Introduction

Image: www.pinterest.co.uk

Imagine standing at a crossroads, where the path you choose can profoundly impact your financial future. This is the quintessential dilemma faced by options traders, who must navigate a labyrinth of complex decisions to maximize profit potential while managing risk. Fortunately, there is a tool that can guide you through this treacherous terrain: the option trading decision tree model.

In this comprehensive guide, we will unveil the secrets of the option trading decision tree model, empowering you to make informed and potentially profitable choices.

Delving into the Option Trading Decision Tree Model

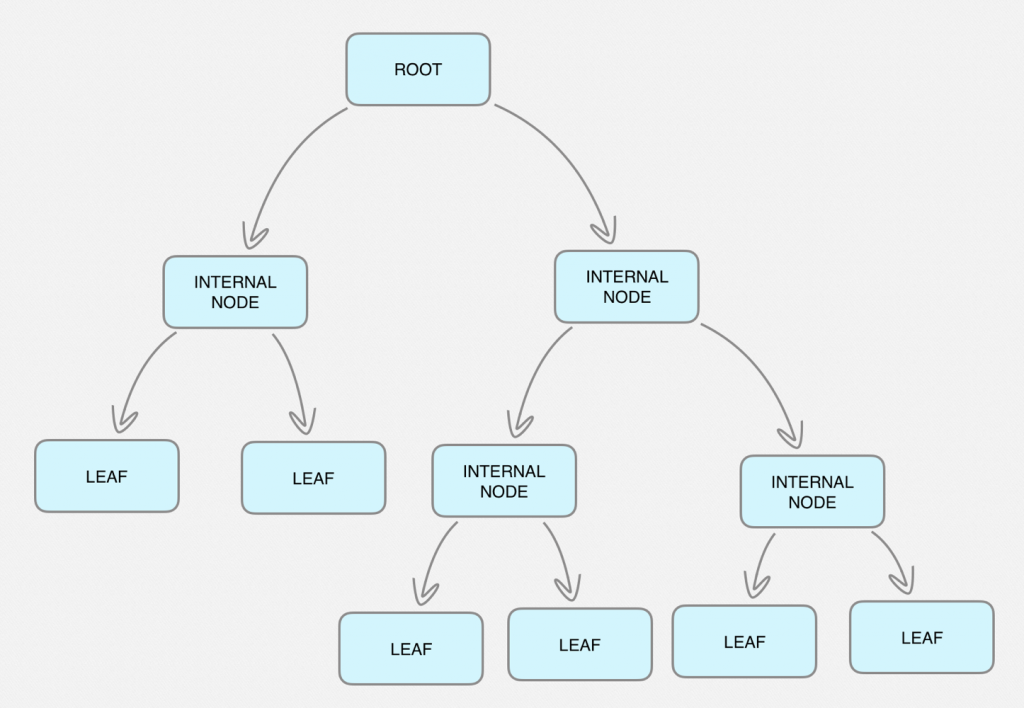

Like a roadmap for financial fortune, the option trading decision tree model is a systematic framework that guides traders through a series of questions and variables to determine the most optimal course of action. It operates on the principles of decision theory, breaking down intricate market situations into manageable choices.

The model encompasses fundamental concepts such as:

- Risk tolerance: Identifying your appetite for risk and determining strategies that align with it.

- Time horizon: Assessing the period over which you expect to hold the option.

- Market volatility: Gauging the degree of movement in the underlying asset’s price.

By systematically evaluating these factors and incorporating additional relevant information, the model generates a decision tree that presents the most promising options and their potential outcomes.

Expert Insights and Actionable Tips

Renowned options trading expert, Dr. Mark Rubinstein, emphasizes the importance of customizing the decision tree model to one’s individual circumstances. “Tailor the model to your unique risk profile, investment horizon, and market outlook,” he advises.

To make the most of this valuable tool, follow these actionable tips:

- Understand the underlying asset: Familiarize yourself with the price history, volatility, and other characteristics of the asset you intend to trade.

- Set realistic goals: Determine achievable profit targets and risk tolerance thresholds to avoid overleveraging or emotionally driven decisions.

- Stay up-to-date: Monitor market trends and news that may impact the value of the options you trade.

Leveraging the Model for Success

Armed with the option trading decision tree model, you can approach market decisions with confidence and finesse. The model enables you to:

- Identify high-probability opportunities: Pinpoint options that have the potential to yield maximum returns.

- Mitigate risk: Evaluate the potential risks associated with each option and develop strategies to minimize losses.

- Optimize your portfolio: Make informed choices about which options to include in your trading portfolio.

Empower Yourself with the Decision Tree Model

The option trading decision tree model is an indispensable tool for navigating the often-turbulent waters of financial markets. By embracing this analytical approach, you empower yourself to make sound decisions, increase your chances of success, and ultimately achieve your financial goals.

Remember, the true value of any decision-making tool lies in its practical application. Dedicate time to understanding and customizing the model to your specific needs. With the option trading decision tree model as your trusted guide, you can traverse the complex market landscape with confidence and reap the rewards of well-informed trading.

Image: blog.quantinsti.com

Option Trading Decision Tree Model

Image: www.analyticsinhr.com