Introduction

The world of finance beckons with tantalizing possibilities, and among its avenues lies the intriguing realm of options trading. It’s a realm where dreams of substantial profits dance alongside the sobering reality of potential losses. By understanding the advantages and disadvantages of options trading, you can make informed decisions and navigate this market with a strategic edge.

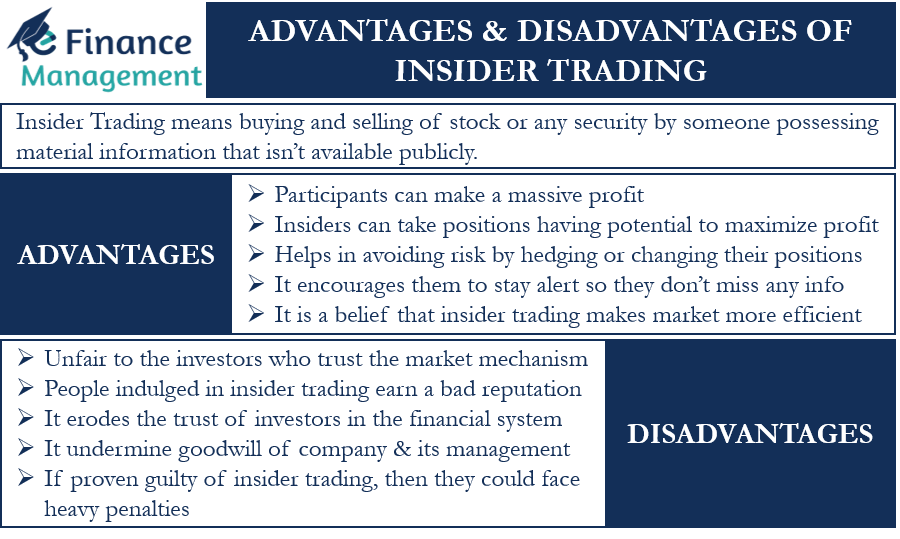

Image: efinancemanagement.com

Delving into the Advantages

-

Leverage Potential for High Returns: Options trading offers the tantalizing potential for significant profits, typically much higher than what traditional investments can yield. This leverage allows traders to magnify their returns even with a relatively small amount of capital.

-

Flexibility and Versatility: Options trading grants traders unparalleled flexibility. It enables them to speculate on price movements, hedge against risks, and generate income through various strategies, catering to diverse investment goals and risk appetites.

-

Limited Risk, Defined Exposure: Unlike other investments, options trading allows traders to define their risk upfront. When purchasing an option, the maximum loss is limited to the premium paid, providing a safety net against catastrophic losses.

-

Income Generation Potential: Options trading can serve as a reliable source of income for those who master its intricacies. By employing strategies like selling covered calls or writing cash-secured puts, traders can earn consistent premium income while holding underlying assets.

-

Volatility as an Ally: While volatility can be a double-edged sword, it can also be an advantage for options traders. Options gain value as volatility increases, providing opportunities for strategic positioning and enhanced profit potential.

Navigating the Disadvantages

-

Potential for Significant Losses: The allure of high returns comes with the sobering possibility of substantial losses. Uninformed or reckless trading can lead to the loss of invested capital, making proper risk management paramount.

-

Complexity and Learning Curve: Options trading requires a thorough understanding of complex concepts, market dynamics, and trading strategies. Novice traders must invest considerable time and effort in education and market observation before venturing into live trading.

-

Margin Requirements and Capital Intensity: Options trading often involves margin requirements, which refers to the use of leverage. While this can increase potential returns, it also magnifies potential losses. Traders must possess sufficient capital and risk tolerance to handle margin trading.

-

Time Sensitivity and Liquidity Concerns: Options are time-sensitive contracts, and their value decays as their expiration date approaches. Additionally, liquidity can be a concern for certain options, making it difficult to enter or exit positions efficiently.

-

Emotional and Psychological Challenges: Options trading can be an emotionally charged endeavor, requiring discipline and a resilient mindset. Traders must manage their emotions, avoid FOMO (fear of missing out), and make decisions based on sound judgment, not impulsive reactions.

Expert Insights and Actionable Tips

Dr. Jennifer Hill, a seasoned options strategist, emphasizes the importance of:

-

Mastering technical analysis and chart patterns to identify potential trading opportunities.

-

Understanding Greeks, which are mathematical measures of option risk and sensitivity to market variables.

-

Managing risk through position sizing and stop-loss orders to protect invested capital.

Ray Thomas, a former floor trader, advises traders to:

-

Develop a trading plan and stick to it, avoiding impulsive trades based on emotions or market hype.

-

Use options as part of a diversified investment portfolio to mitigate risk and enhance overall returns.

-

Seek guidance from experienced mentors or educational resources to gain a deeper understanding of options trading.

Image: www.berotak.com

Advantages And Disadvantages Of Options Trading

Conclusion: Empowering Informed Decisions

Options trading presents both enticing opportunities and potential pitfalls. By acknowledging the advantages and disadvantages, you can make informed decisions, embrace informed risk-taking, and navigate the market with a discerning eye. Remember, knowledge is power, and ongoing education is essential in the ever-evolving world of finance.

Embrace the allure of options trading, but do so with a healthy respect for its complexities. By equipping yourself with the insights and strategies discussed, you can maximize your potential for success while mitigating the risks.