Options trading can be a complex and daunting world for novice investors, but with the right guidance and platform, it can become an exciting opportunity for financial growth. Enter Cboe Global Markets (Cboe), a world-renowned options exchange that offers a comprehensive suite of options products and services tailored specifically to help traders maximize their potential. In this comprehensive guide, we will delve into the world of Cboe options trading, exploring its history, key concepts, and strategies to empower you with the knowledge and confidence necessary to navigate this dynamic market.

Image: www.cnbc.com

A Journey Into the Realm of Options Trading

Options contracts, financial instruments derived from underlying assets such as stocks, bonds, commodities, or indices, provide traders with the flexibility to speculate on the future price movements of these assets without the burden of ownership. They confer the right, but not the obligation, to either buy (call option) or sell (put option) the underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). This unique characteristic makes options trading an alluring proposition for investors seeking to manage risk, hedge against market volatility, or amplify potential returns.

Cboe, the brainchild of the Chicago Board Options Exchange, emerged in 1973 as a pioneer in the options trading industry. Over the decades, Cboe has evolved into a global powerhouse, boasting a diverse portfolio of options products encompassing various asset classes and expiration cycles. The exchange’s commitment to innovation and technological advancements has placed it at the forefront of the options trading landscape, attracting a vast network of market participants, including institutional investors, hedge funds, and individual traders.

Cboe Options: A Spectrum of Products for Every Strategy

One of the hallmarks of Cboe’s success lies in its extensive product offerings, catering to the diverse needs and preferences of traders. The Cboe Options product lineup includes:

S&P 500 Index (SPX) options: These options derive their value from the S&P 500 Index, a widely recognized benchmark for the performance of the U.S. stock market. SPX options provide traders with exposure to the overall market direction, enabling them to capitalize on broad market trends.

VIX Index (VIX) options: The Cboe Volatility Index (VIX) is a measure of market volatility based on S&P 500 Index option prices. VIX options offer traders a unique opportunity to speculate on future volatility levels, allowing them to hedge risk or position themselves for potential market swings.

Single-stock options: Cboe provides options on a vast selection of individual stocks, empowering traders to target specific companies and capitalize on their price movements. Single-stock options offer a flexible tool for stock-specific speculation, hedging, or income generation strategies.

Exchange-traded funds (ETF) options: Cboe offers options on various ETFs, providing traders with exposure to baskets of stocks or other assets. ETF options provide a convenient way to diversify exposure and potentially enhance returns.

Understanding the Mechanics of Cboe Options Trading

To navigate the Cboe options market effectively, it is essential to grasp the fundamental mechanics of options trading. Key concepts include:

Premium: The upfront cost of purchasing an options contract, representing the price paid for the right to exercise the option. Options premiums fluctuate based on market conditions, such as the underlying asset’s price, time to expiration, volatility, and interest rates.

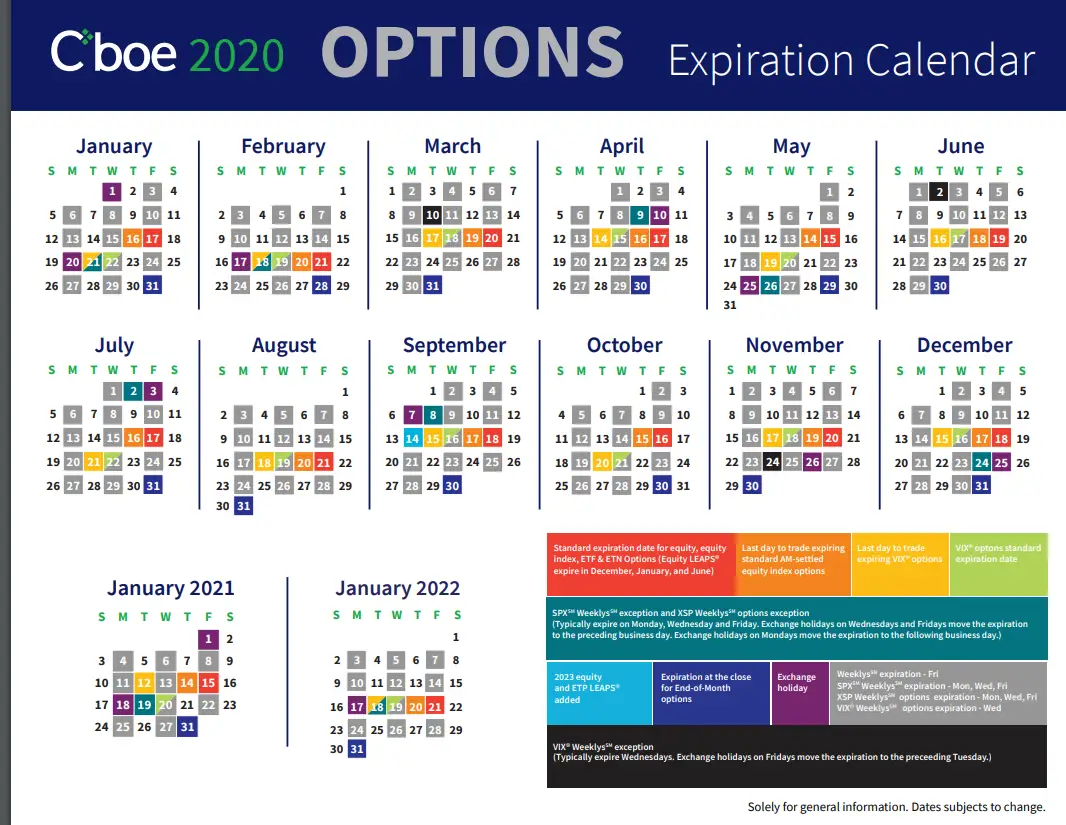

Expiration date: The date on which the options contract expires. Traders must exercise their right to buy or sell the underlying asset before the expiration date or the contract becomes worthless.

Exercise price: The predetermined price at which the holder of the option can buy (call option) or sell (put option) the underlying asset. Options can be exercised anytime before the expiration date, provided the market price of the underlying asset meets or exceeds the exercise price.

Image: calenderjul2021.blogspot.com

Crafting a Successful Cboe Options Trading Strategy

Equipped with a solid understanding of the mechanics, traders can embark on the journey of crafting effective Cboe options trading strategies. Here are some considerations:

Determine your trading objectives: Clearly define your investment goals, such as capital appreciation, hedging, or income generation. Aligning your trading strategies with your objectives is crucial for success.

Research and analysis: Conduct thorough research on the underlying asset, market conditions, and historical data. A comprehensive understanding of the market landscape will inform your decision-making process.

Choose appropriate options products: Select the Cboe options products that align with your risk tolerance, investment horizon, and trading objectives. Each product type offers unique characteristics and potential benefits.

Manage risk effectively: Options trading involves inherent risk, and it is essential to manage it prudently. Employ risk management techniques such as position sizing, stop-loss orders, and hedging strategies to safeguard your capital.

Embracing the Power of Technology at Cboe

Cboe’s commitment to innovation extends beyond product offerings, encompassing a suite of cutting-edge technologies that empower traders. The Cboe suite includes:

CboeTrader: A comprehensive trading platform designed for professional traders, providing real-time market data, advanced order types, and robust analytics tools.

Cboe OptionsHub: A user-friendly platform tailored for individual investors, offering options education, a suite of trading tools, and simplified order entry processes.

Cboe LiveVol: An innovative platform that provides traders with real-time volatility data and analytics, enabling them to make informed decisions in fast-changing market conditions.

Cboe Options Trading

Conclusion: Unveiling the Value of Cboe Options Trading

In the ever-evolving world of finance, Cboe Global Markets stands as a beacon of innovation and opportunity for options traders. Its diverse product offerings, advanced technological platforms, and commitment to trader success provide an unparalleled trading environment. By embracing the power of Cboe options, investors can unlock