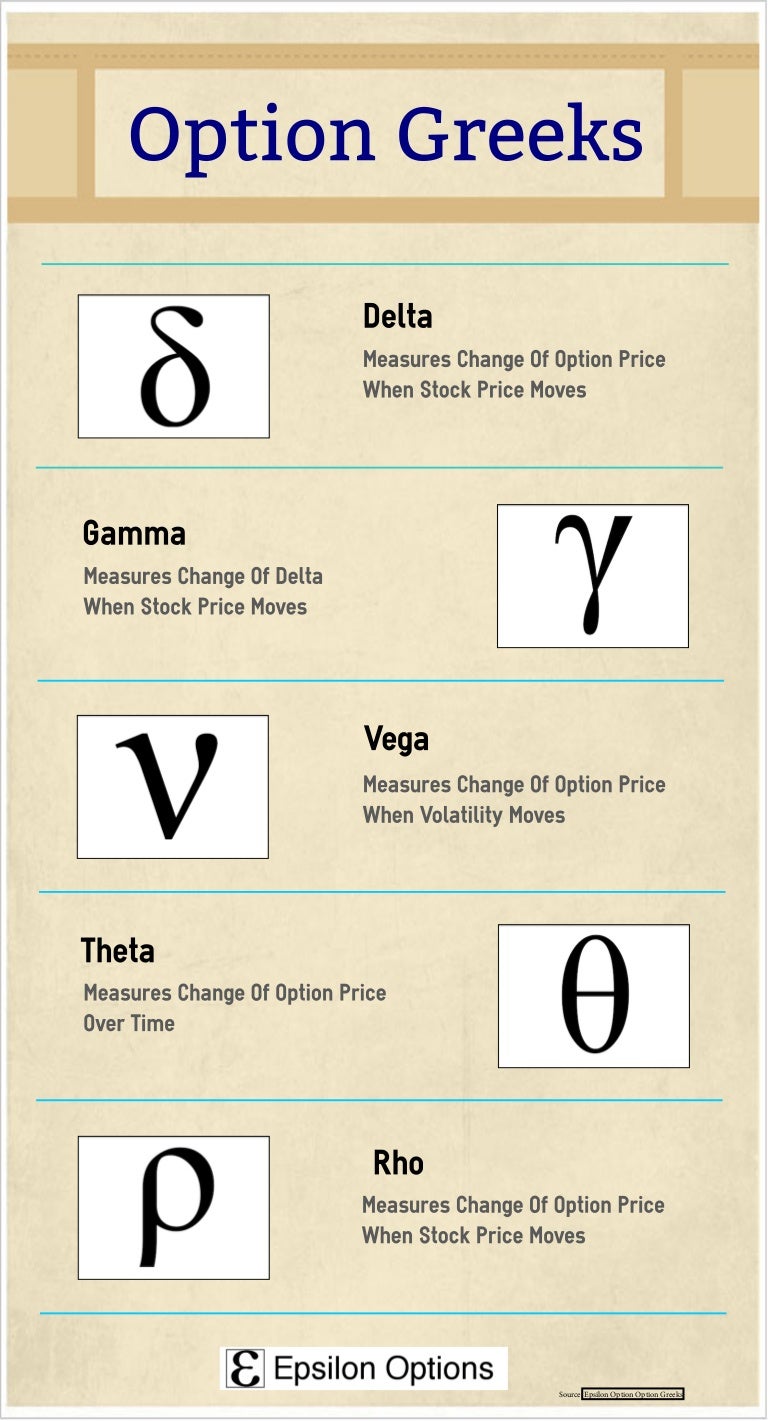

Options, financial instruments that grant the right but not the obligation to buy (call) or sell (put) an underlying asset at a specified price on or before a stipulated date, have become an increasingly popular investment strategy. As with any investment, understanding the associated risks and rewards is crucial for maximizing profit potential and mitigating losses. This is where the Greeks, a set of metrics that quantify these risks and rewards, come into play.

Image: www.slideshare.net

The Greeks provide a comprehensive picture of an option’s price sensitivity to underlying asset price, volatility, and other market factors. Mastering the Greeks enables traders to make more informed decisions, refine their option strategies, and navigate market fluctuations confidently. Let’s delve into the fascinating world of the Greeks and discover how they can empower your options trading endeavors.

Delta: The Price-Sensitivity Coefficient

Delta measures the responsiveness of an option’s price to changes in the underlying asset’s price. In simple terms, it represents the number of shares of the underlying asset that will be bought or sold if the option is exercised. A call option with a Delta of 0.5, for instance, signifies that the option buyer will receive 0.5 shares for every dollar increase in the underlying’s price. As the underlying’s price rises, Delta approaches 1, and as it falls, Delta descends towards 0. Understanding Delta is vital for determining an option’s price exposure to price movements.

Gamma: The Delta’s Damping Companion

Gamma measures the rate of change in Delta, providing insight into how Delta itself adjusts to price fluctuations. A positive Gamma indicates that Delta will increase (or decrease less drastically) for small price movements in the underlying asset. This is particularly relevant for options with non-linear price response curves, such as those near or far from the target strike price. Traders closely monitor Gamma’s behavior to assess how their options’ price sensitivities evolve over time.

Vega: Capturing Volatility’s Impact

Vega measures the relationship between an option’s price and the volatility of the underlying asset. It denotes the absolute change in option premium for a 1% change in the asset’s volatility. Higher volatility corresponds with higher Vega, suggesting that an option’s value will experience a more pronounced increase as the underlying’s price fluctuations intensify. Understanding Vega is critical for gauging an option’s vulnerability to market turbulence.

Image: www.overdrive.com

Theta: The Time’s Ally, the Trader’s Nemesis

Options have a finite lifespan, and as their expiration dates draw near, they lose value progressively. Theta measures the rate of this value decay, indicating the decrease in option premium per day as time passes. Theta’s effect intensifies as expiration approaches, emphasizing the importance of strategic timing in options trading.

Trading Options The Greeks

Rho: Interest Rate Sensitivity Unveiled

Rho quantifies the impact of changes in risk-free interest rates on the value of an option. Positive Rho values signify that an option’s price will increase as interest rates rise, and vice versa. This variable plays a crucial role in interest-rate-sensitive options strategies.

In conclusion, mastering the Greeks empowers options traders with a profound understanding of the intricate dynamics that govern option pricing. By considering the interplay of these metrics, traders can make more informed decisions, finetune their strategies, and adapt to market conditions with greater agility. Whether you’re an options novice or a seasoned professional, embracing the Greeks is the key to unlocking the full potential of this dynamic investment avenue.