Are you ready to venture into the enigmatic world of expert option trading and unlock the potential for lucrative returns? Immerse yourself in this comprehensive guide as we delve into the intricacies of expert option trading, providing you with the knowledge and strategies to navigate the market like a pro. Dive in and let us be your guide on this journey towards financial success.

Image: www.youtube.com

What is Expert Option Trading?

Expert option trading empowers you to speculate on the price movements of underlying assets, such as currencies, stocks, and commodities, without directly owning them. By predicting the future price direction correctly, you can reap significant profits. The allure of expert option trading lies in its flexibility, allowing traders to tailor their trades according to their risk tolerance and profit objectives.

Understanding the Basics

To fully grasp expert option trading, it’s essential to comprehend the fundamental concepts:

- Options: Contracts that grant traders the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) on or before a set date (expiration date).

- Call Option: Grants the buyer the right to buy the asset if its price rises above the strike price.

- Put Option: Grants the buyer the right to sell the asset if its price falls below the strike price.

The Art of Expert Option Trading

Mastering expert option trading requires a strategic approach. Here are some key considerations:

Image: 99infonewz.blogspot.com

Technical Analysis

Expert traders rely on technical analysis to identify patterns and trends in market data. This involves studying price charts, indicators, and historical data to forecast future price movements.

Risk Management

Managing risk is pivotal in expert option trading. Employ strategies such as setting stop-loss orders to limit potential losses and trading within your means to avoid substantial setbacks.

Strategy Selection

Choosing the appropriate trading strategy is crucial. Consider your risk appetite, financial goals, and market conditions to identify the best approach. Some popular strategies include range trading, breakout trading, and trend-following.

Tips from the Experts

Harnessing expert advice can elevate your trading endeavors. Here are some valuable insights:

Start Small

Begin with modest trades until you gain a firm understanding of market dynamics. This conservative approach minimizes risk and allows you to refine your strategies without incurring significant losses.

Don’t Chase Losses

Emotions can cloud judgment. Avoid the temptation to recover losses by making impulsive trades. Stick to your trading plan and refrain from revenge trading.

Frequently Asked Questions

Unveiling some common queries:

Q: Is expert option trading suitable for beginners?

A: While expert option trading offers significant potential, it requires knowledge, experience, and risk management skills. Beginners should approach it with caution and seek guidance from reputable sources.

Q: How much capital do I need to start?

A: Capital requirements vary depending on your trading style and risk tolerance. It’s advisable to start with a small amount and gradually increase it as you gain experience.

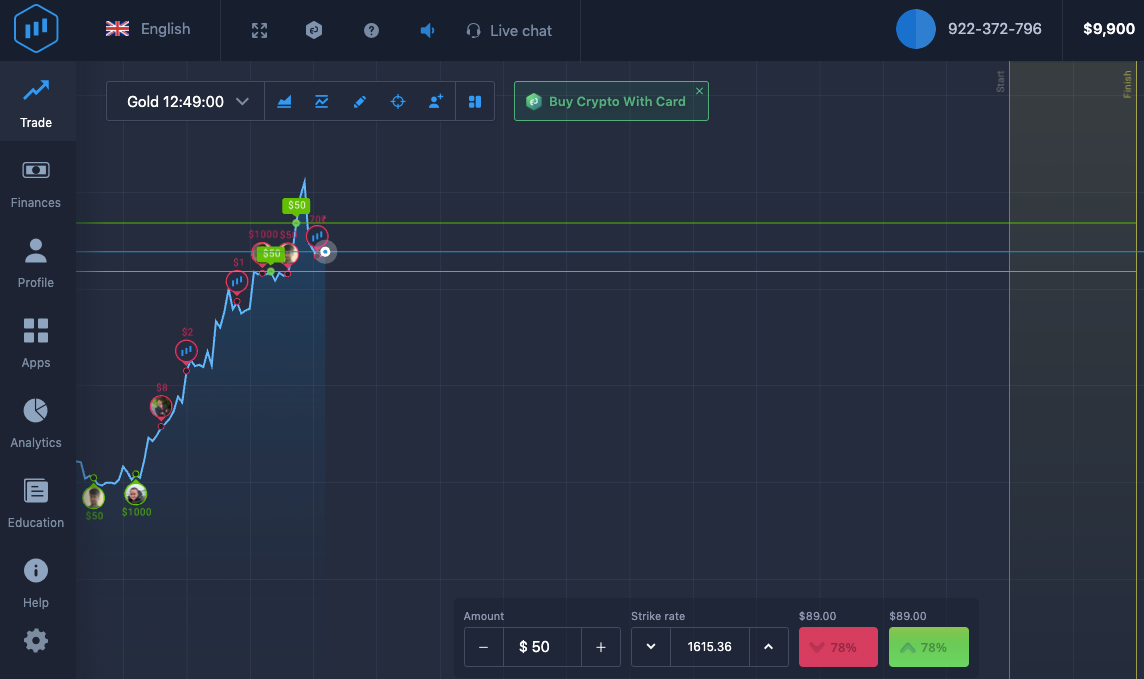

How To Play Expert Option Trading

Image: www.daytrading.com

Conclusion

Mastering expert option trading is a journey that requires dedication, knowledge, and a strategic mindset. Embrace this guide as your compass, and you’ll be well-equipped to make informed trades and reap the rewards of successful expert option trading. Remember, as with any investment, there are inherent risks involved, so it’s essential to proceed with caution and seek professional advice when necessary.

Are you ready to join the ranks of expert option traders and embark on a path towards financial freedom? If yes, then this comprehensive guide has laid the foundation for your success. Start your trading journey today and unlock the potential for substantial returns.