Introduction

Have you ever wondered how seasoned investors amplify their returns, seemingly defying market volatility? Enter leveraged options trading, a financial strategy that can turn modest accounts into substantial fortunes—or lead to significant losses. In this comprehensive guide, we’ll delve into the world of leveraged options trading, exploring its intricacies, risks, and the tantalizing potential that it holds.

Understanding the Basics: A Lever for Returns

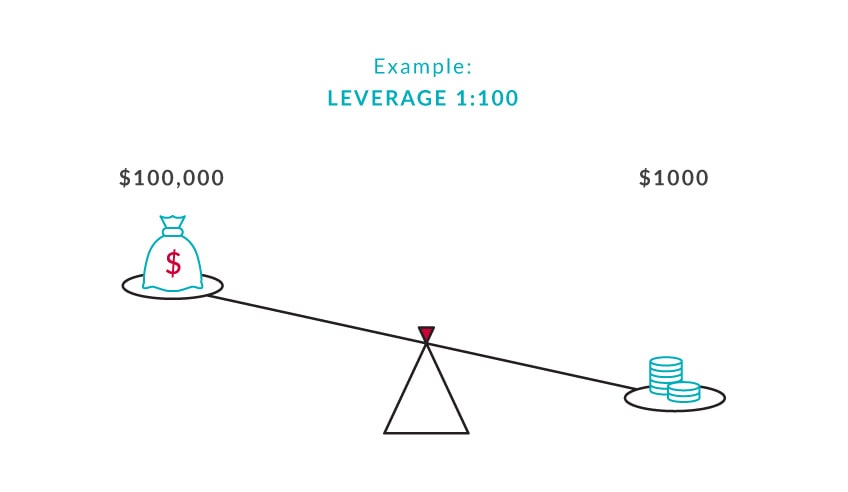

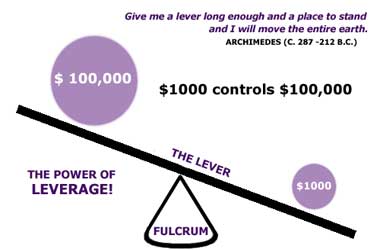

Options trading, by itself, offers leverage by conferring the right, but not the obligation, to buy or sell an underlying asset at a predetermined price. Leveraged options trading takes this concept a step further by employing financial instruments to magnify the potential returns. Margin accounts, which allow you to borrow funds from your broker, play a crucial role, enabling traders to control a larger portfolio with a relatively smaller investment. This leverage can significantly enhance gains, but it amplifies losses with equal vigor.

Advantages and Risks: A Balancing Act

The compelling attraction of leveraged options trading lies in its capacity to generate oversized returns. However, this allure comes with inherent risks that demand careful consideration. Let’s dissect the key advantages and risks associated with this high-stakes strategy:

Advantages:

– Magnified Profits: Leverage amplifies not only your investment but also your potential gains. Astute traders can capitalize on market movements and generate substantial returns.

– Enhanced Flexibility: Leveraged options trading offers a versatile toolset, allowing traders to adapt swiftly to changing market conditions. This flexibility can provide an edge in volatile markets.

Risks:

– Amplified Losses: The double-edged sword of leverage cuts both ways, exacerbating losses as well. Unfavorable market movements can lead to margin calls, forcing you to deposit additional funds or face liquidation of your positions.

– Increased Complexity: Leveraged options trading requires a profound understanding of options strategies, risk management, and market dynamics. This complexity can be daunting for inexperienced traders.

Strategies and Techniques: Unlocking Potential

A wide array of strategies and techniques are employed in leveraged options trading. Here are a few notable approaches:

- Long Call/Put Spreads: These strategies involve buying a call or put option while simultaneously selling an option with a higher strike price.

- Naked Options: A bold move involving selling options without owning or shorting the underlying asset. This strategy carries significant risk but also offers the potential for outsized gains.

- Leveraged ETFs: These exchange-traded funds use leverage to amplify returns on various underlying assets, including options.

Market Trends and Developments: Staying Ahead

The leveraged options trading landscape is constantly evolving, driven by technological advancements and regulatory changes. Here are some key trends and developments:

Image: www.flowbank.com

- Rise of Robo-Advisors: Artificial intelligence-powered platforms are automating options trading, making it more accessible to retail investors.

- Regulatory Scrutiny: Leveraged options trading has attracted the attention of regulators, who are implementing measures to mitigate risks and protect investors.

- Volatility Hedging: Leveraged options strategies are increasingly used by institutional investors to hedge against market volatility.

Image: www.tradersbible.com

Leveraged Options Trading

Image: blog.moneysmart.sg

Conclusion: Mastering the Art of Leverage

Leveraged options trading presents a tantalizing opportunity for investors seeking to amplify their returns. However, the inherent risks demand a comprehensive understanding of options strategies, risk management, and market dynamics. By embracing a judicious approach, leveraging the insights provided in this article, and exercising due diligence, it’s possible to harness the power of leverage while minimizing the associated pitfalls. Remember, the path to successful leveraged options trading lies not only in unlocking potential but also in navigating risks responsibly. May this guide serve as a beacon, illuminating your journey towards financial empowerment.