Trading options can be a lucrative endeavor, but understanding the nuances of implied volatility is crucial. As a seasoned options trader, I’ve experienced firsthand the impact of implied volatility on option values and overall trading strategies.

Image: vangvn.org

Implied Volatility: Unveiling the Future’s Uncertainty

Implied volatility (IV) is a prediction of how much the underlying asset is expected to fluctuate in the future. It’s a gauge of market sentiment, reflecting investors’ expectations of risk and uncertainty. High IV implies greater price volatility, while low IV suggests a more stable future.

Do You Want High Implied Volatility?

Whether or not you desire high IV depends on your trading strategy and risk tolerance.

Option Sellers: High IV is a Boon

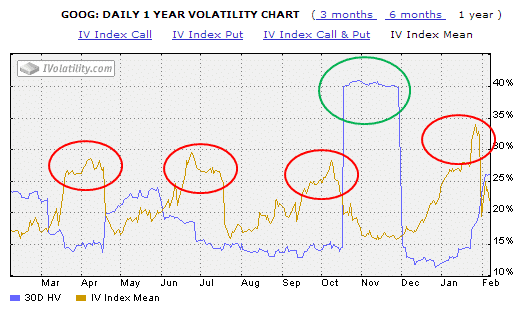

If you’re selling options (writing calls or puts), high IV is generally advantageous. When IV is elevated, options premiums increase, making it more profitable to sell options strategies that capitalize on the expected volatility.

Image: www.getvolatility.com

Option Buyers: High IV can be a Pitfall

Conversely, for option buyers (purchasing calls or puts), high IV can be a potential pitfall. When IV is high, options premiums are also higher, requiring a larger initial investment to establish a position. Furthermore, if the actual volatility turns out to be lower than the implied volatility, option buyers may incur significant losses.

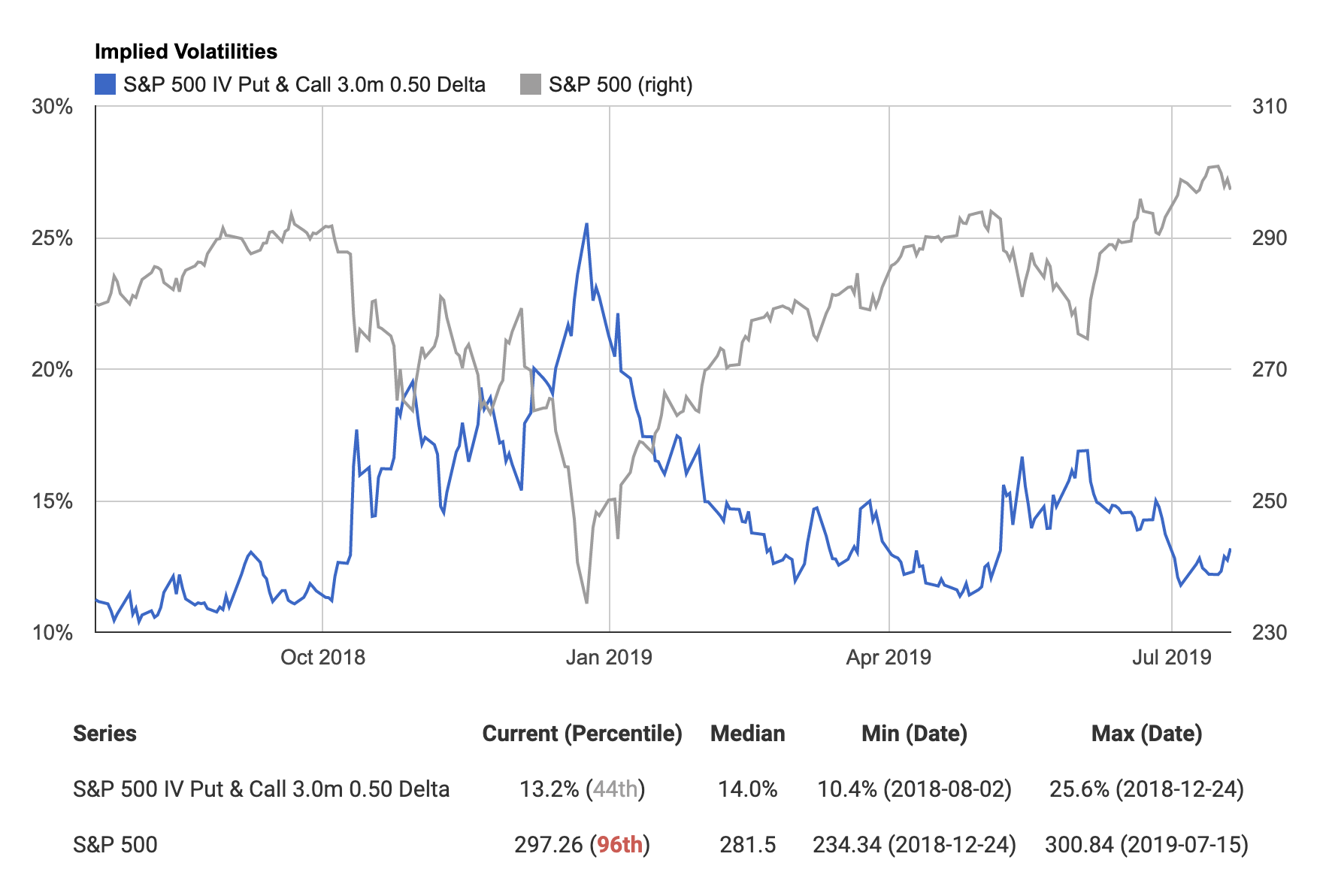

Trends and Developments in Implied Volatility

The world of implied volatility is constantly evolving, influenced by a myriad of factors including economic indicators, news events, and market sentiment. By staying updated on these trends and developments, traders can make informed decisions that align with changing market conditions.

Expert Advice for Navigating IV

Here are some tips from seasoned options traders:

- Consider the option’s delta: Delta measures the sensitivity of the option price to changes in the underlying asset’s price. Higher delta options (e.g., at-the-money) are more sensitive to fluctuations in implied volatility.

- Look at historical and expected volatility: Analyze historical IV levels for the underlying asset and compare them to the current implied volatility. Understanding how actual volatility has compared to implied volatility in the past can shed light on the potential for future market movements.

- Be aware of implied volatility skews: Sometimes, the implied volatility for options with different expiration dates can vary significantly. This skew can often provide insights into market expectations about future volatility.

By following these tips and seeking advice from experienced professionals, you can improve your understanding of implied volatility and make better-informed trading decisions.

FAQs on Implied Volatility

Q: What factors affect implied volatility?

A: Implied volatility is influenced by factors such as economic data, news events, market sentiment, and supply and demand.

Q: How can I trade options despite high implied volatility?

A: Consider selling options to capitalize on high premiums, or purchase options with a longer-term expiration to reduce the impact of IV decay.

Q: Is higher implied volatility always better?

A: For option sellers, yes; for option buyers, no.

Trading Options Do I Want High Implied Volatility

Image: optionstradingiq.com

Conclusion

Implied volatility is a crucial factor to consider when trading options. By understanding the concept of implied volatility, its impact on option values, and the latest trends and developments, traders can make more informed decisions and enhance their overall trading strategies.

Do you have any questions or want to learn more about implied volatility and its significance in options trading? Leave a comment below and let’s engage in a discussion.