In the exhilarating world of finance, I once ventured into the uncharted territory of option trading. The promise of amplified gains beckoned me towards 3x leveraged exchange-traded funds (ETFs). However, I soon discovered that these potent instruments demanded a deep understanding and a calculated approach.

Image: texewekiro.web.fc2.com

Embracing the Concept of 3x Leveraged ETFs

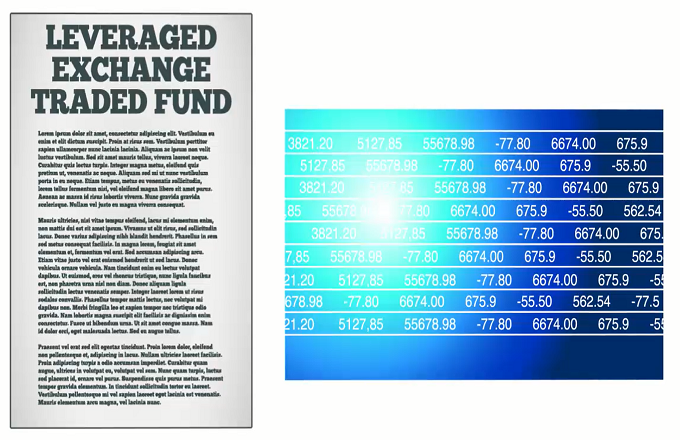

3x leveraged ETFs are a type of ETF that provides exposure to the underlying asset, with a magnification factor of three. In essence, they magnify the daily returns (positive or negative) of the index or asset they track. This can potentially lead to amplified gains, but it also heightens the risk of substantial losses.

Deciphering the Mechanics of Option Trading with 3x Leveraged ETFs

Option trading involves the buying and selling of options, which are contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specific date. When combined with 3x leveraged ETFs, the potential for both gains and losses is amplified.

Understanding Call and Put Options

Call options grant the holder the right to buy the underlying asset, while put options provide the right to sell. The decision of whether to buy a call or put option depends on your market outlook. A bullish outlook suggests buying a call option, anticipating a rise in the underlying asset’s price. Conversely, a bearish outlook favors a put option, anticipating a price decline.

It is crucial to remember that options have a limited lifespan. They expire on a specific date, and if the option is not exercised or sold before expiration, it becomes worthless. This time-sensitive nature adds another layer of complexity to option trading.

Image: www.thetraderisk.com

Expert Insights and Tips for Option Trading with 3x Leveraged ETFs

Venturing into option trading with 3x leveraged ETFs requires a well-informed approach. Here are some invaluable tips from experienced traders:

Mastering Risk Management

The high-stakes nature of 3x leveraged ETFs demands effective risk management strategies. Diversify your portfolio by trading options on different underlying assets and avoid concentrating your investments in a single sector or company. Employ stop-loss orders to limit potential losses and consider utilizing hedging strategies to mitigate risk.

Comprehensive FAQ on Option Trading with 3x Leveraged ETFs

Q: Are 3x leveraged ETFs suitable for all investors?

A: No, they are not recommended for inexperienced or risk-averse investors. They require an in-depth understanding of options and the potential risks.

Q: How do I determine the right leverage for my trading strategy?

A: The appropriate leverage depends on your risk tolerance, trading experience, and market conditions. Start with a conservative leverage ratio and gradually increase it as you gain proficiency.

Q: What are the potential risks involved in option trading with 3x leveraged ETFs?

A: The primary risks include magnified losses due to the leverage, the time-sensitive nature of options, and the volatility associated with underlying assets.

Option Trading With 3x Leveraged Etf

Image: www.simple-stock-trading.com

Conclusion

Option trading with 3x leveraged ETFs offers the potential for amplified gains but also carries substantial risks. By understanding the mechanics, embracing risk management strategies, and seeking expert guidance, you can navigate this complex arena more confidently. Are you ready to delve into the world of 3x leveraged ETFs and explore its formidable possibilities?