In the realm of financial markets, the allure of options trading beckons investors seeking both substantial profits and calculated risks. If you’re a TD Ameritrade customer eager to venture into this dynamic arena, this comprehensive guide will equip you with the knowledge and steps necessary to activate options trading. Join me as we navigate the intricacies of this exciting investment landscape.

Image: dastrader.com

Delving into the World of Options: A Glimpse into the Financial Arena

Options trading empowers investors with the ability to speculate on the future price movements of underlying assets, such as stocks, indices, and commodities. These contracts bestow upon the holder the privilege to buy or sell a specific asset, granting them the flexibility to capitalize on both rising and falling markets. As the options market has expanded and reached unprecedented heights of liquidity, it presents an avenue for investors of all levels to explore the countless opportunities it offers.

Options Terminology Demystified: Understanding the Lingo

In the realm of options trading, it is paramount to master the essential terminology that shapes conversations and decision-making. Familiarize yourself with terms such as “strike price,” the predefined purchase or sale price for the underlying asset; “premium,” the upfront cost of an options contract; and “expiration date,” the predetermined date by which the contract must be exercised or it expires worthless.

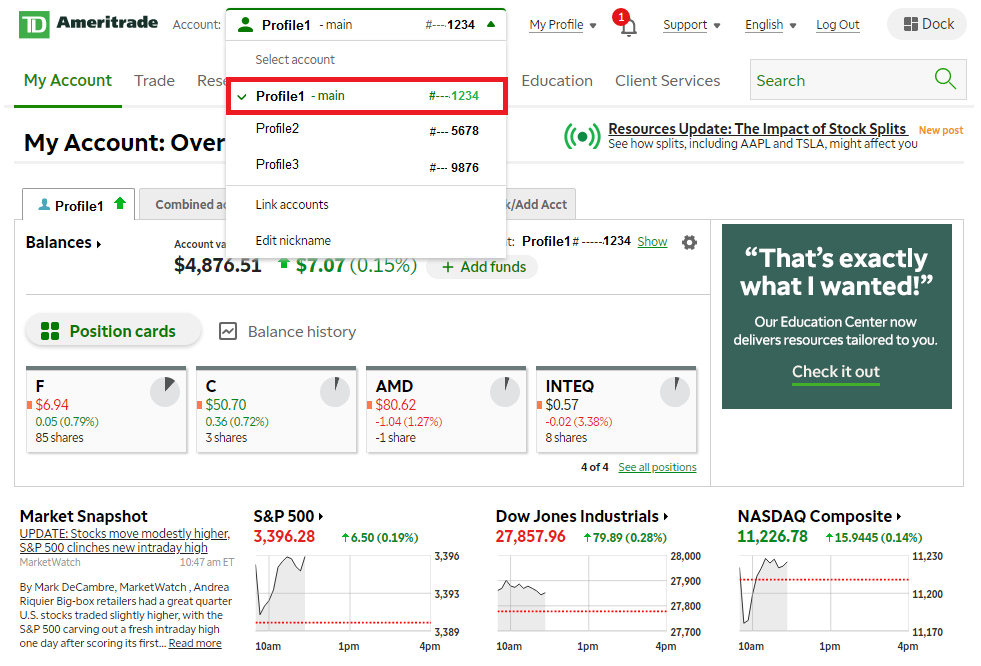

Unveiling the Gateway to Options Trading: Your TD Ameritrade Account

To embark upon your options trading journey, you’ll need to ensure your TD Ameritrade account is properly configured to handle this advanced trading strategy. Take the following steps to ensure your account is options-ready:

– Determine Your Risk Tolerance: Options trading carries inherent risks. Honestly assess your financial situation, risk tolerance, and investment goals before venturing into this realm.

– Complete the Options Agreement and Knowledge-Based Assessment: TD Ameritrade requires all options traders to complete these steps to demonstrate their understanding of the complexities of options trading.

– Submit a Funding Request: Options trading requires a minimum account balance, which varies depending on the options trading strategy you intend to employ.

Image: www.forex.academy

Unlocking Options Trading Functionality: A Step-by-Step Guide

Once your account is deemed suitable for options trading, follow these steps to activate the functionality:

– Navigate to the Account Management tab: Within the TD Ameritrade platform, locate the “Account Management” section.

– Select “Brokerage & Trading”: Click on the “Brokerage & Trading” subsection within the Account Management menu.

– Explore the Trading Preferences: Choose “Trading Preferences” from the available options.

– **Enable Options Trading:** Look for the “Options Trading” section and select “Enable Options Trading” to activate this trading capability.

– Confirm Your Age and Review Disclosures: You may be asked to verify your age and review important disclosures related to options trading.

– Submit Your Request:** Press “Submit” to finalize your options trading activation request.

Enhancing Your Options Trading Expertise: Tips from the Trenches

Now that you’re equipped with the trading power of options, consider these invaluable tips to elevate your trading endeavors:

– Start Small and Gradually Increase Your Position Sizes**: As you gain experience and confidence, incrementally increase the size of your trades.

– Study and Research Extensively**: Immerse yourself in the world of options trading, studying market trends, strategies, and analytical techniques.

– Manage Risk Effectively**: Employ risk management techniques such as stop-loss orders and diversification to mitigate potential losses.

– Seek Professional Advice When Needed**: Don’t hesitate to consult with a financial advisor or experienced options trader to enhance your decision-making.

Frequently Asked Questions about Options Trading

– Question: Is options trading suitable for all investors?**

– **Answer:** No, options trading involves inherent risks and may not be appropriate for inexperienced or risk-averse investors.

– Question: What is the minimum age requirement for options trading?**

– **Answer:** Most brokerages, including TD Ameritrade, require traders to be at least 18 years of age to engage in options trading.

– Question: Can I trade options on any underlying asset?**

– **Answer:** Typically, options contracts are available for a wide range of underlying assets, including stocks, indices, commodities, and currencies. However, availability may vary depending on the brokerage firm and specific market conditions.

How To Enable Options Trading In Td Ameritrade

Image: www.forex.academy

Conclusion:

Embracing options trading can unlock a world of opportunities within the financial markets. By following the steps outlined in this guide and incorporating the expert advice provided, you can confidently navigate the intricacies of options trading and reap its potential rewards. May your trading journey be marked by knowledge, calculated decisions, and the thrill of potential profits.

Are you ready to embark on the captivating adventure of options trading? Elevate your financial acumen and join the ranks of savvy investors who harness the power of options to maximize their market returns.