Image: www.tamim.com.au

Introduction:

In the intricate realm of finance, where risks and rewards dance in delicate balance, there lies a secret weapon for discerning investors: implied volatility options. These enigmatic financial instruments hold the key to unlocking extraordinary returns, but they also demand a deep understanding of their nuanced nature. This article delves into the fascinating world of implied volatility options, unveiling their inner workings and empowering you to harness their transformative potential.

Understanding Implied Volatility Options:

Implied volatility options are derivatives that derive their value from the anticipated future volatility of an underlying asset, such as stocks or commodities. These options grant investors the right, but not the obligation, to buy or sell the asset at a predetermined price on a specified date. The “implied volatility” represents the market’s expectation of future price swings in the underlying asset.

The Role of Volatility in Option Pricing:

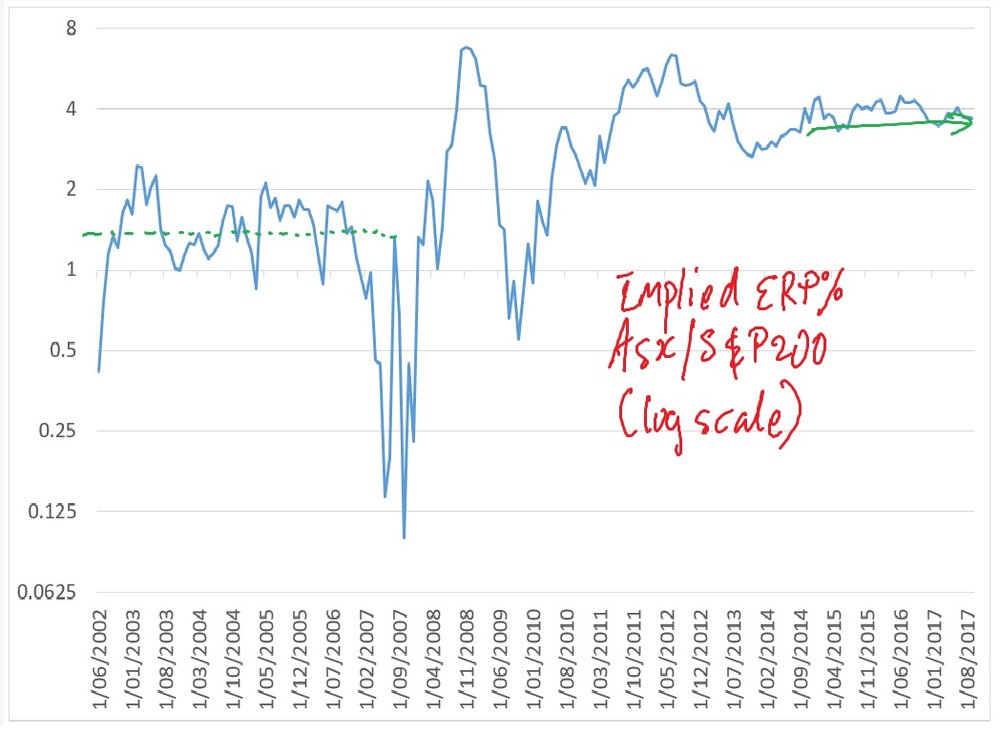

Volatility is the lifeblood of options trading. When volatility is high, the perceived risk of price fluctuations is greater, leading to higher option premiums (prices). Conversely, lower volatility indicates a more stable market environment, resulting in lower premiums. Implied volatility anticipates future market conditions and serves as a crucial factor in pricing options.

Expert Insights on Implied Volatility Trading:

“Understanding implied volatility is essential for option traders,” says renowned expert John Carter. “It allows you to gauge the market’s sentiment and make informed decisions about potential price movements.”

Veteran trader Michael Gooley emphasizes the importance of monitoring implied volatility closely. “Implied volatility can change rapidly, so it’s crucial to stay updated and adapt your trading strategies accordingly,” he advises.

Actionable Tips for Successful Implied Volatility Trading:

- Monitor implied volatility trends: Keep a close eye on historical and current implied volatility levels to identify potential market movements.

- Consider the underlying asset’s fundamentals: Analyze the underlying asset’s financial health, industry trends, and macroeconomic factors to assess its potential volatility.

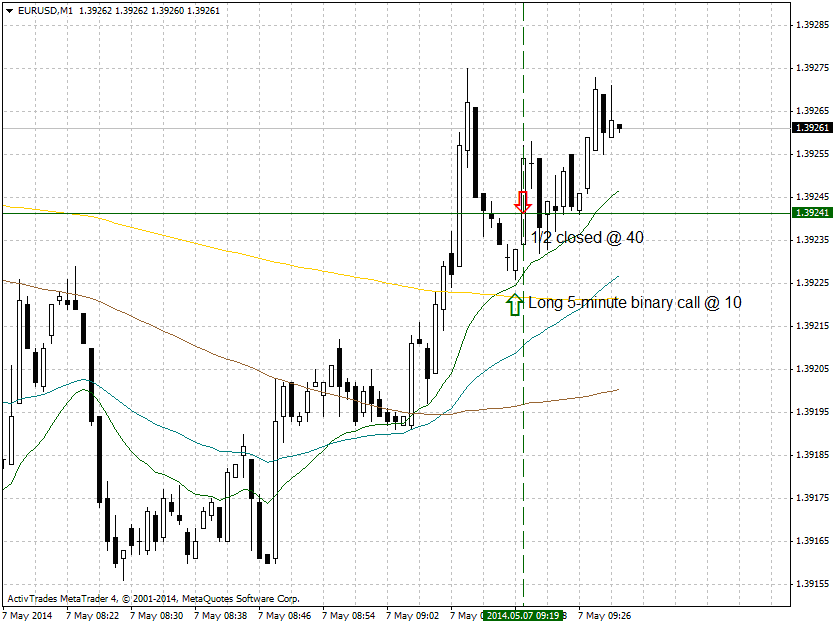

- Choose the right strike price and expiration: Select an option strike price that aligns with your volatility expectations and choose an expiration date that leaves sufficient time for potential price fluctuations.

- Manage risk effectively: Employ risk management strategies such as stop-loss orders and position sizing to mitigate potential losses.

Conclusion:

Implied volatility options offer a powerful tool for unlocking exceptional returns, but only when wielded with precision and comprehension. By understanding their fundamental principles, embracing expert insights, and implementing actionable tips, you can navigate the enigmatic world of implied volatility options with confidence. Remember, the key to successful option trading lies in embracing volatility as an ally, not an enemy, and adapting your strategies to the ever-changing market landscape.

Image: optionalpha.com

Imp Vol Options Trading

Image: forexrobotbuilderfreeeagenerator1.blogspot.com