In the realm of options trading, the long call emerges as a beacon of opportunity, offering traders the potential for handsome returns with measured risk. This strategy, hailed as the optimal choice for beginners and seasoned investors alike, unlocks a wealth of advantages that make it the pinnacle of option strategies. Let’s delve into the intricate details of the long call and explore the reasons why it reigns supreme in the world of options trading.

Image: tradebrains.in

Demystifying the Long Call:

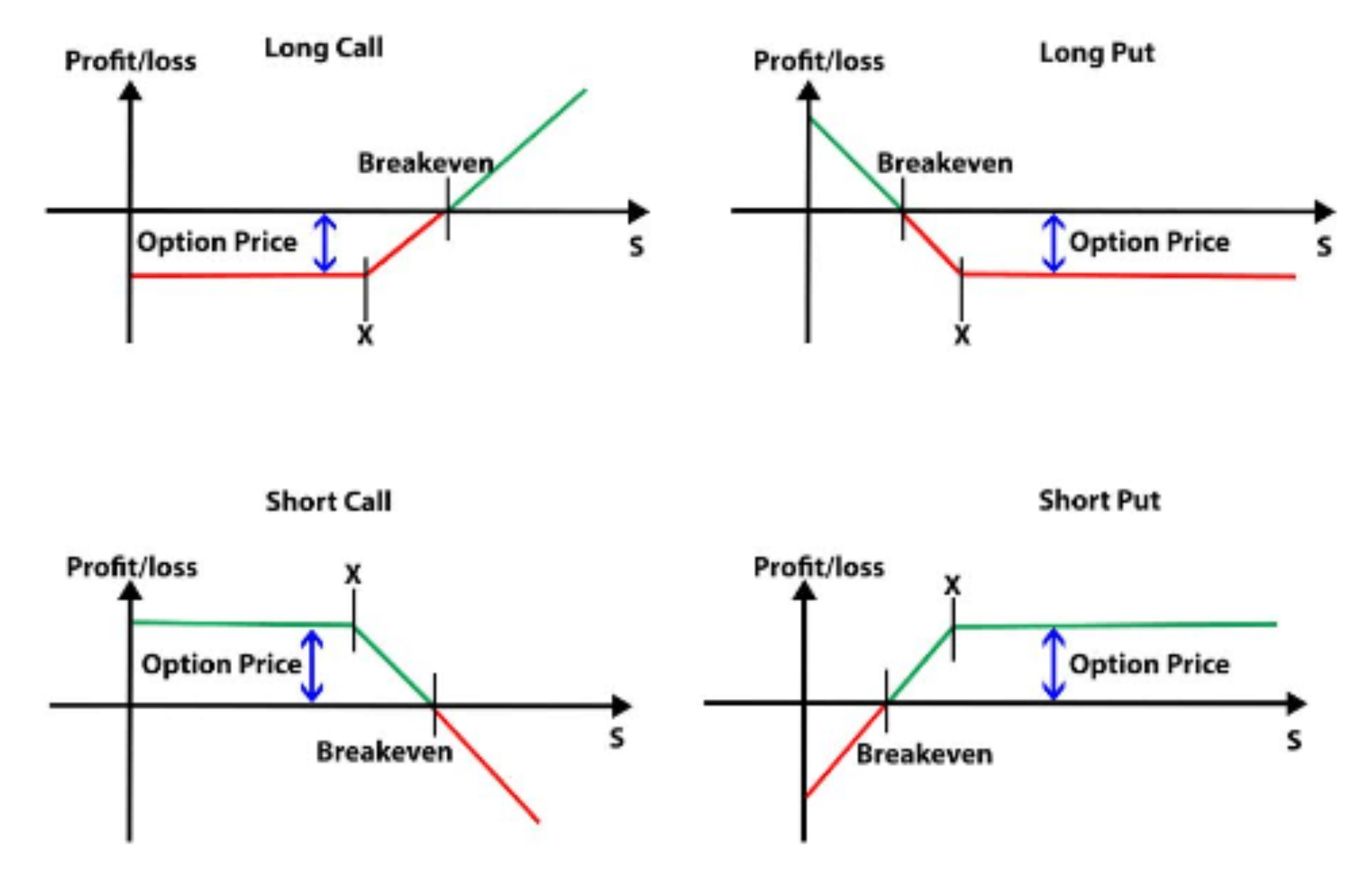

A long call option grants its holder the right, but not the obligation, to purchase an underlying asset, such as a stock or index, at a predetermined price on or before a specified date. By acquiring this option, the investor anticipates that the underlying asset’s price will rise, making their purchase at the strike price a profitable endeavor.

Navigating the Long Call’s Advantages:

- Limited Risk, Boundless Returns:

The long call excels in its ability to limit the trader’s financial exposure while allowing for limitless profit potential. The maximum loss is capped at the premium paid for the option, a far cry from the unlimited losses associated with holding the underlying asset directly. Conversely, should the asset price soar, the investor stands to gain a substantial return on their initial investment.

- Leverage Magnification for Stellar Gains:

Options inherently provide traders with built-in leverage, amplifying both profits and potential losses. Long call options amplify this effect, as the trader is not required to hold the underlying asset, allowing them to control a larger position with a smaller capital outlay.

- Capitalizing on Market Promise, Not Perfection:

Unlike other option strategies, the long call doesn’t demand flawless market timing. It thrives in a moderately bullish market, where time decay erodes option value at a slower pace. This characteristic makes the long call a forgiving strategy, even for novice traders.

- Tailoring to Diverse Market Scenarios:

The long call’s versatility shines through in its adaptability to different market conditions. It empowers investors to structure trades that target specific price targets and time frames. This flexibility allows traders to craft strategies aligned with their risk tolerance and profit goals.

- Hedging Against Unforeseen Risks:

For investors with existing stock positions, a long call option can act as a protective hedge. By buying a long call option with the same strike price and expiration date as the underlying stock, investors mitigate potential losses incurred from a market downturn.

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

Image: www.hoteldarshanpor.com

Why The Long Call Is The Best Option Trading Strategy

Image: tme.net

Conclusion:

The long call option emerges as the undisputed leader in the world of options trading, offering an enticing blend of limited risk, boundless returns, leverage magnification, market flexibility, and hedging capabilities. Whether you’re an options novice or a seasoned professional, the long call remains the optimal choice for harnessing the power of options trading. Embrace its advantages and embark on a journey to financial empowerment in the realm of investing.