Delve into the Realm of Options Trading and Unveil the Secrets of the Greeks

Navigating the complex world of options trading requires a deep understanding of various factors that influence the price and behavior of options contracts. Among these, the Greeks—a set of metrics that measure the risk and reward associated with an option—hold immense significance. In this comprehensive guide, we will delve into the realm of the Greeks, deciphering their meaning, interpreting their values, and unlocking their power to enhance your options trading strategy.

Image: riset.guru

Unraveling the Enigma of the Greeks

The Greeks, a collective term used in options trading, represent a group of seven key metrics that provide a nuanced insight into the behavior of an option contract under various market conditions. They are derived from the Black-Scholes model, a mathematical formula that underpins options pricing. Each Greek measures a specific aspect of an option’s risk and sensitivity, enabling traders to make informed decisions about their trading strategies.

The Pillars of the Greeks: Seven Sentinels of Risk and Reward

-

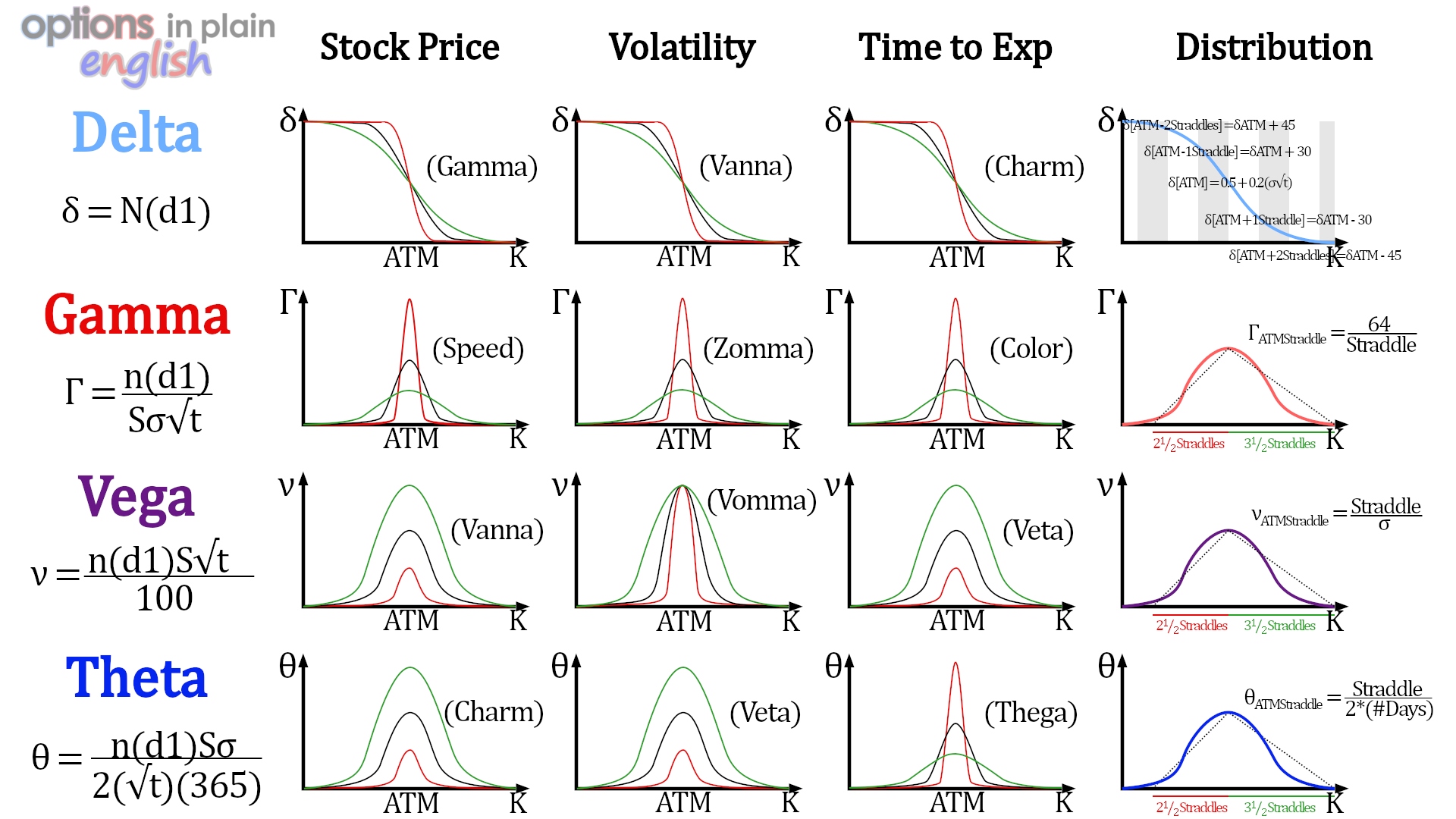

Delta (Δ): Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. It represents the number of shares of the underlying asset that the option represents. For example, a delta of 0.5 indicates that for every $1 increase in the underlying asset’s price, the option’s price will increase by $0.50.

-

Theta (θ): Theta represents the time decay of an option’s value. It measures the change in the option’s price as time passes. Theta is negative for most options, meaning that the value of the option decreases as time passes due to the erosion of its time value.

-

Gamma (Γ): Gamma measures the sensitivity of an option’s delta to changes in the underlying asset’s price. It quantifies how quickly an option’s delta changes as the underlying asset’s price moves.

-

Vega (ν): Vega measures the sensitivity of an option’s price to changes in implied volatility. It indicates the amount by which an option’s price will change for a 1% increase in implied volatility.

-

Rho (ρ): Rho measures the sensitivity of an option’s price to changes in the risk-free rate. It shows how much an option’s price will change for a 1% change in the risk-free rate.

-

Charm (Χ): Charm is a measure of the sensitivity of gamma to changes in the underlying asset’s price. It helps determine how the rate of change of delta (gamma) changes as the underlying asset’s price moves.

-

Speed (Ι): Speed is a measure of the sensitivity of an option’s price to changes in the time to expiration. It quantifies how the decay rate (theta) of an option changes as the time to expiration decreases.

Navigating the Labyrinth of Greeks: Empowering Traders

Harnessing the wisdom of the Greeks allows options traders to make informed decisions and navigate the labyrinthine world of options with confidence. By understanding how each Greek impacts an option’s price and behavior, traders can optimize their strategies to align with their risk tolerance, time horizon, and investment objectives.

For instance, a trader bullish on a stock but concerned about short-term volatility may opt for an option with a high delta (positive) and low theta (negative). Alternatively, a trader anticipating a prolonged market downturn may choose an option with a high theta (negative) to benefit from the accelerated time decay.

Image: www.youtube.com

Calling upon Expert Insights: Distilling Knowledge from Seasoned Traders

Michael Harris, an options trading expert, emphasizes: “Trading without understanding the Greeks is akin to driving a car blindfolded. The Greeks provide essential insights into the intricate behavior of options and are indispensable for successful trading.”

Mary Powell, a seasoned options trader, advises: ” 熟知 the Greeks allows you to tailor your trading strategy to match your individual goals. They provide the precision and control necessary to navigate market volatility and maximize returns.”

Embracing the Power of the Greeks: Unleashing Your Options Trading Potential

By delving into the realm of the Greeks, you unlock a gateway to empowered options trading. Armed with a comprehensive understanding of these metrics, you can refine your strategies, manage risk, and harness market forces to your advantage. Remember, knowledge is the ultimate compass in the ever-evolving landscape of options trading, and the Greeks serve as your trusted guides.

Trading Option Greeks How

Image: www.youtube.com

Additional Considerations

-

Correlation and Interdependence: The Greeks are interdependent and often influence one another. Therefore, it is crucial to consider their collective impact on an option’s price and behavior.

-

Real-Time Monitoring: Monitor the Greeks in real time using trading platforms or online calculators to stay abreast of market changes and adjust your strategy accordingly.

-

Seek Professional Guidance: If you are new to options trading or find the Greeks overwhelming, it is advisable to seek guidance from a financial advisor or experienced trader.

-

Start Small and Learn: Start with smaller trades and gradually increase your position size as you gain experience and confidence in working with the Greeks.

By embracing the power of the Greeks and incorporating them into your options trading strategy, you empower yourself to make informed decisions, manage risk, and navigate the financial markets with greater precision and confidence.