Have you ever wondered why option prices seem to fluctuate so unpredictably at times? It’s like they’re on a rollercoaster ride, just bouncing up and down without any discernible pattern. Well, there’s actually a scientific explanation for this phenomenon, and it’s called Brownian motion.

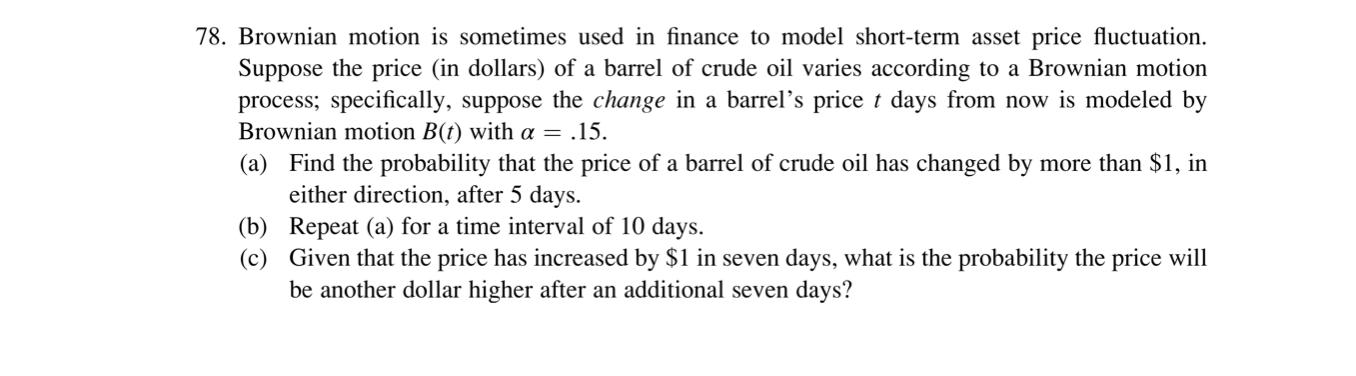

Image: www.chegg.com

Brownian motion is the random movement of particles suspended in a liquid or gas. It was first observed by the botanist Robert Brown in 1827, who was studying the erratic movement of pollen grains in water under a microscope.

Brownian Motion and Option Trading

Brownian motion is a fundamental concept in option trading because it helps us understand how option prices fluctuate over time. Option prices are constantly changing due to a variety of factors, such as the underlying asset price, interest rates, volatility, and time to expiration. However, even when all of these factors are held constant, option prices will still fluctuate due to Brownian motion.

This is because the underlying asset price is constantly being bombarded by random events, such as news announcements, natural disasters, and political upheavals. These events can cause the asset price to move up or down, which in turn causes the option price to change. Brownian motion is the mathematical model that describes this random movement of the asset price.

Implications for Option Traders

The implications of Brownian motion for option traders are significant. First, it means that option prices are inherently unpredictable. There is no way to know for sure how an option price will move over time. Second, Brownian motion makes it difficult to profit from option trading strategies. This is because it is impossible to consistently predict the direction of the asset price, and therefore the direction of the option price.

Expert Advice and Tips for Successful Option Trading

- Understand the risks involved. Option trading is a complex and risky investment strategy. It is important to understand the risks involved before you start trading options.

- Do your research. Before you trade any options, be sure to do your research and understand the underlying asset. This will help you make more informed trading decisions.

- Trade with a plan. Do not trade options without a plan. Know what you want to achieve and how you are going to achieve it.

- Manage your risk. It is important to manage your risk when trading options. This means using stop-loss orders and position sizing to limit your potential losses.

- Don’t try to time the market. It is impossible to time the market. Instead, focus on finding good trading opportunities and trading them with a plan.

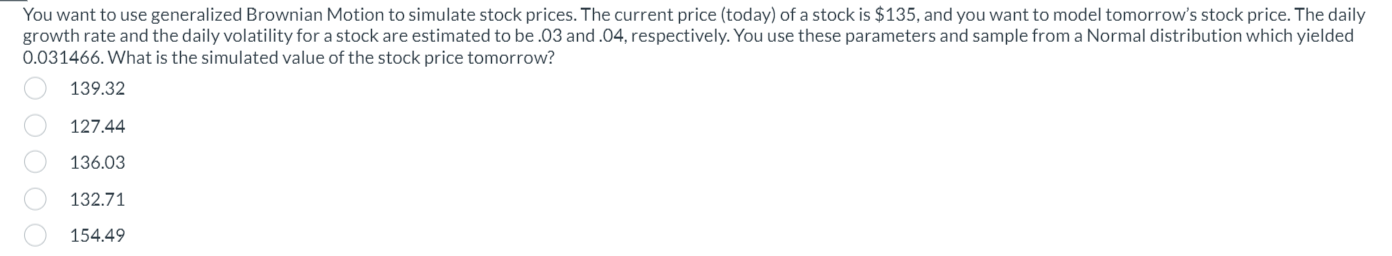

Image: studylib.net

FAQs

- What is Brownian motion? Brownian motion is the random movement of particles suspended in a liquid or gas.

- How does Brownian motion affect option trading? Brownian motion makes option prices inherently unpredictable. This is because the underlying asset price is constantly being bombarded by random events, such as news announcements, natural disasters, and political upheavals.

- What are some tips for successful option trading?

- Understand the risks involved.

- Do your research.

- Trade with a plan.

- Manage your risk.

- Don’t try to time the market.

What Does Brownian Motion Tells Us In Option Trading

Image: www.chegg.com

Conclusion:

Brownian motion is a fundamental concept in option trading. It helps us understand how option prices fluctuate over time and why they are inherently unpredictable. While Brownian motion makes it difficult to profit from option trading strategies, it is still possible to achieve success by focusing on finding good trading opportunities and trading them with a plan.

Are you ready to start trading options like a pro? Here are some additional tips not mentioned above that may help you become successful:

- Learn to read and understand option Greeks.

- Use technical analysis to identify trading opportunities.

- Be patient and persistent. Option trading takes time and practice to master.

With hard work and dedication, you can achieve your option trading goals!