**A Comprehensive Guide to Option Trading Fees and Commissions**

Option trading on Robinhood offers a unique and potentially lucrative opportunity for investors. However, it’s essential to understand the associated costs before embarking on this trading strategy.

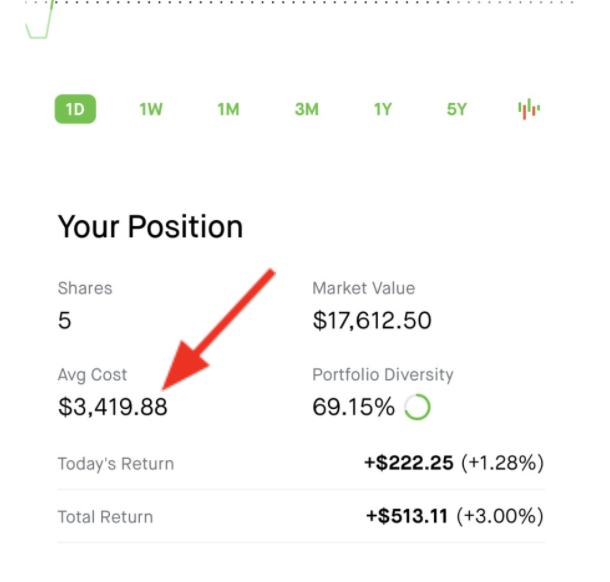

Image: robinhood.com

In this article, we’ll dive into the details of option trading fees and commissions on Robinhood, providing a comprehensive overview to help you make informed decisions. We’ll cover the different types of fees, their impact on profitability, and ways to minimize costs.

**Understanding Option Trading Fees**

Option trading involves buying or selling contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specific date. These contracts are subject to fees, including:

- Option Premium: The price paid to purchase an option contract.

- Commission: A fee charged by the broker for executing the trade.

**Robinhood’s Option Trading Fees**

Robinhood offers commission-free trading for stocks, ETFs, and most options. However, there are certain scenarios where commissions may apply:

- Option Exercise: If you choose to exercise an option, a $0.65 fee is charged per contract.

- Option Assignment: When an option is assigned to you, you’ll pay a fee of $0.65 per contract.

- Options Clearing Corporation (OCC) Fee: A regulatory fee of $0.00015 per share is charged for options clearing.

**Minimizing Option Trading Costs**

To minimize option trading costs on Robinhood, consider the following tips:

- Choose expiring options carefully: Premium prices increase as options approach expiration.

- Trade at lower contract prices: Options with lower strike prices have lower premiums.

- Use limit orders: Limit orders allow you to control the execution price, potentially saving on commissions.

- Consider long-term options: Longer-term options have lower time value, resulting in lower premiums.

- Explore other platforms: Compare fees with other brokers to ensure you’re getting the best deal.

Image: www.youtube.com

**Expert Advice for Option Traders**

Experienced option traders recommend the following expert advice:

- Properly educate yourself: Option trading involves complex strategies that require thorough knowledge.

- Understand risk management: Options can be risky, so carefully manage your positions and limit losses.

- Use reputable brokers: Trustworthy brokers provide transparent fees and excellent customer support.

- Monitor market trends: Stay informed about economic conditions and news events that can impact option prices.

- Seek mentorship and support: Connect with experienced traders or join online forums for guidance.

**FAQ on Option Trading Costs**

- Q: What are the different types of option trading fees on Robinhood?

- A: Option premium, commission (for specific circumstances), and OCC fee.

- Q: How can I minimize option trading costs?

- A: Choose expiring options carefully, trade at lower contract prices, use limit orders, consider long-term options, and explore other platforms.

- Q: Is option trading suitable for all investors?

- A: No, option trading is complex and risky. It’s recommended for experienced investors with a strong understanding of the market.

How Much Is Option Trading On Robinhood

Image: dxminds.com

**Conclusion**

Understanding option trading fees on Robinhood is crucial for informed decision-making. While the platform offers commission-free trading for most options, there are certain instances where fees may apply. By carefully considering the tips and expert advice provided, you can minimize costs and potentially improve your profitability.

Are you interested in exploring the world of option trading on Robinhood? Feel free to reach out for further guidance and support. Remember, education, risk management, and reliable resources are the keys to successful option trading.