Have you ever dreamt of amplifying your investment returns with the potential for exponential growth? Imagine turning a modest investment into a fortune with the right strategy. While the stock market offers opportunities for steady gains, there’s another realm of trading that holds the key to unleashing explosive potential – options trading. And believe it or not, you can dive into this world right from the comfort of your phone, thanks to the ever-popular trading platform, Robinhood.

Image: www.youtube.com

But before you jump in headfirst, it’s imperative to understand the complexities of options trading. It’s a powerful tool that can amplify both profits and losses. Therefore, approaching it with knowledge and a well-defined strategy is paramount. In this comprehensive guide, we’ll delve deep into the world of options trading on Robinhood, demystifying the concepts, strategies, and risks involved, equipping you with the knowledge to make informed decisions and navigate this exciting realm of trading.

Understanding the Basics of Options Trading

Options trading is a complex and nuanced area of the financial markets. The core principle is simple: you are purchasing a contract that provides you with the right to buy or sell an underlying asset – typically a stock – at a specific price within a specified period. There are two primary types of options:

Calls and Puts: The Building Blocks of Options

1. Call options grant you the right to *buy* an underlying asset at a predetermined price (the “strike price”) by a specific date. Imagine buying a call option on a stock currently trading at $100, with a strike price of $110 and an expiration date in three months. If the stock price rises above $110 before the expiration date, you can exercise your option by buying the stock at $110 and immediately selling it in the market at the higher price, generating a profit. However, if the stock price remains below $110, your option will expire worthless, and you’ll lose your initial investment.

2. Put options grant you the right to *sell* an underlying asset at a predetermined price (the “strike price”) by a specific date. If the stock price falls below the strike price, you can exercise your option by buying the stock at the lower market price and selling it to the option issuer at the higher strike price, generating a profit. But, if the stock price stays above the strike price, your option will expire worthless.

Types of Options Orders

To navigate the options market effectively, you need to be familiar with common types of orders:

- Market Orders: These are executed at the best available market price at that moment, regardless of whether they’re advantageous for you.

- Limit Orders: You set a specific price at which you want to buy or sell. The order is only filled if the market reaches your price.

- Stop-Loss Orders: These protect your potential losses by automatically selling your options if the price drops below a predetermined level.

- Trailing Stop Orders: These follow the market price and automatically sell if it drops by a certain percentage.

Understanding these orders is crucial for controlling your risk and maximizing potential profits.

Image: marketxls.com

Diving Deep: Options Strategies

Now that you have a grasp of the basics, let’s dive into some popular options strategies, each designed to cater to specific market conditions and investment goals.

1. Covered Calls

Imagine a scenario where you already own a stock and believe it won’t drastically appreciate in value. A covered call strategy lets you earn premium income while maintaining ownership of the stock. It involves selling a call option on the stock you own, receiving a premium payment for doing so.

For example, you own 100 shares of XYZ stock at $100 per share. You sell a call option with a strike price of $110 and an expiration date in three months. If the stock price stays below $110, the buyer of the call will not exercise the option, the option expires worthless, and you keep both the premium and your shares. If the stock price rises above $110, they will exercise their option, obligating you to sell your shares to them at $110. You would capture the profit from the premium and the price difference between your purchase price and the strike price, but you lose potential gains above $110.

2. Protective Puts

Imagine you own stock in a company you believe in, but you want to safeguard against potential price drops. You can employ a protective put strategy to safeguard your investment.

For example, you own 100 shares of ABC stock at $50 per share. You purchase a put option with a strike price of $45 and an expiration date in three months. If the stock price falls below $45, you can exercise your put option by selling your stock at a higher price, limiting your losses to the difference between the strike price and the market price. If the stock price stays above $45, your option expires worthless, and you keep your shares while paying a premium for the insurance.

3. Covered Straddles

A covered straddle combines a covered call and a put option on the same underlying security. You own shares in a stock and sell a call option while buying a put option. This strategy maximizes your profit potential if the stock price moves significantly in either direction, but it comes at the cost of a larger premium.

4. Covered Strangles

Similar to covered straddles, covered strangles involve owning the underlying stock and selling a call option and buying a put option. However, unlike straddles, the strike prices of the options in a strangle are different, a lower strike price for the put and a higher strike price for the call, allowing for a lower premium compared to a straddle.

5. Iron Condors

This strategy involves selling one put and call option with a higher strike price and buying another put and call option with a lower strike price. Iron Condors offer potential profit if the stock price stays within a defined range and provide a limited loss scenario if the price moves outside this range.

Options Trading on Robinhood: A User-Friendly Platform

Robinhood has successfully made options trading accessible to everyone, bringing the complex world of options to the fingertips of everyday investors. Its user-friendly platform allows you to easily navigate the options market, buy and sell options, and manage trades. Here’s what makes Robinhood stand out:

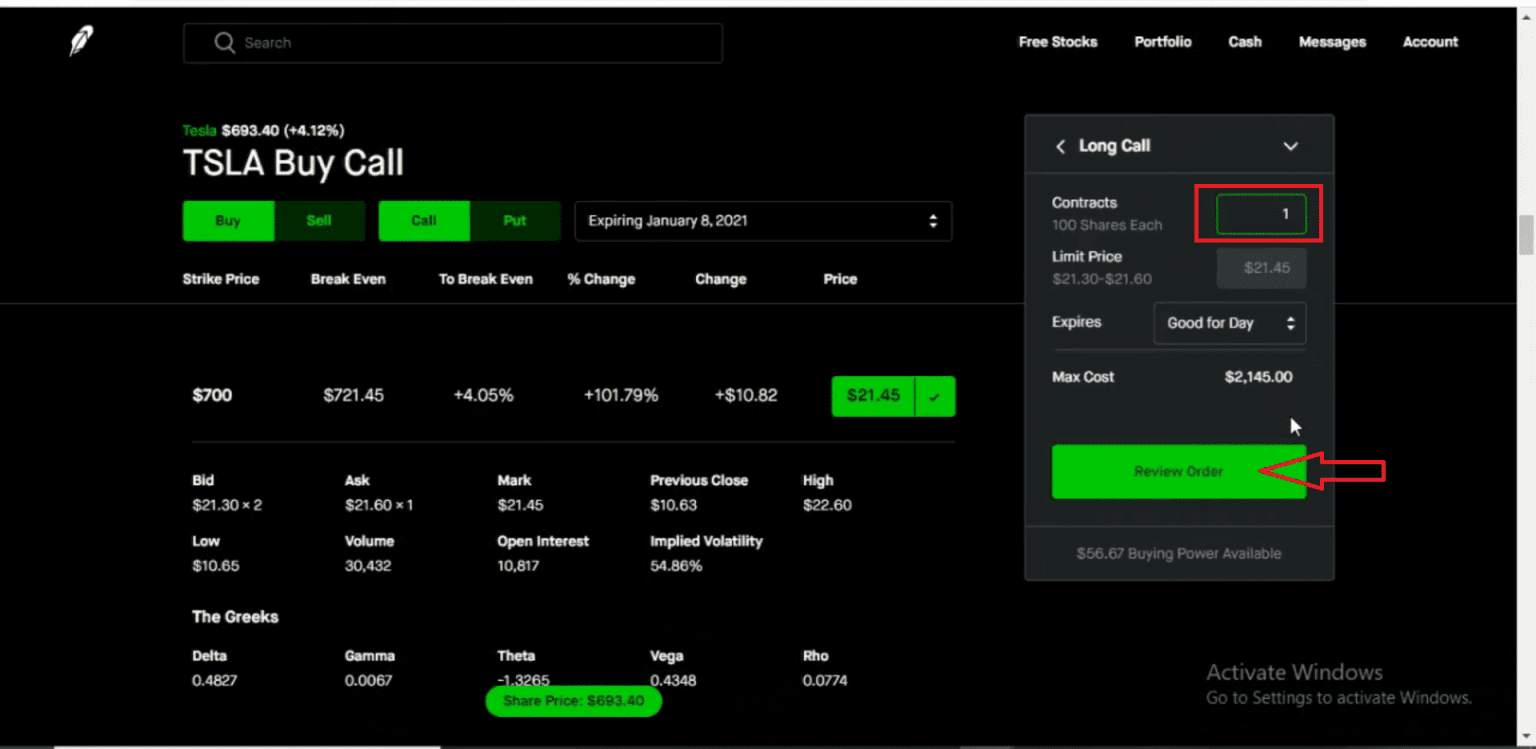

1. Easy-to-Use Interface

Robinhood’s intuitive interface simplifies the process of placing and managing options orders. It provides clear visualizations of option chains, enabling you to see strike prices, expiry dates, and premiums for different options contracts. This makes it easier for beginners to understand and navigate the options world.

2. Educational Resources

While Robinhood doesn’t offer in-depth educational resources specifically on options trading, they provide a wealth of information on stocks and investing basics. They offer interactive tutorials that can equip you with the foundational knowledge needed to approach options trading responsibly.

3. Affordable Trading

Robinhood’s commission-free trading structure makes it an attractive platform for those starting out on their options trading journey. This eliminates the added costs associated with traditional brokerage accounts and allows you to focus on your strategy without worrying about hefty transaction fees.

4. Mobile Accessibility

Robinhood’s mobile app allows you to manage your options trades anytime, anywhere. This accessibility is instrumental, especially for traders who want to keep an eye on their positions and execute trades quickly.

Risks and Considerations

While options trading offers the potential for lucrative returns, it comes with its fair share of risks. Understanding these risks is essential before jumping into options trading:

1. Time Decay (Theta)

Options have limited lifespans. As time passes, their value decreases, as they get closer to their expiration date. This decay in value is known as “theta,” and it can significantly impact your profits or lead to losses. It’s imperative to choose expiry dates that align with your trading strategy.

2. Volatility Risk

Options prices are highly sensitive to volatility in underlying assets. Unexpected price movements can significantly impact your profits or losses. To mitigate this risk, understand the volatility of the underlying asset and consider using options strategies that can hedge against it.

3. Limited Leverage

Options offer significant leverage, allowing you to control a larger position with a smaller initial investment. While this can amplify your profits, it also amplifies potential losses. Carefully manage your risk by setting appropriate stop-loss orders and diversifying your portfolio.

Options Trading Robinhood

The Final Word: Embrace Options Trading with Prudence and Knowledge

Options trading is a powerful tool for investors seeking to enhance their returns and diversify their portfolios. Robinhood’s platform provides a gateway for beginners to explore this exciting world. However, remember that options trading carries inherent risks, and it’s crucial to approach it with a solid understanding of the concepts, strategies, and risks involved. Before diving into the world of options, educate yourself, familiarize yourself with the basics, and experiment with simulated trading or practice accounts to build confidence. Remember, patience, discipline, and a carefully crafted plan are key to navigating the world of options successfully.

This article serves as a starting point for your options trading journey. Don’t hesitate to explore further resources, consult with financial advisors, and stay informed about the ever-evolving world of options trading. By equipping yourself with knowledge, you can navigate the exciting and potentially rewarding realm of options trading with confidence.