A Beginner’s Guide to Amplified Trading Strategies

Trading options on leveraged exchange-traded funds (ETFs) can be a highly lucrative endeavor, offering the potential for substantial returns. However, it is crucial to approach this strategy with caution, as it also carries significant risks. In this comprehensive guide, we will delve into the intricacies of trading options on leveraged ETFs, providing a thorough overview for beginners and experienced investors alike.

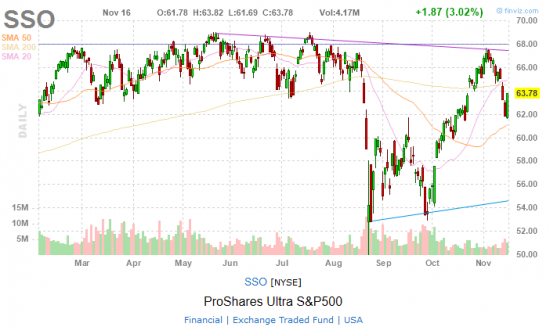

Image: www.entrepreneur.com

What are Leveraged ETFs?

Leveraged ETFs are a type of ETF that uses financial instruments, such as derivatives or debt, to amplify the returns of an underlying index or asset. This leverage allows investors to magnify their exposure to the underlying, potentially leading to increased gains. However, it also amplifies any losses, making leveraged ETFs a double-edged sword.

Understanding Leverage

Leverage is expressed as a multiplier, indicating how much the ETF’s performance is amplified. For instance, a 3x leveraged ETF will aim to deliver a return three times that of the underlying index. This can be a potent tool for investors seeking to capitalize on strong market trends. However, it is essential to remember that leverage works both ways, exacerbating losses as well as gains.

Types of Leveraged ETFs

There are two main types of leveraged ETFs: long leveraged ETFs and inverse leveraged ETFs. Long leveraged ETFs amplify the returns of the underlying index or asset, while inverse leveraged ETFs amplify the inverse returns. This means that an inverse leveraged ETF will rise in value when the underlying falls and vice versa.

Image: www.simple-stock-trading.com

Trading Options on Leveraged ETFs

Options contracts provide investors with the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a certain date. Trading options on leveraged ETFs can offer investors a way to benefit from market movements while mitigating some of the risks associated with direct ownership of leveraged ETFs.

Benefits of Trading Options on Leveraged ETFs

There are several benefits to trading options on leveraged ETFs:

- Potential for higher returns: Options can offer the potential for higher returns compared to direct ownership of leveraged ETFs, as they allow investors to leverage their position without taking on as much risk.

- Hedging against risk: Options can be used to hedge against the risks associated with leveraged ETFs. For example, an investor could buy a put option to protect against a potential decline in the underlying index or asset.

- Flexibility: Options provide investors with flexibility in managing their positions. Investors can choose the strike price, expiration date, and option type that best suits their investment goals.

Risks of Trading Options on Leveraged ETFs

While trading options on leveraged ETFs offers potential benefits, it also carries significant risks:

- Complexity: Options trading can be complex, and leveraged ETFs add an additional layer of complexity. It is crucial for investors to fully understand the risks involved before trading options on leveraged ETFs.

- Volatility risk: Leveraged ETFs are inherently volatile, and this volatility can be amplified when combined with options trading. Investors should be prepared for significant price swings.

- Loss of investment: It is possible to lose the entire investment when trading options on leveraged ETFs. This risk is especially high for investors who use aggressive strategies or do not manage their risk carefully.

Tips and Expert Advice

To increase your chances of success when trading options on leveraged ETFs, follow these tips:

- Do your research: Before trading options on leveraged ETFs, it is essential to thoroughly research the underlying index, asset, and ETF itself. Understand the risks and potential rewards involved.

- Use proper risk management techniques: Risk management is paramount when trading options on leveraged ETFs. Establish clear stop-loss levels and position size limits to protect your capital.

- Consider your investment goals: Determine your investment goals and choose options strategies that align with those goals. Do not trade options on leveraged ETFs if you are not comfortable with the risks involved.

- Learn from experienced traders: Seek advice and guidance from experienced options traders. Attend workshops, read books, and connect with professionals who can share their insights and strategies.

- Use a reputable broker: Choose a reputable broker that offers a comprehensive options trading platform and provides reliable customer support.

FAQs

- Q: What is the difference between a long leveraged ETF and an inverse leveraged ETF?

- A: A long leveraged ETF amplifies the returns of the underlying index or asset, while an inverse leveraged ETF amplifies the inverse returns.

- Q: How do I choose the right strike price when trading options on leveraged ETFs?

- A: The strike price should be based on your investment goals and risk tolerance. Consider the current market conditions and the potential volatility of the underlying asset.

- Q: What is the best way to manage risk when trading options on leveraged ETFs?

- A: Use proper risk management techniques such as stop-loss orders, position size limits, and diversification. Monitor your positions closely and adjust them as needed.

Trading Options On Leveraged Etfs

Conclusion

Trading options on leveraged ETFs can be a rewarding but risky endeavor. By understanding the intricacies of leveraged ETFs and options trading, as well as implementing sound risk management strategies, investors can increase their chances of success. Are you ready to explore the world of options trading on leveraged ETFs?