Imagine a world where employees are not solely compensated with a monthly paycheck, but also have a stake in their company’s potential growth. This vision has become a reality in Silicon Valley, the epicenter of technological innovation, where stock option trading has become an integral part of the corporate landscape. These options offer employees the chance to reap significant rewards if their company succeeds, fostering a culture of ownership and shared aspiration.

Image: fiaks.com

Stock options grant employees the right to purchase a specific number of shares of their company’s stock at a predetermined price within a set time frame. This strike price is typically below the market price, providing employees with the potential for profit if the stock price climbs. The exercise period usually spans several years, giving employees flexibility in determining the optimal time to purchase the shares.

The significance of stock option trading lies in its ability to align the interests of employees with those of the company. By incentivizing employees to contribute to their company’s success, stock options foster a sense of ownership and responsibility. This alignment creates a workforce driven not only by monetary compensation but also by the prospect of long-term financial gain.

Furthermore, stock options act as a powerful retention tool, helping companies attract and retain top talent. In the fiercely competitive tech industry, offering stock options can be a major differentiator in the eyes of potential employees. By providing employees with the opportunity to share in the company’s growth, businesses can demonstrate their commitment to employee rewards and career growth.

The issuance of stock options has also become a significant factor in the wealth creation of many Silicon Valley employees. Success stories of early employees cashing in on their options have become commonplace, fueling the desire of aspiring tech professionals to join the valley’s ever-growing tech companies.

However, stock option trading is not without its complexities. Employees need to carefully consider the potential risks and rewards before exercising their options. Factors such as market volatility, tax implications, and the company’s financial performance can significantly impact the value of their options.

To navigate these complexities, many tech professionals seek advice from financial advisors who specialize in stock option trading. These advisors help employees understand the mechanics of options, guide them through tax implications, and provide strategic advice on when to exercise their options.

The rise of stock option trading in Silicon Valley has had a profound impact on the tech industry and its culture. By aligning the interests of employees with the success of their companies, stock options have fostered a workforce that is driven by innovation, risk-taking, and long-term rewards. As the tech industry continues to evolve, stock option trading will undoubtedly remain a cornerstone of its unique employment landscape.

Navigating the Complexities of Silicon Valley Stock Option Trading

-

Understanding Taxes on Stock Options

Navigating the tax implications of stock options is crucial for maximizing financial gain while minimizing tax liability. Employees who exercise their options will incur capital gains tax on the difference between the exercise price and the fair market value of the stock at the time of exercise. The tax treatment of capital gains depends on the holding period of the stock after it’s exercised:

- Short-term capital gains tax applies to stocks held for less than one year, taxed at your ordinary income tax rate.

- Long-term capital gains tax applies to stocks held for more than one year, taxed at a lower rate.

Understanding your potential tax liability can help you make informed decisions about when to exercise your options.

-

The Quandary of Early Exercise

Employees may face the dilemma of whether to exercise their options early. Exercising early can provide opportunities for long-term capital gains if the stock price appreciates, but it also comes with financial risks. If the stock price declines after exercising, the employee may end up paying more for the shares than their market value.

Factors to consider when weighing early exercise:

- Belief in the company’s long-term growth potential.

- Financial capacity to cover the exercise price and potential tax liability.

- Risk tolerance and ability to withstand potential losses.

-

Image: www.slideshare.netAdvanced Strategies for Seasoned Options Traders

As seasoned traders gain experience, they may venture into more sophisticated stock option strategies to enhance their potential returns. These strategies include:

- LEAPs (Long-Term Equity Anticipation Securities): LEAPs are long-term options with extended expiration dates, providing more time for stock appreciation.

- Covered Calls: Selling call options against a portion of owned shares to generate additional income.

- Collar Strategy: Combining buying a protective put option with selling a call option to limit both gains and losses.

-

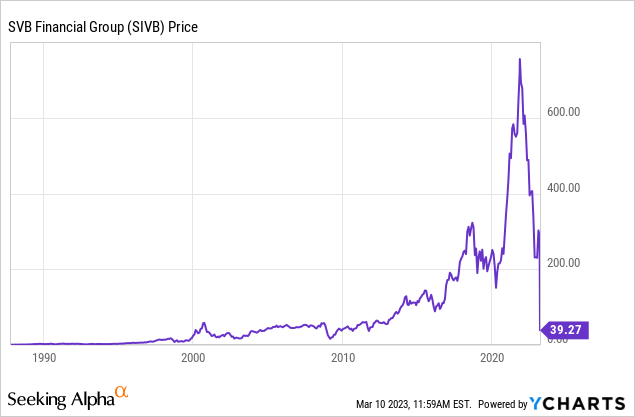

Silicon Valley Stock Options Trading

Image: seekingalpha.comThe Path to Informed Decision-Making

Making wise decisions in stock option trading requires a comprehensive understanding of the complex factors involved. By educating themselves, seeking professional advice, and exercising due diligence, employees can optimize their stock option strategies to maximize financial benefits while managing risks.