In the ever-evolving landscape of financial planning, savvy investors seek innovative strategies to maximize their returns while optimizing their tax liabilities. Option trading emerges as a powerful tool that can seamlessly integrate with tax-saving plans, unlocking the door to potential wealth creation and tax savings.

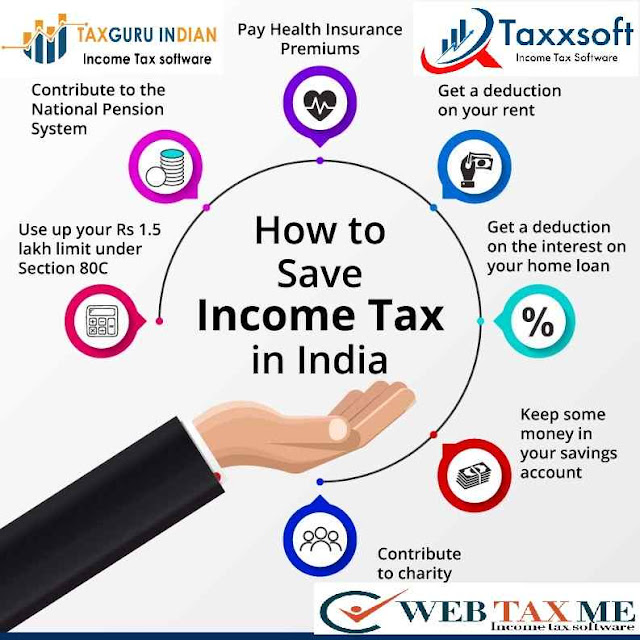

Image: www.pinterest.ca

Introduction to Option Trading for Tax Saving

An option is a contract that grants the buyer the right, but not the obligation, to buy or sell an underlying asset (such as stocks or commodities) at a specific strike price within a specified time frame. By incorporating options into their tax-saving plans, investors can potentially enhance their returns and optimize their tax efficiency.

Types of Option Trading Strategies for Tax Savings

Covered Calls

Covered calls involve selling a call option against an existing holding of the underlying asset. If the underlying asset’s price increases above the strike price, the option buyer exercises their right to purchase the asset, resulting in a gain for the seller. Simultaneously, you can reduce your capital gains tax liability by lowering the cost basis of the underlying asset.

Image: taxexcel.blogspot.com

Cash-Secured Puts

Cash-secured puts entail selling a put option while holding cash as collateral. If the underlying asset’s price falls below the strike price, the option buyer exercises their right to sell the asset, obligating the seller to purchase it. This strategy generates income through the premium received from selling the option and can offset potential losses from a decline in the asset’s price.

Collar Strategy

Collar strategies combine a covered call with a protective put option. The covered call generates income and limits upside potential, while the protective put safeguards against significant downside risks. This strategy is ideal for investors seeking a balance between income generation and downside protection.

Benefits of Option Trading for Tax Savings

- Enhanced Returns: Options can augment returns by providing additional income streams through premium received from selling options.

- Tax Optimization: Covered calls can lower capital gains tax liability, while cash-secured puts can generate income taxed at a lower rate than capital gains.

- Risk Management: Collar strategies provide downside protection, limiting potential losses.

- Portfolio Diversification: Optionen can diversify portfolios and reduce overall risk exposure.

Key Considerations

While option trading offers significant benefits, careful consideration of the following factors is crucial:

- Volatility: Option pricing is heavily influenced by market volatility. Investors should carefully assess market conditions before implementing option strategies.

- Time Decay: Option values decay over time, impacting strategy execution and returns.

- Risk Tolerance: Option Trading involves financial risk. Investors should thoroughly understand their risk tolerance and invest within their limits.

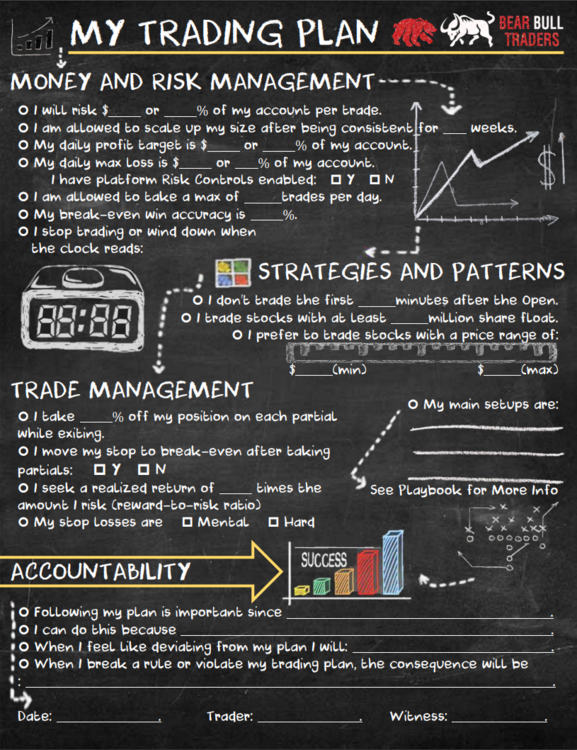

Option Trading For Trief Saving Plans

Image: forums.bearbulltraders.com

Conclusion

Option trading presents a compelling opportunity to enhance returns and optimize tax savings within a tax-saving plan. By embracing carefully chosen strategies such as covered calls, cash-secured puts, or collar strategies, investors can unlock the potential of option trading to achieve their financial goals. However, it is paramount to approach option trading with a comprehensive understanding of market dynamics, risk factors, and tax implications. Consult with a qualified financial advisor to determine if option trading aligns with your investment objectives and risk tolerance.