Captivating Introduction:

Imagine the exhilaration of wielding a powerful financial tool that has the potential to multiply your wealth exponentially. Option trading offers just that possibility, allowing investors to bet on the future direction of underlying assets like stocks and bonds. However, before embarking on this thrilling journey, it’s crucial to understand the hidden costs that can erode your profits: option trading fees.

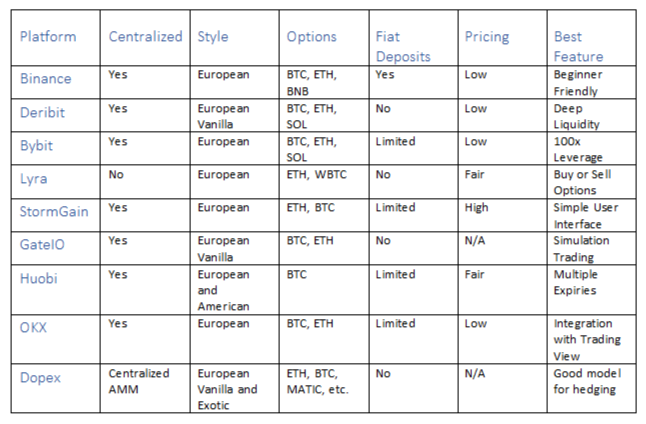

Image: beincrypto.com

This comprehensive guide unravels the intricate web of option trading fees, empowering you to navigate the landscape with confidence. Dive in and discover the factors that influence these fees, how to compare different brokers’ fee structures, and most importantly, actionable tips to minimize these costs, maximizing your investment returns.

Delving into Option Trading Fees:

Option trading fees can be likened to the tolls you pay on a highway, except in this case, the destination is financial success. Understanding these fees is the key to ensuring a smooth, profitable journey.

-

Per-contract fees: These are charged each time you buy or sell an option contract. The amounts vary widely among brokers, so comparing fees is essential.

-

Exchange fees: Exchanges, the marketplaces where options are traded, also impose fees for each contract. These fees are typically flat across brokers.

-

Clearing fees: Clearing firms, which process option trades, charge a per-contract fee to cover their operational costs.

-

Market data fees: Real-time market data is vital for informed option trading. However, this information often comes with a price tag, which can add up over time.

Comparing Broker Fee Structures: A Step-by-Step Guide:

Navigating the maze of option trading fees can be daunting, but with the right approach, you can find the most cost-effective broker for your trading style.

-

Assess your trading volume: The more contracts you trade, the more fees you’ll pay. Consider your trading activity and choose a broker with competitive fees for your volume.

-

Compare base fees: Per-contract and exchange fees form the foundation of option trading fees. Cross-compare these base fees among different brokers.

-

Consider clearing fees: While clearing fees are usually standardized, some brokers absorb these costs within their trading commissions.

-

Evaluate market data fees: Compare the fees brokers charge for real-time market data access, especially if you rely heavily on this information.

-

Negotiate with brokers: For high-volume traders, it’s worth approaching brokers to negotiate reduced fees based on your trading volume.

Actionable Tips to Minimize Option Trading Fees:

Empower yourself with these expert-approved tips to reduce the impact of fees on your trading returns:

-

Bulk orders: Placing multiple contracts in a single order can often attract lower per-contract fees.

-

Off-exchange trading: Over-the-counter (OTC) trading platforms offer fee structures that may be more competitive than traditional exchanges.

-

Consider long-term options: Options with longer expiration dates typically have lower premiums, reducing the upfront cost of trading.

-

Embrace technology: Utilize online brokers and trading platforms that offer low or zero-commission trading options.

-

Monitor fee changes: As fee structures can change over time, it’s wise to periodically monitor your broker’s fees to ensure they remain competitive.

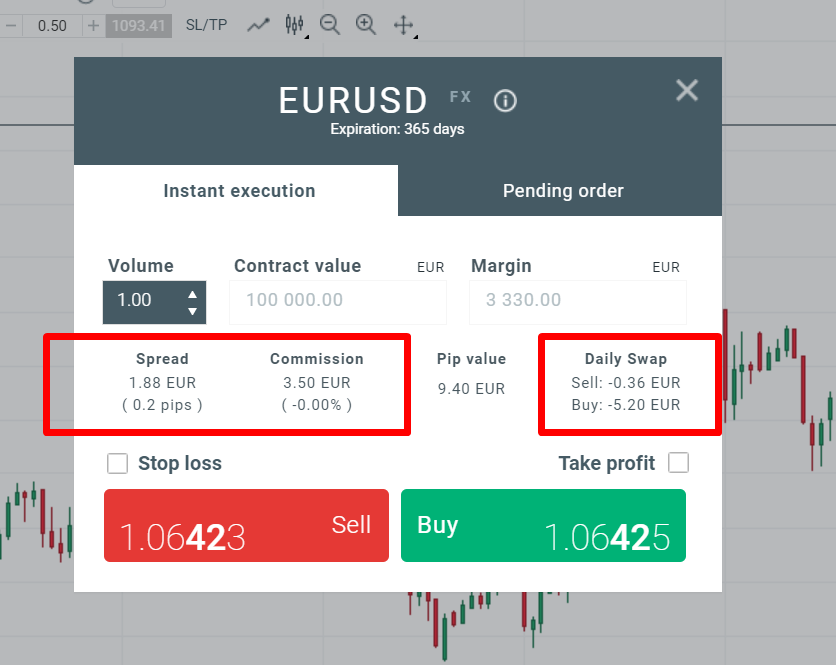

Image: www.trusted-broker-reviews.com

Option Trading Fees Comparison

Empowering Conclusion:

Mastering the art of option trading fees is a crucial step towards maximizing your investment returns. By understanding the factors that influence these fees, comparing broker fee structures, and implementing cost-minimizing strategies, you gain the upper hand in this financial arena. Remember, the ultimate goal is not just to minimize fees but to optimize your trading performance, transforming option trading from a toll-collecting highway into a path paved with financial success.