In the realm of investing, options trading stands as a potent tool that can amplify both gains and risks. Robinhood, the popular trading app, has democratized options trading, making it accessible to a broader range of investors. However, beneath the surface of Robinhood’s user-friendly interface lies a secret that could erode your profits: hidden costs.

Image: www.youtube.com

While Robinhood boasts zero-commission options trading, this claim only tells half the story. In the grand scheme of things, options trading on Robinhood can incur substantial fees that can eat into your potential returns. Let’s delve into the complexities of these costs and how they can impact your trading endeavors.

Options Premiums: The Price of Flexibility

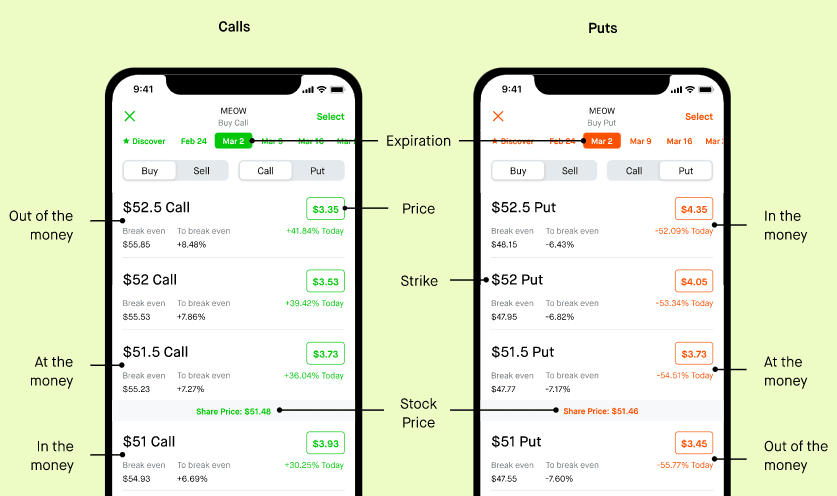

Options contracts, like any other tradable asset, come with a price tag known as the premium. This premium represents the value of the contract’s flexibility, which allows you to profit from price fluctuations without owning the underlying asset directly. The premium is determined by various factors, including the underlying asset’s price, time to expiration, and implied volatility.

On Robinhood, the options premium is explicitly displayed when you place an order. However, it’s crucial to remember that the premium is not a one-time expense. When you exercise an option, you must pay the strike price of the contract, which often exceeds the premium you initially paid. This additional cost, known as the exercise fee, can significantly reduce your potential profits or even result in losses.

Hidden Costs: Unleashing the True Burden

Beyond the upfront costs, Robinhood also layers on several hidden fees that can stealthily drain your trading account. These fees include:

• Assignment Fees: If an option you’ve sold is assigned before its expiration, Robinhood may charge you an assignment fee of $20. This fee adds another layer of expense to your trading activities.

• Regulatory Fees: All options trades are subject to regulatory fees known as exchange fees and SEC fees. These fees vary depending on the exchange where the trade is executed but typically range from $0.02 to $0.10 per contract. While these fees might seem insignificant, they can add up over time, especially if you trade frequently.

The cumulative effect of these hidden costs can significantly impact your trading performance. Robinhood’s zero-commission facade masks a web of expenses that can erode your returns.

Expert Insights: Navigating the Costly Maze

To mitigate the impact of these costs on your trading strategy, consider the following insights from industry experts:

• Understand the Full Cost Structure: Before embarking on options trading on Robinhood, thoroughly familiarize yourself with its cost structure. Know the difference between premiums, exercise fees, and hidden fees and factor them into your trading decisions.

• Trade Strategically: Options trading on Robinhood can be profitable, but it requires a strategic mindset. Carefully consider the underlying asset’s price movements, time decay, and potential risks before entering a trade.

• Explore Alternative Platforms: While Robinhood offers a low barrier to entry for options trading, it may not always be the most cost-effective choice. Compare its fees to those of other platforms to find one that aligns with your trading style and budget.

Image: www.youtube.com

Why Options Trading In Robinhoid Expensice

Image: optionstradingiq.com

Conclusion: Knowledge is Power, Costs Unveiled

Unveiling the hidden costs associated with options trading on Robinhood is crucial for any trader seeking to maximize returns. While Robinhood’s zero-commission policy is alluring, the full cost picture extends beyond upfront fees. By comprehending the true expense of options trading on this platform, you can make informed decisions, mitigate risks, and navigate the markets with greater confidence. Remember, knowledge is power, and when it comes to investing, knowing the hidden costs is the key to unlocking greater financial success.