Introduction

In the bustling landscape of cryptocurrency trading, Litecoin (LTC) stands out as a formidable asset with its fast transaction times and low fees. Options trading offers a sophisticated layer to LTC trading, unlocking a world of opportunities for savvy investors. Understanding the intricacies of Litecoin options trading empowers you to maximize your profit potential and manage risk effectively.

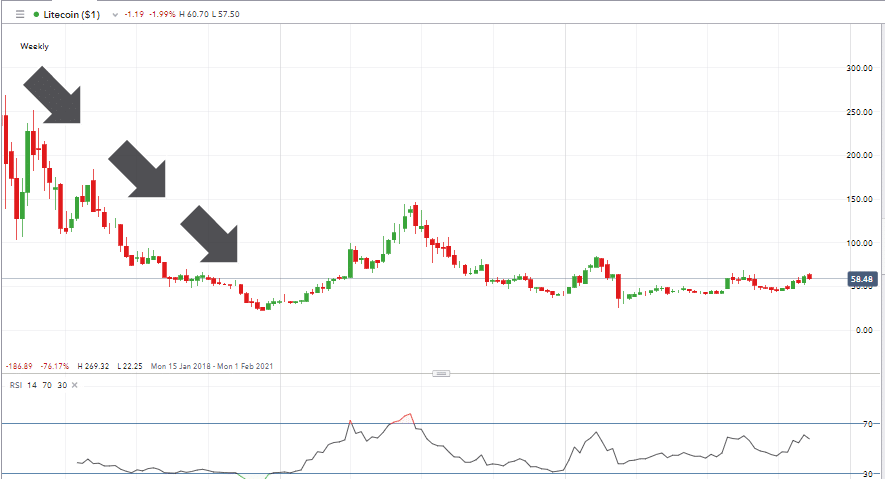

Image: www.asktraders.com

An options contract grants the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a certain timeframe. In Litecoin options trading, the underlying asset is LTC, and traders can choose between call options, which give the right to buy LTC, and put options, which provide the right to sell LTC.

Delving into Litecoin Call Options

When a trader anticipates an increase in LTC’s price, they can opt for a call option. This gives them the right to purchase LTC at a predetermined strike price on or before a specific expiration date. If LTC’s market price surpasses the strike price, the trader can exercise their call option, buying LTC at a lower price than its current market value and realizing a profit.

Understanding Put Options

In situations where a trader anticipates a decline in LTC’s price, they may choose to purchase a put option. This grants them the right to sell LTC at a predetermined strike price on or before a specific expiration date. If LTC’s market price falls below the strike price, the trader can exercise their put option, selling LTC at a higher price than its current market value and locking in a profit.

Exploring the Benefits of Options Trading

Options trading adds a versatile dimension to Litecoin trading, offering several advantages. Leverage is one significant benefit, allowing traders to control a larger position in LTC with a relatively small investment. This magnifies potential profits, but it also amplifies the risk.

Another advantage is the flexibility to express a variety of market views. Options provide traders with the ability to hedge against risk and speculate on both rising and falling prices.

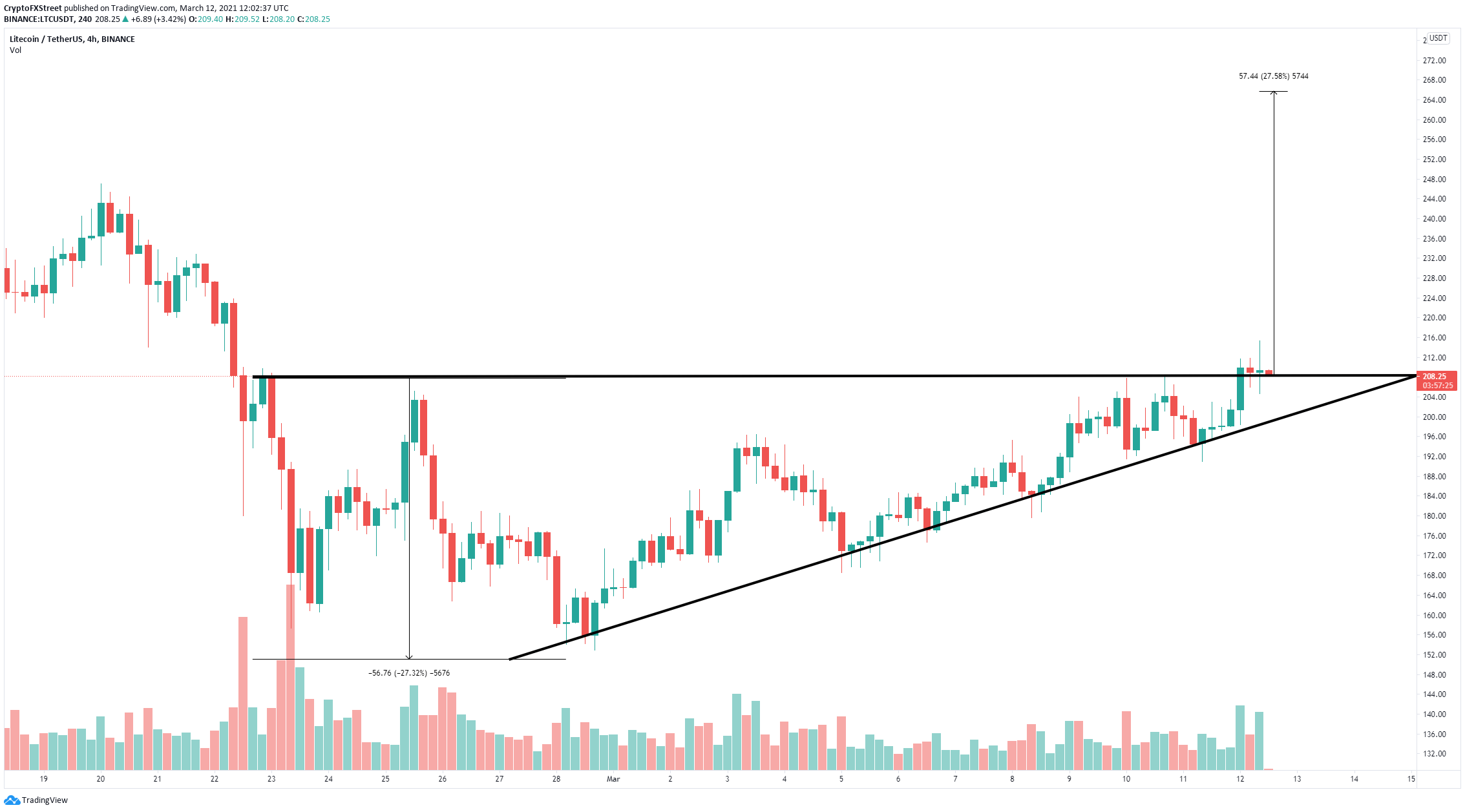

Image: www.fxstreet.com

Navigating the Risks in Options Trading

While options trading offers substantial opportunities, it’s crucial to acknowledge the potential risks involved. Options have a limited lifespan, so traders must carefully consider the expiration date. Moreover, the value of an option can fluctuate rapidly, making it imperative to monitor market conditions closely and manage risk prudently.

Litecoin Options Trading

Image: www.cryptonewsz.com

Conclusion

Litecoin options trading empowers traders with sophisticated investment strategies, but it demands a thorough understanding of the concepts and risks involved. By embracing the knowledge shared in this article and continuing to explore the subject, you can unveil the full potential of Litecoin options trading and navigate the cryptocurrency landscape with greater confidence.