortcomings that had contributed to the disaster and vowed to learn from their mistakes. The incident became a catalyst for positive change, a painful but necessary lesson in the relentless pursuit of mitigating risk.

Image: www.pinterest.com

Tips for Prudent Risk Management: Expert Insights

Seasoned investors and financial experts offer invaluable advice for navigating the treacherous waters of risk management, drawing upon decades of hard-earned experience. These tips, if heeded, can help investors navigate the complex landscape of investing with greater confidence and prudence:

- Conduct thorough research: Before venturing into an investment, dedicate ample time to understanding the risks involved. Assess the market conditions, study the underlying asset, and identify potential risks to your capital.

- Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments across different asset classes, reducing your exposure to any one particular market or sector.

These expert tips, when diligently applied, can mitigate risk and enhance the likelihood of long-term investment success. By embracing prudent risk management practices, investors can empower themselves to navigate the financial markets with greater confidence and resilience.

Frequently Asked Questions: Exploring Common Concerns

Q: What caused Goldman Sachs’ options trading error?

A: The error stemmed from a miscalculation of the VIX’s potential movement, leading to an excessively large options position that backfired when volatility spiked unexpectedly.

Q: What were the consequences of the error?

A: Goldman Sachs suffered a substantial financial loss, damaged its reputation, and faced regulatory scrutiny and lawsuits.

Q: What lessons can be learned from the incident?

A: The error highlights the importance of robust risk management, thorough research, and avoiding excessive risk-taking.

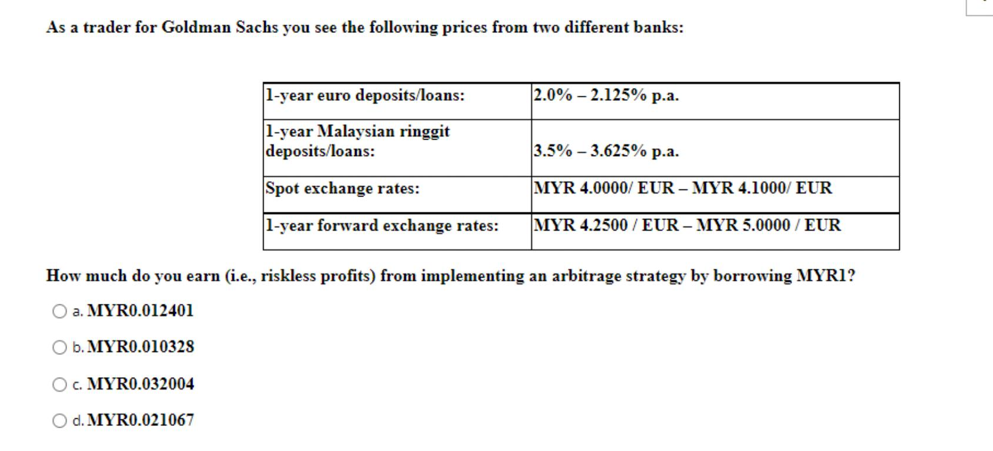

Goldman Sachs Options Trading Error

Image: www.chegg.com

Conclusion: A Cautionary Tale and a Call to Action

Goldman Sachs’ options trading error stands as a cautionary tale in the annals of investing, a vivid reminder of the unforgiving consequences of inadequate risk management. The incident serves as a poignant lesson for investors of all levels, underscoring the importance of prudence, diversification, and a thorough understanding of the risks involved.

Are you interested in learning more about risk management in investing? If so, we encourage you to delve deeper into the subject, equipping yourself with the knowledge and tools necessary to navigate the financial markets with greater confidence and success.