Options trading can be a powerful tool for experienced investors looking to enhance their returns or hedge against risk. However, navigating the world of options can be complex, and understanding the associated costs is crucial for informed decision-making.

Image: www.asktraders.com

This article delves into a comprehensive comparison of options trading costs, including brokerage commissions, exchange fees, and option premiums. We’ll help you make informed choices that minimize your trading expenses and maximize your profits.

Understanding Options Trading Costs

Options trading involves the purchase or sale of options contracts, which grant the holder the right but not the obligation to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date).

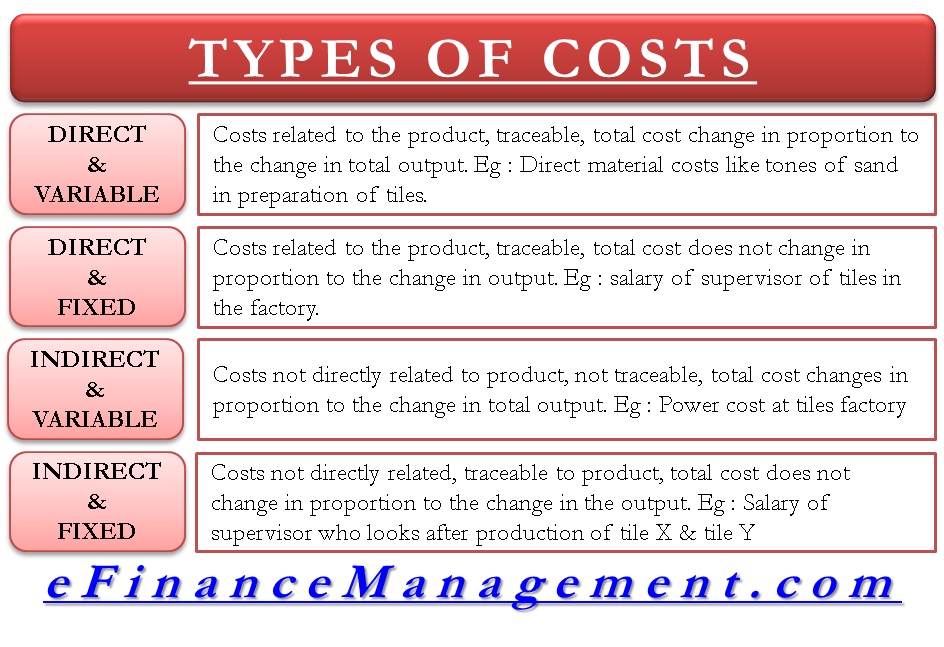

The cost of options trading encompasses three primary components:

1. Brokerage Commissions:

Brokerage commissions are fees charged by online trading platforms for facilitating options trades. Commission rates vary widely depending on the broker and the type of account. Some brokers offer discounted commissions for high-volume traders or those who opt for subscription-based pricing models.

2. Exchange Fees:

Exchange fees are levied by options exchanges such as the Chicago Board Options Exchange (CBOE) for processing and executing trades. These fees are typically charged per contract and can vary based on the underlying asset and the volume of trading activity.

Image: efinancemanagement.com

3. Option Premiums:

Option premiums are the prices paid to acquire options contracts. These premiums are determined by market conditions and factors such as the underlying asset’s volatility, time to expiration, and strike price. Traders must consider both the exchange fees and the option premium when evaluating the cost of an options trade.

Minimizing Your Trading Costs

Adopting the following strategies can help you minimize your options trading costs:

1. Compare Brokerage Fees:

Research and compare brokerage commissions offered by different platforms. Consider your trading volume and account type to identify the broker that provides the most competitive rates.

2. Negotiate Exchange Fees:

For high-volume traders, it’s worth exploring the possibility of negotiating exchange fees with options exchanges. By demonstrating significant trading activity, you may be able to secure reduced fees.

3. Select Lower-Priced Options:

Options with longer expirations or higher strike prices generally have lower premiums. Consider adjusting your trading strategies to incorporate these options into your portfolio.

4. Utilize Options Spreads:

Options spreads involve combining multiple options contracts to achieve a specific trading objective. By employing spreads, you can potentially reduce the overall cost of your option trades.

5. Seek Expert Advice:

Consulting with experienced traders or financial advisors can provide valuable insights to help you develop cost-effective trading strategies tailored to your specific goals.

FAQs on Options Trading Costs

Q: What factors influence brokerage commissions?

Brokerage commissions vary based on the broker’s pricing model, account type, and trading volume.

Q: How are exchange fees determined?

Exchange fees are typically based on the underlying asset, the number of contracts traded, and the overall volume of trading activity.

Q: What strategies can I employ to reduce option premiums?

Consider trading options with longer expirations or higher strike prices, utilizing options spreads, and adjusting your trading strategies to take advantage of market conditions.

Q: When should I consider seeking expert advice?

Seeking professional guidance is recommended for complex trading strategies, high-volume trading, or when seeking tailored advice based on your financial goals.

Options Trading Cost Comparison

## Conclusion

Understanding the intricacies of options trading costs can empower you to make informed choices and minimize your expenses. By carefully comparing brokerages, negotiating fees, selecting cost-effective options, and adopting strategic trading techniques, you can maximize your profits and achieve your financial objectives.

Are you ready to delve into the world of options trading with confidence? Join our community of like-minded traders and discover the full potential of this powerful financial tool.