In the realm of investing, options trading holds both allure and risk. Robinhood, a popular trading platform, has drawn attention for offering commission-free options trading. While this may seem enticing, it’s crucial to delve into the underlying costs and implications before diving in.

Image: www.youtube.com

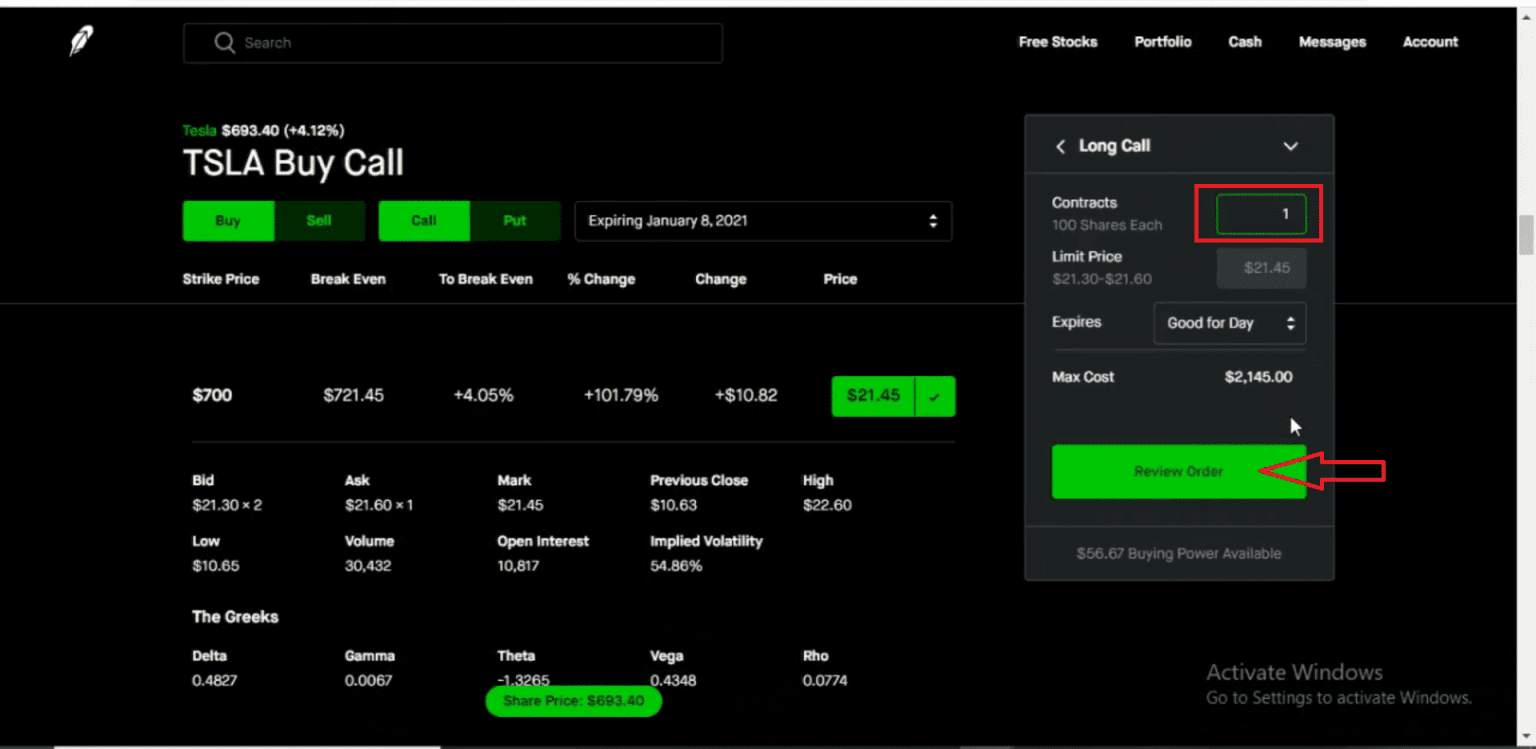

Understanding the Mechanics of Options Trading

Options contracts confer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) before a specified date (expiration date). By purchasing an option, you effectively gamble on the future price of the underlying asset.

Commission Costs

Robinhood stands out for its zero commission policy on options trades. However, this does not eliminate the associated costs altogether.

Transaction Fee (per Contract)

Each options contract carries a transaction fee of $0.65, regardless of whether you are buying or selling. This fee is deducted from your account balance upon trade execution.

Image: marketxls.com

Exercise and Assignment Fees

If you decide to exercise your option, you will incur an exercise fee of $0.15 per contract. This fee is paid to the Options Clearing Corporation (OCC), which facilitates options trades.

Similarly, if your option is assigned (i.e., you are obligated to buy or sell the underlying asset), the OCC charges an assignment fee of $0.15 per contract.

Margin Interest

If you trade options using margin (i.e., borrowing money from Robinhood), you will be charged interest on the borrowed funds. The interest rate is variable and depends on market conditions.

Risk Considerations

Options trading carries inherent risks that go beyond the transaction fees.

Market Risk

The value of an option contract is directly tied to the price of the underlying asset. If the asset’s price moves in an unfavorable direction, you may lose a significant portion of your investment.

Time Decay

As the expiration date approaches, the value of an option decays rapidly. This is because the time value, which represents the premium you pay to postpone the decision of buying or selling the underlying asset, dwindles.

Volatility Risk

Options are more sensitive to changes in volatility than the underlying asset itself. A sudden increase or decrease in volatility can significantly impact the value of your option contracts.

Hidden Costs

In addition to the direct costs, there are hidden expenses associated with options trading on Robinhood.

Data and Information Costs

To make informed trading decisions, you need access to up-to-date market data and company information. These services often come with a fee, which can add up over time.

Educational and Training Costs

Trading options requires a high level of understanding and expertise. If you lack the necessary knowledge, you may need to invest in educational courses or professional training, which can be costly.

Cost Of Options Trading Robinhood

Image: www.youtube.com

Conclusion

While Robinhood’s zero commission policy may initially seem appealing, it’s essential to consider the true cost of options trading on the platform. Transaction fees, exercise fees, margin interest, and the inherent risks can chip away at your potential profits. Additionally, hidden expenses, such as data and educational costs, can further burden your investment portfolio.

If you are considering options trading on Robinhood, it’s imperative to carefully assess your financial situation, risk tolerance, and trading knowledge. By understanding all the associated costs and risks, you can make informed decisions and avoid costly mistakes. Remember, the cost of options trading goes beyond mere transaction fees, and it’s vital to approach it with due diligence and a clear understanding of the potential implications.