In the thrilling world of options trading, understanding implied volatility is like having the key to unlock hidden treasures. It’s a crucial factor that can make or break your trading performance, revealing insights into market sentiment and predicting the potential price swings of an underlying asset.

Image: alchetron.com

Embark on a journey with us as we delve into the fascinating world of implied volatility, empowering you with the knowledge to harness its potential and elevate your trading strategies to new heights.

Demystifying Implied Volatility

Implied volatility, often abbreviated as IV, reflects the market’s expectations of the future price volatility of an asset. It’s a metric derived from option prices, providing a forward-looking estimate of how much the asset’s price may fluctuate over a specific period.

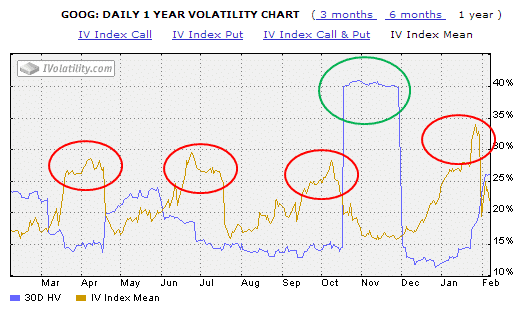

Why is IV so important? It helps you gauge the market’s perception of risk and uncertainty surrounding the asset. High IV indicates that the market anticipates significant price movements, while low IV suggests a more stable trading environment. This information is invaluable for options traders, who use it to make informed decisions and adjust their strategies accordingly.

Incorporating IV in Your Trading

Now that you understand the significance of IV, let’s explore how to incorporate it into your trading. There are several strategies you can employ:

-

Selling Options with High IV: When IV is high, traders often sell options to collect premia, expecting the market to remain within a particular range. This strategy can generate decent income if the volatility remains subdued.

-

Buying Options with Low IV: If you anticipate a surge in volatility, consider buying options with low IV. As volatility rises, the premiums on these options increase, potentially yielding substantial returns.

-

Trading Volatility Indices: Volatility indices like the VIX (CBOE Volatility Index) measure the market’s overall expectations of volatility. By trading these indices, you can capitalize on market sentiment shifts and hedge against volatility risks.

Expert Insights

“Implied volatility is a critical indicator that allows me to gauge market sentiment and adjust my trading strategies accordingly,” reveals Dr. Jim Gathergood, a renowned financial analyst. “By embracing IV, you can identify potential trading opportunities and minimize losses.”

“Understanding implied volatility empowers traders to make informed decisions about entering or exiting trades,” adds Dr. Mark Hamrick, a leading economics expert. “It’s not just a number but a powerful tool that can unlock the potential of options trading.”

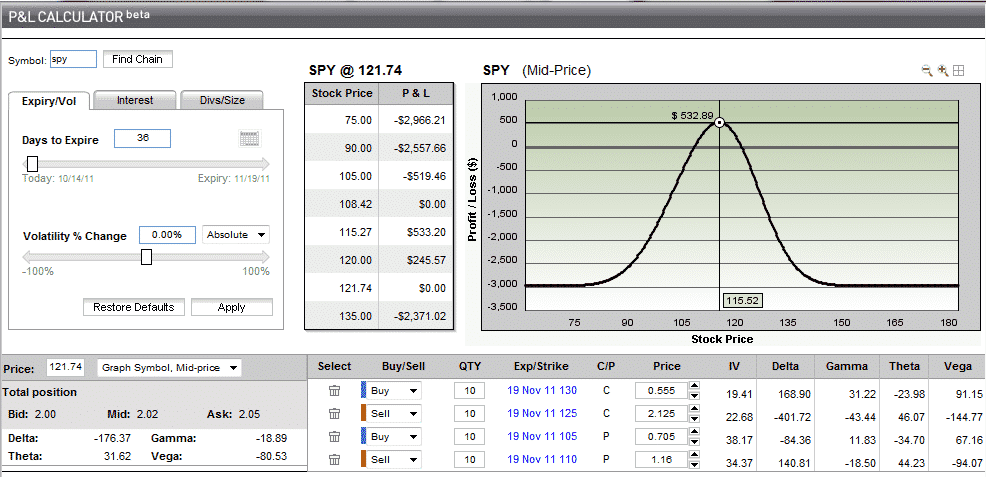

Image: steadyoptions.com

Actionable Tips

-

Stay informed about macroeconomic events and market news that can influence implied volatility.

-

Utilize IV charts and calculators to visualize and analyze historical and current IV trends.

-

Monitor the spread between implied volatility and realized volatility to identify potential discrepancies.

-

Consider using IV as a risk management tool to adjust your position sizing and hedging strategies.

How To Incorporate Implied Volatility In Option Trading

Image: micaelachrislyn.blogspot.com

Conclusion

Embracing implied volatility in your options trading is like unlocking a secret superpower. By understanding the market’s expectations of future volatility, you gain an edge in decision-making, maximizing profit potential and minimizing risks. As you venture into this exciting world, remember that continuous learning and practice are key to mastering this valuable tool. Let the thrill of options trading, fueled by the power of implied volatility, guide you to new heights of success.