When investing in the stock market, options trading provides a versatile and potentially lucrative strategy for experienced investors. However, not all investment accounts offer options trading capabilities, particularly for beginners or those seeking lower-risk investment options. If you’ve encountered the message “Fidelity options trading is not available for this account,” this article delves into the reasons for this restriction and presents alternative solutions to fulfill your options trading aspirations.

Image: www.youtube.com

Why Options Trading May Not Be Available on Your Fidelity Account

Fidelity Investments, a renowned financial institution, offers a range of investment accounts tailored to different investor needs and risk appetites. While some Fidelity accounts grant access to options trading, others may restrict this capability due to several factors, including regulatory compliance, account type limitations, and individual investor profiles.

Regulatory Considerations

Options trading involves inherent risks and requires a comprehensive understanding of financial markets and investment strategies. The Financial Industry Regulatory Authority (FINRA) and U.S. Securities and Exchange Commission (SEC) impose strict regulations on options trading to protect investors from excessive risk. Fidelity adheres to these regulations meticulously, ensuring that inexperienced investors or those with low-risk tolerance are not exposed to potentially hazardous trading strategies.

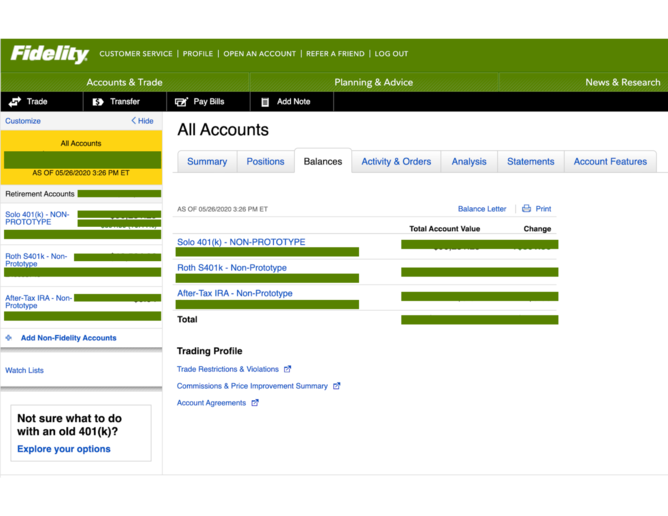

Account Type Restrictions

Certain types of Fidelity accounts, such as traditional IRAs, Roth IRAs, and custodial accounts, may not offer options trading capabilities. This restriction exists to safeguard retirement savings and protect vulnerable investors from high-risk investments. Options trading is typically reserved for more advanced investors holding brokerage accounts, where they have greater control over their investment decisions.

Image: goldiraexplained.com

Individual Investor Profile

Fidelity takes into account an individual investor’s knowledge, experience, and risk tolerance when evaluating eligibility for options trading. Investors who lack sufficient options trading knowledge or exhibit a low risk tolerance may be restricted from participating in this type of trading. Fidelity prioritizes investor protection and ensures that individuals are equipped with the necessary understanding and risk appetite before engaging in options trading.

Exploring Alternative Options for Options Trading

If options trading is not available on your Fidelity account, there are various alternative avenues to consider:

Consider Margin Trading

Margin trading allows investors to borrow funds from their broker to enhance their buying power. By accessing leveraged capital, investors can amplify their potential returns. However, margin trading also magnifies potential losses, making it a suitable option only for experienced and risk-tolerant investors.

Explore Exchange-Traded Funds (ETFs)

ETFs are baskets of securities that track the performance of a specific index or market sector. Some ETFs are designed to provide exposure to options strategies, offering investors a convenient way to diversify their portfolios and participate indirectly in options trading.

Seek Professional Advice

If you’re determined to engage in options trading but encounter account limitations, consider seeking guidance from a qualified financial advisor. A financial advisor can assess your investment objectives, risk tolerance, and knowledge level and recommend suitable options trading strategies or recommend other options trading brokerages that cater to your specific needs.

Fidelity Options Trading Is Not Available For This Account

Image: www.youtube.com

Conclusion

While Fidelity options trading may not be available on all accounts, investors can explore alternative pathways to fulfill their options trading aspirations. Margin trading, ETFs, and professional advisory services offer viable options for investors seeking to leverage the potential benefits of options trading while mitigating risks. By carefully evaluating your investment needs, risk tolerance, and experience level, you can make informed decisions and navigate the intricacies of the financial markets effectively.